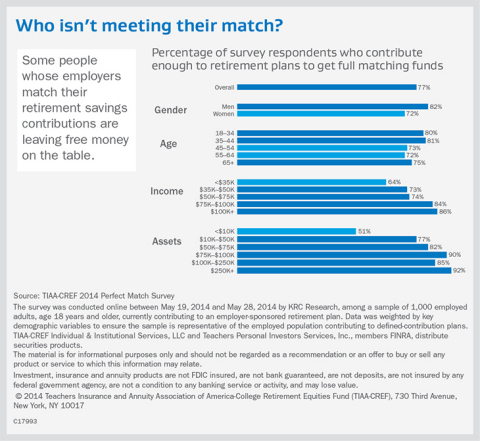

NEW YORK--(BUSINESS WIRE)--A new survey by TIAA-CREF shows that 78 percent of Americans who contribute to an employer-sponsored retirement plan receive matching contributions from their employer, and 77 percent of those who have matching contributions save enough to receive the full employer match. However, only 72 percent of women contribute enough to receive the full employer match, compared with 82 percent of men, and only 64 percent of those earning less than $35,000 a year receive the full match.

The survey was conducted by an independent research firm and polled a random sample of more than 1,000 adults nationwide on their retirement plans.

“These survey results show that some groups of people in particular aren’t maximizing the full value of their retirement plan,” said Teresa Hassara, executive vice president of TIAA-CREF’s Institutional Business. “When employees don’t get the full match that their employers offer, they are essentially walking away from free money.”

Helping employees maximize their match

The survey found that employees would welcome more information from their employers on making the most of their retirement plan match. Forty percent of the employees who are not currently contributing enough to get the maximum matching funds from their employers said they get reminders to do so and are happy to receive them. An additional 32 percent do not receive reminders from their employer but said they wish they did.

“An employer match is a very compelling factor in determining whether employees contribute to a defined-contribution retirement plan,1 but just offering it is not enough,” Hassara said. “Plan sponsors must ensure they are communicating the benefits of the match to employees, particularly those who are not currently reaching the full match. Their communications should be targeted to various groups’ unique financial needs.”

For low earners, for example, plan sponsors can explain the inherent benefits of saving for retirement and position the matching contribution as part of a larger focus on long-term financial well-being. For women, more information about the match may be effective: Of those not receiving the full match, 17 percent of women (compared to 10 percent of men) said that more information about how the match works would make them consider increasing contributions.

The long-term implications of missing the full match

There is clearly a need for outreach and information, as many Americans may not know what they’re missing if they don’t contribute enough to their employer-sponsored retirement plans to get the full match. TIAA-CREF asked survey respondents how much they would earn from a 3 percent employer match.2 In the example, the match would be worth $72,518 by the time they were 65. However, one-third (32 percent) of respondents thought it would be worth less than $50,000. Women, Gen Y respondents and those earning less than $35,000 a year were even more likely to underestimate how much the employer contributions will translate into retirement.

“Getting the full employer match on retirement savings, even if the percentage doesn’t seem like a lot on paper, can have a significant impact on the total value of an employee’s savings by the time he or she retires,” Hassara said. “Providing employees with more concrete examples like these can really underscore the importance of increasing their contributions to maximize their match.”

For more information about the survey, read the executive summary. TIAA-CREF also has prepared articles for plan sponsors and individuals that discuss how to make the most of the employer match.

About TIAA-CREF

TIAA-CREF (www.tiaa-cref.org) is a national financial services organization with $613 billion in total assets under management (as of 6/30/2014) and is the leading provider of retirement services in the academic, research, medical and cultural fields.

Survey Methodology

The findings come from TIAA-CREF’s Perfect Match Survey, which was conducted among a sample of 1,000 adults currently contributing to an employer-sponsored retirement plan, conducted by an independent research firm between May 19, 2014, and May 28, 2014.

The survey was conducted by KRC Research online among a sample of 1,000 employed adults, age 18 years and older, currently contributing to an employer-sponsored retirement plan. Data was weighted by key demographic variables to ensure the sample is representative of the employed population contributing to defined-contribution plans.

Respondents for this survey were selected from among those who have volunteered to participate in online surveys and polls. Because the sample is based on those who initially self-selected for participation, no estimates of sampling error can be calculated. All sample surveys and polls may be subject to multiple sources of error, including, but not limited to, sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options.

Disclosures

The material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate. Certain products and services may not be available to all entities or persons. Past performance does not guarantee future results.

TIAA-CREF does not and cannot provide tax or legal advice. Please consult with your own advisors.

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

TIAA-CREF Individual & Institutional Services, LLC and Teachers Personal Investors Services, Inc., members FINRA, distribute securities products.

© 2014 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017.

C18014

1 The Plan Participation Puzzle: Comparison of Not-for-Profit Employees and For-Profit Employees, LIMRA, December 2010.

2 Survey respondents were asked to give their best estimate to the following question: “You are 35 years old, making $50,000 per year, and your employer will match your retirement contributions up to 3 percent of your salary. Assuming that your salary remains the same for the next 30 years, and you contribute enough each year to get the match, and your investments earn a return of 3 percent per year… how much will you have gained in potential earnings by the time you retire at age 65?” This is purely hypothetical and is not intended to predict or project returns.