AMSTERDAM--(BUSINESS WIRE)--Management and technology consultancy BearingPoint’s latest study on the state of online new car sales assesses the online sales performances of major OEMs and identifies where they need to improve to catch up with Tesla and differentiate themselves. Online shops for new cars are popping up in all major markets worldwide, and car manufacturers (OEMs) are rightly establishing digital journeys to enable new business models and the implementation of direct sales strategies.

Christoph Landgrebe, Partner at BearingPoint: “To be and remain competitive, car manufacturers need to make huge investments to successfully convert their traditional sales channels to online sales by implementing state-of-the-art technology. First and foremost, a champion in online car sales adapts quickly to the changing buying behavior of customers and frees up the necessary resources for online sales. It’s about knowing the importance of the individual elements of the sales process from the customer’s point of view and one’s competitive position – and it’s not looking particularly good for traditional manufacturers. There is still a lot of room for improvement.”

Competition is growing

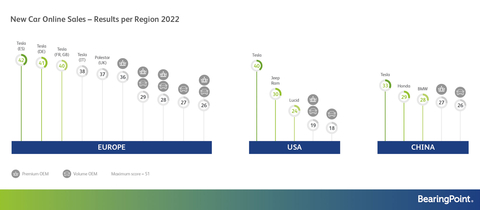

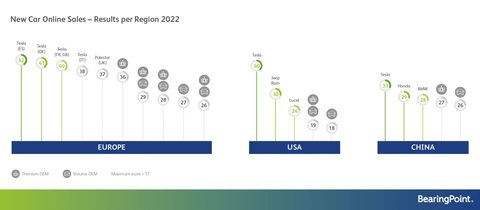

The new study again ranks OEMs in three phases of the customer journey: pre-sales, sales and handover, with a total of 17 assessed touchpoints. Each touchpoint has four levels of maturity that are evaluated by the degree of fulfillment – 0 for no fulfillment to 3 for maximum fulfillment, leading to a top score of 51 points. Tesla once again claimed the top spot in all assessed markets.

Though Tesla remains the global champion of direct sales, it now has a challenger with a similar business model in Polestar, the Swedish automotive brand acquired by Volvo in 2015. Polestar provides a mature online shop with superb usability and design. Mercedes-Benz also had a respectable score with its online shop in the UK. A large number of new volume OEMs like Citroen, Renault and FIAT launched online shops in all European markets, so competition is growing significantly.

Doubling of online shops in just one year

The number of online shops in the assessed markets almost doubled, from 31 to 60, compared to the 2021 study, pointing to a very dynamic 2022 online sales market. BearingPoint identified 14 new OEMs selling their new cars online, noting that the Stellantis Group brands introduced a blueprint solution that can be used for multiple brands and markets for faster scaling.

The study showed that France, Italy and Spain had the biggest market growth, moving to the same level as their European neighbors. Germany and Spain top the continent in terms of available online shops. China remains the number one market for online sales in terms of quantity, and it had the highest number of assessed online shops with 12.

The US market still trails behind the other regions with seven online shops but is showing good growth compared to the previous year when only four shops were assessed. The stock car character of the US market enables leaner shops that focus primarily on stock cars from dealers.

Differentiation is more and more difficult

According to the study, since an increasing number of OEMs are offering online purchases by the year, differentiation is getting harder. “An online shop is no longer a differentiator: brands can only differentiate themselves by providing leading practices in user experience and design, combined with a seamlessly integrated outstanding service quality,” said Christoph Landgrebe.

This years study highlights the Lucid car configurator in the US and the Tesla order tracking as two leading practices. Furthermore virtual reality has been identified as a white spot that could help OEMs to stand out from the competition by bringing the dealership right to the customer’s home.

The study revealed that most online shops still lack important functionalities, customer journeys are far from seamless, and differentiation is hard to come by, which is reflected in the similar scores among the assessed online shops. “The success of new competitors such as Tesla or Polestar suggests that one of the biggest challenges for car manufacturers is the internal legacy systems and processes behind the customer journey, which slow down the implementation and rollout processes with their technical and organizational complexity. Many manufacturers are challenged by the question of whether they should redesign their existing landscape or go straight for a completely new approach,” said Christoph Landgrebe.

As in last year’s study, differences can be found market-wise, with OEMs providing fundamentally different online shops in different markets, especially when comparing Europe, China, and the US. The creation and rollout of a global blueprint seem to be challenging. Nevertheless, BearingPoint identified that inside of Europe, many OEMs have started to introduce such a blueprint solution.

“Incumbent OEMs must be careful not to be left behind when it comes to online sales, which would impact the overall sales performance of the individual brands. Traditional carmakers are currently still too far away from the customer compared to the online champions identified in the study, which we honored with our sales awards,” said Dr. Stefan Penthin, global leader Automotive at BearingPoint

About the study

BearingPoint once again analyzed the online offerings of leading OEMs in China, the US and Europe and assessed their online sales readiness, identified leading practices and derived recommendations for action. The study also evaluated how OEMs are meeting changing customer needs along the digital customer journey, particularly the buying experience. Because the new car market is diverse and customer behavior differs from market to market, the scope of the study was designed to include the world’s major car markets – China, the US, and Western Europe. The assessment of the online car shops was conducted in all markets in December 2021.

You can download the study here to find out more, including a detailed analysis and ranking of the OEMs: https://www.bearingpoint.com/en/our-success/insights/new-car-online-sales-2022/

About BearingPoint

BearingPoint is an independent management and technology consultancy with European roots and a global reach. The company operates in three business units: The first unit covers the advisory business with a clear focus on selected business areas. The second unit provides IP-driven digital assets and managed services beyond SaaS. The third unit is designed to explore innovative business models with clients and partners by driving the financing and development of start-ups and leveraging ecosystems.

BearingPoint’s clients include many of the world’s leading companies and organizations. The firm has a global consulting network with more than 10,000 people and supports clients in over 70 countries, engaging with them to achieve measurable and sustainable success.

For more information, please visit:

Homepage: www.bearingpoint.com

LinkedIn: www.linkedin.com/company/bearingpoint

Twitter: @BearingPoint