HARTFORD, Conn.--(BUSINESS WIRE)--A recent survey conducted by Conning with the American Council of Life Insurers (ACLI) captured the concerns of 50 U.S. life insurance CEOs, highlighting declining investment income and the need for capital appreciation as primary concerns. In addition, a recent study published by Conning’s insurance research team illustrated how over the past five years, U.S. life insurance companies have continued to address their income needs by adding Triple-B corporate credit exposure and extending out the yield curve – despite declining risk premiums.

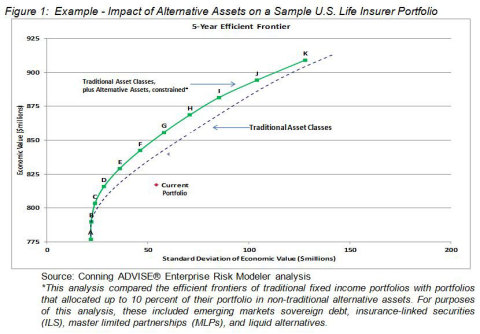

Conning believes that an approach that focuses exclusively on adding Triple-B corporate credit may overlook other important investment considerations, including the need for diversification and proactive risk management. Conning’s risk management team developed an efficient frontier analysis of a sample U.S. life insurer’s portfolio (including representative inputs and parameters) that illustrated how taking a broader approach to asset allocation, inclusive of non-traditional and alternative asset classes, can result in improved performance in terms of economic value at the same level of risk (see Figure 1).

“The insurance industry, including life insurers, needs to consider a more holistic approach to enhancing portfolio performance,” said Mike Haylon, Managing Director at Conning. “We strongly believe that companies that incorporate strategies involving diversification, expertise in alternative investing, and a comprehensive risk management approach can position themselves more strategically for growth in the current investment environment. Conversely, over-concentration in certain investment strategies is likely to weaken the outcome,” added Haylon.

The efficient frontier analysis of the impact of alternative assets measured economic value and risk (standard deviation of economic value). It considered the performance difference between a sample portfolio that included non-traditional and alternative asset classes not extensively used by life insurers and a portfolio that included only traditional asset classes over a five-year period.

Figure 1: Example - Impact of Alternative Assets on a Sample U.S. Life Insurer Portfolio

“While life insurers will need to take a close look at their respective investment objectives and constraints, certain non-traditional asset classes such as those considered in this analysis can add further levels of diversification to portfolios, reduce sensitivity to higher interest rates, and enhance income and the potential for capital appreciation,” added Haylon.

About Conning

Conning (www.conning.com) is a leading investment management company for the global insurance industry, with more than $94 billion in assets under management as of December 31, 2014, through Conning, Inc., Conning Asset Management Limited, Cathay Conning Asset Management (CCAM) Limited, Goodwin Capital Advisers, Inc., and Conning Investment Products, Inc. The company's unique combination of asset management, risk and capital management solutions and insurance research helps clients achieve their financial goals through customized business and investment strategies. Founded in 1912, Conning provides clients with innovative solutions, leveraging its global capabilities, investment experience, proprietary research and risk management technology. Headquartered in Hartford, Connecticut, Conning also delivers its services globally through its offices in New York, London, and Cologne, and in Hong Kong through CCAM, a joint venture between Conning and Cathay. ADVISE® is a registered trademark of Conning, Inc. Copyright© 1999 - 2015 Conning, Inc. All Rights Reserved.

Note to the Reporters:

Conning/ACLI Survey:

- 77% of surveyed CEOs of life insurance companies indicated investment yield was of critical importance to maintain profitability.

- More than 80% of surveyed CEOs are diversifying portfolios beyond traditional fixed income assets as a strategy to drive investment yield and returns.

Conning Insurance Research Study:

- Spreads between Triple-B bonds and treasuries have narrowed dramatically since the financial crisis, so much so that companies have been taking more risk every year, but are getting paid less to do so.

- The life insurance industry has less than 1% of invested assets in Emerging Market debt even though EM countries are contributing to over 50% of global GDP.

- When looking at government debt to GDP, debt in developed countries represents over 106% of GDP, whereas debt in emerging markets countries now represents 33% of GDP.

- Emerging markets debt credit ratings have been on a steady incline. According to Barclay’s Emerging Markets Debt Index, the weighted average rating of this asset class is now in the Triple-B.