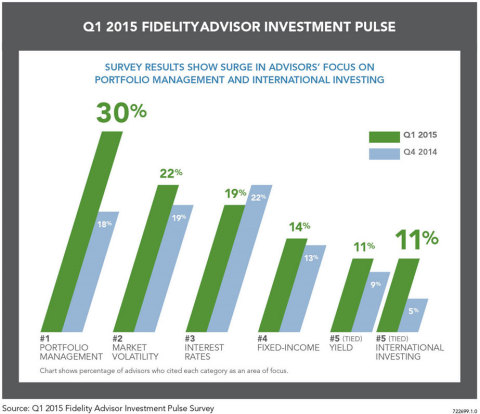

BOSTON--(BUSINESS WIRE)--Fidelity Financial Advisor Solutions today announced the Q1 2015 results of the Fidelity® Advisor Investment Pulse, which revealed a significant increase in financial advisors’ focus on portfolio management and international investing. Portfolio management took the No. 1 spot during the quarter – up from No. 3 in Q4 2014. In addition, for the first time since results of the Fidelity Advisor Investment Pulse were published, the international market is ranked within the top five themes that are top-of-mind for advisors.

Topics such as market volatility, interest rates, fixed income and yield remained important for advisors, taking the No. 2, No. 3, No. 4 and joint No. 5 spots respectively. When combined, these themes help to explain advisors’ overall focus on portfolio management and asset allocation.

“In a volatile market environment, one of the biggest challenges for advisors is how to help clients diversify their portfolio effectively without taking on undue risk,” said Scott E. Couto, president, Fidelity Financial Advisor Solutions. “What we’re hearing is that advisors are trying to leverage multiple asset classes to strike a balance between risk and reward. Their clients want to keep some peace of mind with fairly low-risk investments while potentially increasing returns.”

As part of their focus on portfolio management, advisors also want to better understand how to allocate between domestic and international investments. They are concerned by political instability in regions such as the Middle East, Russia and Ukraine, economic uncertainty in Europe, and the effect of the rising dollar on non-U.S. equities and treasuries.

While the outlook for domestic equities is strong as the economy remains in a mid-cycle expansion and continues to benefit from the decline in oil prices, Couto suggests that advisors continue to look outside the U.S. to help clients diversify their portfolios. This is because historically, international and U.S. stock performance have seen a low correlation. To help clients maintain an exposure to international markets and diversify effectively, advisors should identify international opportunities as they emerge.

“As economies stabilize and recoveries continue, some regions, sectors and companies may present a surprising potential for upside growth,” explained Couto. “The rest of the world may be more complicated, but opportunities are emerging and advisors should position their clients to take advantage.”

Here are some reasons why advisors might be encouraged to help their clients navigate international markets:

1. Bigger opportunity set – Globalization has resulted in an increase in the investment opportunity set. Among the world’s publicly traded companies, around 75 percent are located outside the U.S.1, including many industry-leading firms. To avoid needlessly narrowing their opportunity set and to tap into the potential of these sector leaders, advisors may need to look at international markets. In addition, international markets may offer better dividend yields than U.S. equities.

2. Potential for growth – While the U.S. economy is a bright spot among developed countries, many of the fastest growing economies in the world have been outside the U.S. Whereas the U.S. comprised 33 percent of global gross domestic product in 2001, the country represented just 23 percent in 2013.2 In some cases, other economies have grown more rapidly in part because of a younger population and also less mature markets.

3. Valuation anomalies – Macroeconomic uncertainty and event shocks outside the U.S. can present valuation anomalies. In other words, in places where political or economic uncertainty is dominating the headlines, some opportunities may be unfairly punished with lower valuations as investors shy away. A portfolio management team with the flexibility to capitalize on valuation anomalies as well as asset price divergences through active allocation adjustments may potentially help generate better portfolio outcomes.

Active managers with access to global research can help advisors analyze and mitigate the risks and complexities associated with the international investment landscape. They can make active asset allocation adjustments within a risk-controlled framework, helping advisors improve portfolio outcomes. For example, unlike equities, bond markets are typically more influenced by local factors – these include economic growth, inflation, tax rates, credit, and currency movements. As a result, bond yields, returns, and therefore risk exposure can diverge significantly from country to country. Because risk factors vary, a global portfolio by its very nature may provide advisors with opportunities to diversify against these risks. An active manager of a global balanced strategy may potentially be able to improve the portfolio’s risk-return profile by helping advisors navigate this complex terrain.

