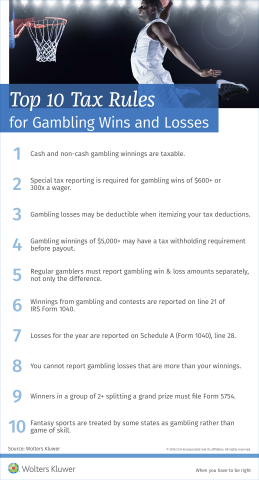

RIVERWOODS, Ill.--(BUSINESS WIRE)--What are the Top 10 need-to-know tax rules when it comes to college basketball bracket pools, casino wagers or other forms of gaming? Details are in the accompanying infographic from Wolters Kluwer Tax & Accounting.

Media Only: Federal and state tax experts are available for interviews to clearly explain tax rules as well as provide guidance and analysis on this and other tax-related topics.