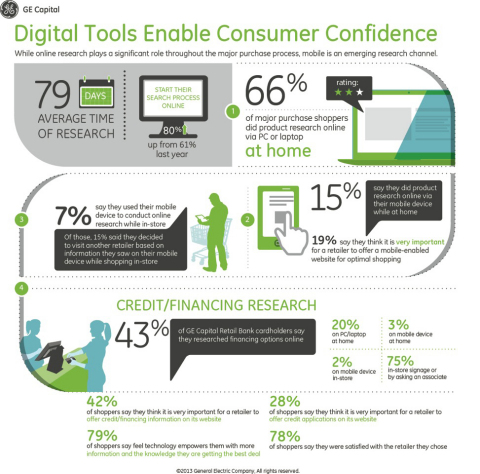

STAMFORD, Conn.--(BUSINESS WIRE)--Patience and the pursuit of information pay off, according to GE Capital Retail Bank’s second annual Major Purchase Shopper Study. Empowered by technology, consumers extensively research and compare prices and financing offers before they make any major purchase. More than 80 percent start their search process online from home – up 20 percent from last year – and spend an average of 79 days gathering information before making a major purchase. While consumers carefully consider before they buy, 41 percent of random major purchase shoppers say they are more open to making a large purchase than they were a year ago.

The survey and interviews, conducted by Rothstein Tauber, Inc., a marketing research company based in Stamford, Conn., explored the shopping habits of 3,220 consumers nationwide who had recently made purchases of $500 or more and were in the market for major items in 12 segments including: appliances, electronics, flooring, home furnishings and bedding, home improvements, jewelry, eyewear, power sports products, and lawn and garden equipment. More than 2,200 of the participating consumers were GE Capital Retail Bank (GECRB) accountholders and one third of respondents were random shoppers.

“We took a deeper look at how consumers use digital tools to approach a major purchase, including the role of mobile devices and preferred search engines, keywords and sites,” said Toni White, chief marketing officer of GE Capital’s Retail Finance business. “While online research plays a bigger role throughout the major purchase process, 60 percent of consumers start by visiting a search engine, then go to the retailer’s website, and ultimately, 88 percent made their final purchase in store.”

The availability of financing options continues to be a key factor in the shopper’s choice of retailer, with nearly half of all shoppers researching payment options online before visiting a store. Financing influenced the decision to buy from a specific retailer for 77 percent of GECRB cardholders surveyed, and nearly half would not have made the purchase or would have gone to another merchant if financing was not available, indicating that merchant marketing, awareness and loyalty programs can impact sales.

Depending on the category, between 40 and 137 days was spent researching the purchase. While the Study data represents the average major purchase experience, it is inclusive of shoppers who had a short decision cycle based on a critical need to replace an item.* The findings also revealed the following:

- For one out of four major purchase shoppers, their purchase was part of a larger project.

- Replacement and upgrades are the two most prevalent triggers to purchase.

- The length of the purchase cycle and price are highly correlated.

- Consumers say digital tools empower them to compare prices and find the best value.

- Shoppers search for the following when they visit the retailer’s website (in order of importance): warranty information (66%); pricing (52%); specs/model information (51%); payment/financing information (47%); sales/discounts; availability; and shipping information.

- On average, consumers visited five unique retailers – at least three online merchants and two brick-and-mortar stores – before making their purchase.

“These insights can help guide merchants in building better businesses by developing holistic marketing plans and effective sales training and digital strategies,” adds White. “The propensity for using the credit program again was also high, with 79 percent of cardholders stating they are likely to use their card again, so cultivating loyalty and high customer satisfaction can lead to reuse, referrals and favorable reviews.”

For 80 years, GE Capital’s Retail Finance business has provided billions of dollars in consumer financing through major retailers and more than 200,000 small- and mid-sized businesses throughout the United States. GE Capital supports its clients with proprietary online service, marketing and sales tools through its Business Center, as well as its Learning Center, providing access to comprehensive training and retail insights and analytics. Cardholders can manage their accounts with a suite of digital tools, including the online Consumer Center and mService, a mobile servicing platform available on iOS, Android, Blackberry and Windows devices.

*The GE Capital Retail Finance Annual Major Purchase Shopper Study represents the average major purchase experience. The data reflects recent purchases valued at $500 or more that were categorized by consumers as both need and want. Note some product category differences (i.e., eyewear and appliance shoppers may have a shorter consideration cycle.)

About GE Capital’s Retail Finance business

GE Capital’s Retail Finance business is among the country’s most successful retail lenders, with 80 years of experience in consumer financing. The business, with its lending entity GE Capital Retail Bank, provides customized credit programs to retailers and consumers in the United States and Canada that help drive sales. This includes private label and bankcard credit programs to major national, regional and independent retailers in the U.S., as well as private label credit card programs, promotional and installment lending, bankcards and financial services for consumers through dealers; contractors; manufacturers; healthcare practices; and service providers across nearly 20 industries. More information can be found at www.gogecapital.com and twitter.com/GoGECapital.

GE Capital is one of the world’s largest providers of credit. For over one million businesses, large and small, GE Capital provides financing to purchase, lease and distribute equipment, as well as capital for real estate and corporate acquisitions, refinancings and restructurings. For our 100+ million consumer customers, GE Capital offers credit cards, sales finance programs, home, car and personal loans and credit insurance. For more information, visit www.gecapital.com or follow company news via Twitter @GECapital.

GE (NYSE: GE) works on things that matter. The best people and the best technologies taking on the toughest challenges. Finding solutions in energy, health and home, transportation and finance. Building, powering, moving and curing the world. Not just imagining. Doing. GE works. For more information, visit the company's website at www.ge.com.

Editor Note: Graphic data representations, photography and industry-specific findings available.

©2013 General Electric Company, All rights reserved.