TOKYO--(BUSINESS WIRE)--The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU), a subsidiary of Mitsubishi UFJ Financial Group, Inc. (MUFG) hereby announces that, subject to required regulatory permission and approval, BTMU will rename its U.S. financial holding company subsidiary, UnionBanCal Corporation, and its wholly-owned U.S. national bank, Union Bank, N.A., as “MUFG Americas Holdings Corporation” and “MUFG Union Bank, N.A.,” respectively, and operate its Americas banking operations through an integration of all BTMU’s U.S. employees into MUFG Union Bank, N.A.

1. Outline of the business integration

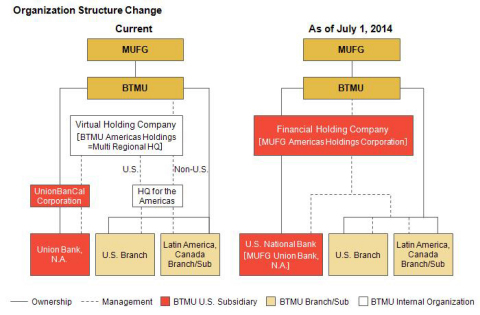

| (1) | BTMU’s Americas banking operation will be integrated as follows and operated under a single management structure on July 1, 2014. | |

| (2) | The U.S. financial holding company, UnionBanCal Corporation, will be renamed “MUFG Americas Holdings Corporation,” and it will supervise BTMU’s Americas banking operation which consists of Union Bank, N.A., BTMU branches in the U.S. and BTMU branches and subsidiaries in Latin America and Canada. | |

| (3) | Union Bank, N.A., a wholly-owned bank subsidiary of UnionBanCal Corporation, will be renamed “MUFG Union Bank, N.A.” and all the U.S. employees of BTMU and Union Bank, N.A. will be integrated into MUFG Union Bank, N.A. | |

| (4) | The corporate headquarters (Principal Executive Office) for MUFG Americas Holdings Corporation and MUFG Union Bank, N.A. will be located in New York City. However, our current sales organization covering the East and West Coasts of the U.S. will be firmly maintained and further developed. | |

| (5) | In order to fully leverage the customer service related benefits of operating BTMU branches in the U.S., in addition to MUFG Union Bank, N.A., the New York, Chicago, and Los Angeles branches of BTMU will remain in full operation. The branches will retain their current functions and roles in the foreign exchange and settlement businesses, and continue to provide services to Japanese customers. The operation of businesses in the Americas which are located outside of the U.S. (in Latin America and Canada) will remain unchanged. | |

2. Background and objectives of the business integration

| As part of the global strategy, BTMU considers it essential to increase BTMU’s presence in the U.S. We believe that this business integration will be the foundation toward accomplishing our goal of joining the ranks of the “Top-Ten” U.S. financial institutions. | ||

| Through this business integration, we aim to deliver the following benefits: | ||

| (1) | Enhanced services: | |

| Streamlining duplicate operations between Union Bank, N.A. and BTMU Headquarters for the Americas and by concentrating our talents and expertise, we aim to enhance our product development and solution provision capability and develop an organization able to meet diversified customer needs through the provision of comprehensive financial services. | ||

| (2) | Strengthened U.S. dollar funding capability: | |

| Leveraging MUFG Union Bank, N.A.’s stable U.S. dollar funding capability as a U.S. bank, we aim to respond to customer needs for smooth U.S. dollar funding. Improvement of the Americas funding independence for our group as a whole will also allow us to reduce foreign currency liquidity risk. | ||

| (3) | Advanced governance structure: | |

| As a result of centralizing our chain of command, strategic planning and resource allocation will be performed on an integrated basis, opening opportunities to further improve profitability. In addition, the strengthening of our internal controls structure will result in an even more solid organization, capable of responding to the trend of heightened regulatory expectations, both locally and internationally. | ||

3. Change of the legal names of subsidiaries

|

(1) Outline of the affected subsidiaries |

||||

|

a) Current legal name |

UnionBanCal Corporation | Union Bank, N.A. | ||

| b) New legal name | MUFG Americas Holdings Corporation | MUFG Union Bank, N.A. | ||

| c) Location* |

San Francisco, California,

United States of America |

San Francisco, California,

United States of America |

||

|

d) Title/Name of representative director |

President & CEO, Masashi Oka | President & CEO, Masashi Oka | ||

| e) Business description | Financial holding company | Banking | ||

|

f) Capital stock |

136 million dollars | 605 million dollars | ||

|

* Registered head office of the financial holding company and main office of the bank subsidiary |

||||

| (2) | Reason for changes | ||||

| a) | MUFG Americas Holdings Corporation | ||||

| Using “MUFG,” our global master brand, we will clearly identify membership in the MUFG Group. | |||||

| b) | MUFG Union Bank, N.A. | ||||

| The purpose of the trade name change is to appeal to a broader range of customers by combining “MUFG,” our global master brand, with “Union Bank,” a name widely recognized in the U.S. | |||||

| Taking into consideration our current presence and service offerings, the “MUFG” brand will be used for corporate banking customers, and the “Union Bank” brand for retail and commercial banking customers. Regardless of the brand, our commitment to growing together with our community as a responsible bank remains unchanged. | |||||

| (3) | Planned date for the name changes | ||||

| July 1, 2014 | |||||

4. Outlook

The impact of the business integration and legal name changes on the financial results of MUFG and BTMU is expected to be negligible.