Regardless of whether they serve individual investors, businesses, plan sponsors or institutions, Fidelity offers advisors a range of insights to help them navigate the market. For access to the insights and resources that Fidelity offers, advisors can visit: advisor.fidelity.com/investmentpulse. They include:

- Does the Number of Stocks in a Portfolio Influence Performance? – New research shows that historically, there is no meaningful relationship between the number of holdings in a stock portfolio and its performance.

- The International Opportunity Today – Fidelity’s capital markets strategist shares some of his investment themes for the year and highlights the opportunities in a more complicated world.

- Managing Fixed Income Is About More Than Just Interest Rates – Fidelity’s senior analyst in asset allocation discusses how balancing interest-rate and credit risks is crucial to meeting the overall objectives of a portfolio.

The Fidelity Advisor Investment Pulse is a survey that captures the investment topics on the minds of around 300 advisors in order to identify common concerns and deliver resources to help them navigate changing market conditions. Fidelity Financial Advisor Solutions has been tracking advisor sentiment about investing concerns and opportunities since April 2012. This proprietary research enables Fidelity to provide advisors with timely perspectives from their peers, and offer tools to take advantage of the investment opportunities that exist today.

About the Fidelity Advisor Investment Pulse

The

Advisor Investment Pulse is an ongoing primary research effort that

captures the views of more than 1,000 FFAS advisor clients annually. All

FFAS advisor clients in the broker-dealer and registered investment

advisor communities are asked to participate in the online survey. These

advisors serve a range of clients, including individual investors,

businesses, plan sponsors and institutions. Respondents are asked an

open-ended question: “Thinking about the investing environment and

outlook, and the potential impact on your client portfolios, what

investment challenge or opportunity would you say is top-of-mind for you

right now?”

The survey reports “Top of Mind” themes of most concern to financial advisors in both their practices and in the financial markets. These themes are distilled from individual financial advisor comments. The chart reflects the most current five themes that represent the most widely held views. Given the variability of the number of responses over time, and the ongoing nature of this effort, confidence levels also will be variable.

Fidelity Financial Advisor Solutions has been tracking advisor sentiment about investing concerns and opportunities since April 2012. This proprietary research enables Fidelity to provide advisors with timely perspectives from their peers, and offer tools to take advantage of the investment opportunities that exist today.

About Fidelity Investments

Fidelity’s

goal is to make financial expertise broadly accessible and effective in

helping people live the lives they want. With assets under

administration of $5.2 trillion, including managed assets of $2.1

trillion as of March 31, 2015, we focus on meeting the unique needs of a

diverse set of customers: helping more than 24 million people investing

their own life savings, nearly 20,000 businesses to manage their

employee benefit programs, as well as providing nearly 10,000 advisory

firms with technology solutions to invest their own clients’ money.

Privately held for nearly 70 years, Fidelity employs 41,000 associates

who are focused on the long-term success of our customers. For more

information about Fidelity Investments, visit https://www.fidelity.com/about.

Before investing in any mutual funds, consider the funds’ investment objectives, risks, charges, and expenses. Contact your investment professional or Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity Investments does not provide advice of any kind. You should conduct your own due diligence and analysis based on you and your firm’s specific needs.

Diversification does not ensure a profit or guarantee against a loss.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future returns.

In general the bond market is volatile, and fixed-income securities carry interest rate risk. Fixed-income securities also carry inflation, credit, and default risks for both issuers and counterparties. Lower-quality bonds can be more volatile and have greater risk of default than higher-quality bonds.

Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments. Foreign securities are subject to interest rate, currency exchange rate, economic and political risks. Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry.

The registered trademarks and service marks appearing herein are the property of FMR LLC.

Fidelity Institutional Wealth Services provides brokerage products and services and is a division of Fidelity Brokerage Services LLC. Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917.

National Financial is a division of National Financial Services LLC through which clearing, custody and other brokerage services may be provided. Both members NYSE, SIPC. 200 Seaport Boulevard Boston, MA 02210.

Products and services provided through Fidelity Financial Advisor Solutions (FFAS) to investment professionals, plan sponsors and institutional investors by Fidelity Investments Institutional Services Company, Inc., 500 Salem Street, Smithfield, RI 02917.

723268.1.0

© 2015 FMR LLC. All rights reserved.

1 Sources: FMRCo, FactSet, using MSCI ACWI IMI data, as of 4/30/2014.

2 Source: FactSet, as of 11/30/2013. Data presented for the MSCI AC World Index, which represents 44 countries and contains 2,436 stocks. The index is not intended to represent the entire global universe of tradable securities.