CAMBRIDGE, Mass.--(BUSINESS WIRE)--Most wholesalers know that getting face time with high-end producers is no easy task, but making those interactions effective is even more challenging, according to new findings from Cogent Reports, a division of Market Strategies International. Only 10 mutual fund providers out of 44 leading firms managed to accomplish both with their external wholesaling force in the first quarter of 2014. These findings are the latest from the Cogent Beat™ Advisor platform, which continually tracks the attitudes and behaviors of advisors on a wide range of topics related to product usage, wholesaler effectiveness and brand equity.

According to Cogent Reports, $100 million-plus advisors saw an average of 4.4 external wholesalers from mutual fund firms per month during Q1 of 2014, with a full 81% reportedly seeing at least 1 of the 44 firms tracked in the Cogent Beat platform. However, a closer examination of the data reveals that, on average, individual fund firms touched only 1 in 10 (11%) of the highly coveted $100 million-plus advisor population in any given month.

Unfortunately, once “in the door,” external wholesalers from mutual fund firms were more apt to receive neutral than positive ratings from $100 million-plus advisors. In fact, 55% of high-end producers gave external wholesalers a neutral (52%) or negative (3%) rating, while fewer than half (45%) said they were more likely to invest in the firms’ products as a result of the visit.

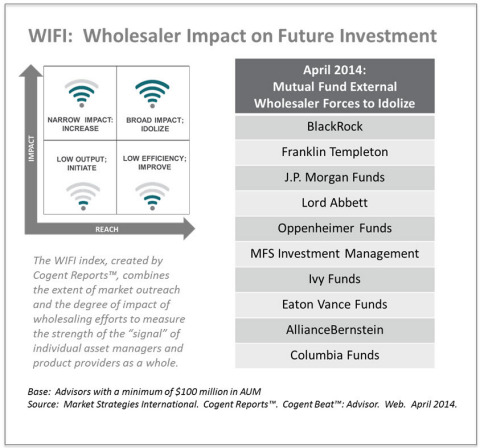

However, a handful of firms—1 in 4—achieved above-average ratings on both reach and impact, a status Cogent Reports has termed “idolize” in its WIFI (Wholesaler Impact on Future Investment) quadrant analysis. These 10 firms include BlackRock, Franklin Templeton, J.P. Morgan Funds, Lord Abbett, OppenheimerFunds, MFS Investment Management, Ivy Funds, Eaton Vance Funds, AllianceBernstein and Columbia Funds. The greatest number of mutual fund firms (18) fall into the “initiate” quadrant, as they have below-average reach and impact among $100 million-plus advisors. Four mutual fund firms need to “improve,” as they have above-average reach but low impact, while 12 mutual fund firms should consider an “increase” to their efforts as their wholesaling teams are effective at influencing advisors but their reach is relatively low.

About Cogent Beat

Cogent Reports collects data via an online survey among a representative cross section of 300-500 registered financial advisors on a rolling monthly basis. Survey participants are required to have an active book of business of at least $5M, and offer investment advice or planning services to individual investors on a fee or transactional basis. The survey has a sampling error varies by month based upon the sample size. Market Strategies International will supply the exact wording of any survey question upon request.

About WIFI. The WIFI (Wholesaler Impact on Future Investment) Index was created by Cogent Reports and is tracked in the Cogent Beat Advisor platform. The metric combines the extent of market outreach and the degree of impact of wholesaling efforts to measure the strength of the “signal” of individual asset managers at the product class level. The measure is calculated for internal and external wholesaling efforts, and separately for each product class (mutual funds, ETFs and variable annuities) among all users of the product class.

About Market Strategies International and Cogent Reports

Market Strategies International is a market research consultancy with deep expertise in communications, consumer/retail, energy, financial services, healthcare and technology. The firm is ISO 20252 certified, reflecting its commitment to providing intelligent research, designed to the highest levels of accuracy, with meaningful results that help companies make confident business decisions.

Market Strategies conducts qualitative and quantitative research in 75 countries, and its specialties include brand, communications, customer experience, product development, segmentation and syndicated. Its syndicated products, known as Cogent Reports, help clients understand the market environment, explore industry trends and evaluate and monitor their brand and products within the competitive landscape. Founded in 1989, Market Strategies is one of the largest market research firms in the world, with offices in the US, Canada and China. Read Market Strategies’ blog at FreshMR, and follow us on Facebook, Twitter and LinkedIn.