CAMBRIDGE, Mass.--(BUSINESS WIRE)--While more than 7 in 10 (72%) affluent pre-retirees, age 55 and older, feel confident about their ability to generate a suitable income stream in retirement, less than one-third (29%) have determined the most sensible Medicare option or evaluated financial protections against major health event expenses—which could substantially impact their ability to make their retirement savings last throughout their lifetime. These and other important findings are included in Investor Retirement Income TrendsTM, a recently published Cogent ReportsTM study by Market Strategies International.

According to the report, 64% of affluent pre-retirees have estimated their monthly expenses in retirement, and 68% have calculated the best time to begin taking Social Security payments. But just 29% have identified the best Medicare option for their personal situation, and only 32% have investigated options to protect their savings from catastrophic healthcare costs.

“The majority of pre-retirees have essentially done the easy part,” explains Julia Johnston-Ketterer, author and senior director at Cogent Reports. “They’ve used some online calculators and talked with their financial advisors about ways to generate a 'paycheck' in retirement from the assets they’ve accumulated. But relatively few of these conversations address the topic of healthcare in retirement, which is essential in ensuring that these pre-retirees don’t outlive their savings.”

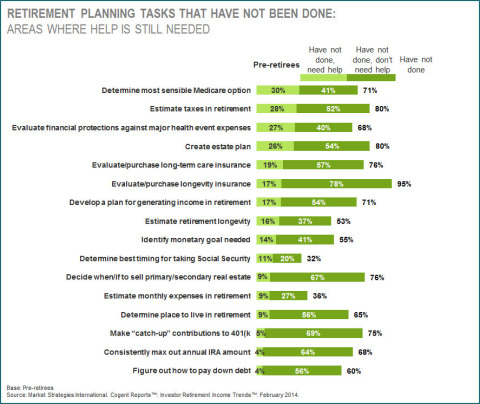

Going beyond healthcare, the study asked pre-retirees about the extent to which they had completed a set of 16 tasks considered vital components of a comprehensive retirement plan, ranging from the typical financial aspects like estimating taxes, to more personal choices such as determining the best place to live in retirement. Less than half said they completed more than 2 of these 16 tasks.

“Clearly there is more the financial industry can do to help pre-retirees with their retirement planning needs,” says Johnston-Ketterer. “As more and more Baby Boomers approach retirement age, opportunity abounds for financial services providers who can successfully position themselves as a go-to resource—either for the investors themselves or for financial advisors who are challenged to provide retirement planning assistance with complex tasks outside of their traditional investment advisory role.”

About the Investor Retirement Income Trends study

Cogent Reports interviewed a sample of 890 affluent investors who were recruited from the Research Now opt-in online panel. Respondents were required to be age 55 or older and have at least $100,000 in investable assets (excluding real estate). Due to its opt-in nature, this online panel (like most others) does not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Market Strategies International will supply the exact wording of any survey question upon request.

About Market Strategies International

Market Strategies International is a market research consultancy with deep expertise in telecommunications, consumer/retail, energy, financial services, healthcare and technology. Offering custom research services and syndicated research products, the firm provides insights from more than 75 countries, focused in the areas of brand, communications, CX, product development and segmentation. Its syndicated products, known as Cogent Reports, help clients understand the market environment, explore industry trends and evaluate and monitor their brand and products within the competitive landscape. Founded in 1989, Market Strategies is one of the largest market research firms in the world, with offices in the US, Canada and China.

Read Market Strategies’ blog at FreshMR, and follow us on Facebook, Twitter and LinkedIn. Sign up for our syndicated newsletter, Cogent Thoughts, to get monthly insight from Cogent Reports.