RED BANK, N.J.--(BUSINESS WIRE)--With over $1.48 billion in assets under management, WBI Shares has surpassed WisdomTree to grab the #5 spot in Active ETF Market Share, according to AdvisorShares Active ETF Report for the month ending 8/31/15. WBI Tactical Income Shares (WBII), an impressive outperformer during the recent China Market Crisis, has moved up to the #15 spot in the Top 20 Active ETFs by AUM. WBI Tactical High Income Shares (WBIH) has also cracked into the Top 20 list, securing the #20 spot.

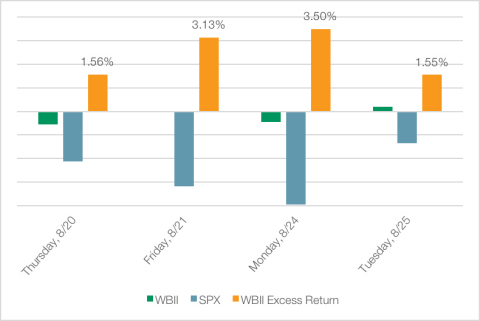

“Given the recent market volatility, investors should be looking for vehicles that aim to protect their capital,” said Matt Schreiber, President of WBI. “WBI’s goal has always been to first and foremost protect capital, and while we don’t get all of the upside, we typically get significantly less of the down.” Figure 1 illustrates exactly this, showing WBII’s outperformance in the days surrounding the recent market fall.

With September and October notoriously known for volatile market conditions, WBI Shares’ suite of 10 active ETFs aim to reduce volatility for investors.

WBI Shares recently celebrated the first anniversary of their historic launch of 10 active ETFs, garnering $1 billion of assets under management on the first day of trading.

About WBI

For over two decades, WBI has helped investors stay comfortably invested by aiming to reduce risk to capital. Our tactical, low volatility, alternative strategies can provide investors with a smoother ride than traditional buy-and-hold approaches. The firm’s unconstrained process invests globally to take advantage of a wide range of opportunities or raises cash in an effort to protect capital. WBI targets an optimal blend of bear market capital preservation and bull market return.

As of 6/30/15 WBII has returned 2.77% and 2.84%, since inception (8/25/2014), on NAV and Market Price respectively.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.05%.

Investors should consider the investment objectives, risk, charges, and expenses carefully before investing. For a current prospectus with this and other information about the Funds, please visit our website at www.wbishares.com or call 1-800-772-5810. Read the prospectus carefully before investing.

An investment in the Fund is subject to investment risk, including the possible loss of principal amount invested. The Fund may invest in foreign and emerging market securities which carry additional risks than investing in the United States such as currency fluctuation, economic or financial instability, lack of timely or reliable financial information, or unfavorable political or legal developments. The Fund is subject to model risk, the investment process includes the use of proprietary models and analysis which rely on third party data and if inaccurate could adversely affect the Fund performance. The Fund may invest in Exchange-Traded Funds (ETFs), mutual funds, and Exchange Traded Notes (ETNs) which will subject the Fund to additional expenses of each ETF, mutual fund, or ETN and risk of owning the underlying securities held by each. Options on securities may be subject to greater fluctuations in value than an investment in the underlying securities. Master Limited Partnership risk entails risks such as fluctuations in energy prices, decrease in supply of or demand for energy commodities. In addition, the Fund is subject to market risk, management risk, dividend risk, growth risk, value risk, debt security risk, high-yield security risk, small and medium company risk, portfolio turnover risk, securities business risk, mortgage-backed securities risk, new fund risk, and trading price risk.

Foreside Fund Services, LLC, Distributor.

© Copyright 2015 WBI Investments, Inc. www.wbiinvestments.com