LONDON--(BUSINESS WIRE)--Kelp, a FinTech decision and analytics platform for alternative investors, and PitchBook, the leading data provider for the private and public equity and credit markets, are excited to announce today an agreement to integrate PitchBook data within Kelp’s software suite. This collaboration marks a significant milestone in the pursuit of data-driven solutions in combination with cutting-edge digitization to foster innovation within the private market ecosystem.

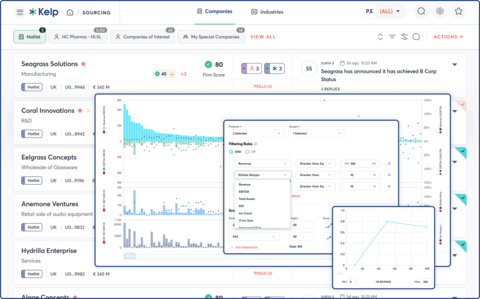

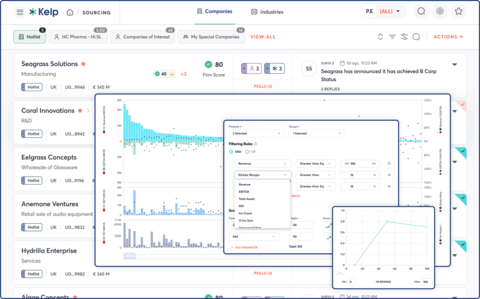

With the launch of this partnership, Kelp clients can integrate PitchBook data – including financial data on private and public companies, investors, funds, limited partners and service providers – directly into their instance of Kelp.

"With the integration of PitchBook's financial and deal data, combined with our own proprietary firmographic research, analytics and advanced algorithms, Kelp's clients can overlay their own nuanced investment criteria and quickly and accurately identify companies at scale," said Douglas A. Trafelet, Managing Director of Kelp. "This powerful combination will enable our clients to gain competitive advantages by efficiently building and maintaining target shortlists, modelling valuations and delivering on the best exit opportunities."

About Kelp:

Kelp is a FinTech solution that uniquely combines its proprietary software technology and 360° private company data—paid, public and proprietary—to support clients from idea to exit. The Kelp platform is an end-to-end solution across Deal Identification, Deal Management and Value Creation. Kelp augments organisational intelligence and automates routine tasks to enable high-quality decision making. Kelp’s prescriptive decision support technology brings the power of structured and unstructured data to investment professionals, surfaces actionable institutional learnings and intelligently automates workflows for efficiency and continuous learning. Kelp was founded in 2022 and has offices in London, Singapore and Mumbai.

About PitchBook:

PitchBook is a financial data and software company that provides transparency into the capital markets to help professionals discover and execute opportunities with confidence and efficiency. PitchBook collects and analyzes detailed data on the entire venture capital, private equity and M&A landscape—including public and private companies, investors, funds, investments, exits and people. The company's data and analysis are available through the PitchBook Platform, industry news and in-depth reports. Founded in 2007, PitchBook operates globally with more than 3,000 team members. Its platform, data and research serve over 100,000 professionals around the world. In 2016, Morningstar acquired PitchBook, which now operates as an independent subsidiary.