NEW YORK--(BUSINESS WIRE)--A new study by TIAA-CREF shows that the number of Americans who are interested in receiving financial advice increased to 35 percent from 24 percent in a 2013 survey. But even with this 11-point increase, 65 percent of people still say they are not interested in receiving financial advice – a precarious situation considering the majority of Americans are underprepared for retirement.1

Many people who are not interested in advice may simply not understand the benefits, or what advice includes. TIAA-CREF found that only 57 percent of individuals who are not interested in receiving financial advice are aware that it can include specific recommendations on investing, compared to 82 percent of people who are interested in advice.

At the same time, the findings also revealed that people are more and more concerned about retirement: Of those who did receive advice, 86 percent sought out retirement-related advice, up from 81 percent last year and 71 percent in 2012.

TIAA-CREF’s third annual Financial Advice Survey was conducted by an independent research firm and polled a random sample of 1,000 adults nationwide to assess their attitudes, preferences and behaviors about receiving financial advice.

Financial Advice Leads To Action

“Those who aren’t interested in advice may not know what it includes or how valuable it can be,” said Eric Jones, senior managing director of advisory solutions at TIAA-CREF. “Sound advice begins with the advisor’s deep understanding of your situation and your financial needs and goals. Based on that, the advisor can provide recommendations on how much to save, how to diversify investments, or what financial solutions make sense for your situation. Building a relationship over time with an advisor who knows you and your financial needs can help you navigate changes over the course of your life.”

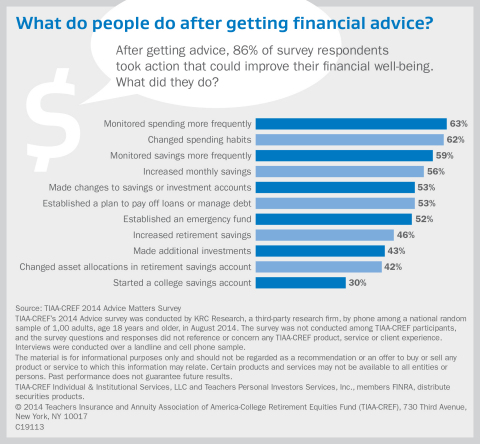

The survey found that two-thirds of Americans who have received financial advice feel optimistic about their finances, and 86 percent act on financial advice after they receive it. Sixty-two percent of respondents report changing their spending habits after receiving financial advice, and 46 percent increased the amount they contribute to their retirement.

Other positive behaviors that survey respondents reported after receiving advice include:

- Making a plan for paying off loans (53 percent)

- Establishing an emergency fund (52 percent)

- Increasing the amount of money directed to retirement savings (46 percent)

Popular Misconceptions Inhibit People From Seeking Advice

However, many respondents believe there are challenges to accessing the counsel they need. Sixty-four percent of respondents say it’s hard to know which sources of advice can be trusted, up 16 percentage points from last year. Respondents also called out several other obstacles to obtaining advice, including:

- 44 percent think good financial advice will cost more than they can afford.

- 39 percent say the information available does not meet their individual needs.

- 35 percent say it’s hard to find the time to look for financial advice.

- 32 percent are not sure what questions to ask.

“Many popular misconceptions about financial advice are just that—misconceptions,” said Jones. “Unfortunately, they can paralyze people’s search for trustworthy advice, leaving many people disengaged with their financial futures. The fact is, there are many reliable, affordable sources for high-quality financial advice—including, for many people, their employer.”

In fact, half (52 percent) of the survey respondents say the availability of no-cost financial advice in their benefits package would have an impact on their decision to accept a job offer.

TIAA-CREF helps build financial well-being and confidence by offering a variety of resources and interactive tools related to financial advice and goal-setting. In addition to the online Advice and Guidance Center, TIAA-CREF offers educational programs focusing on trending financial issues and organizes financial empowerment workshops for women. The company offers in-person financial services at more than 100 offices across the country and provides access to licensed and trained phone representatives who can answer questions.

For more information on the survey, please read the 2014 TIAA-CREF Advice Matters Executive Summary. For more information on TIAA-CREF’s Advice and Guidance offerings, visit our Advice and Guidance Center.

Survey Methodology

The survey was conducted by KRC Research by phone among a national random sample of 1,000 adults, age 18 years and older, between July 28 and August 7, using a combination of landline and cell phone interviews. The margin of error for the entire sample is plus or minus 3.1 percentage points. The survey was not conducted among TIAA-CREF participants, and the survey questions and responses did not reference or concern any TIAA-CREF product, service or client experience.

About TIAA-CREF

TIAA-CREF (www.tiaa-cref.org) is a national financial services organization with $613 billion in total assets under management (as of 6/30/2014) and is the leading provider of retirement services in the academic, research, medical and cultural fields.

Disclosures

The material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate. Certain products and services may not be available to all entities or persons. Past performance does not guarantee future results.

TIAA-CREF Individual & Institutional Services, LLC and Teachers Personal Investors Services, Inc., members FINRA, distribute securities products.

© 2014 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017

C19111

1 According to TIAA-CREF’s Lifetime Income Survey (January 2014), one out of five respondents who haven’t retired (21 percent) reported not saving anything for retirement, and 44 percent are saving 10 percent or less of their current annual income, a figure that includes their own savings and any employer contributions.