VANCOUVER, British Columbia--(BUSINESS WIRE)--Hawkmoon Resources Corp. (CSE:HM) (“Hawkmoon” or the “Company”) announces the option to acquire 100% of the Wilson Gold Project (“Wilson” or the “Property”) from Cartier Resources (TSX.V: ECR) (“Cartier” or the “Vendor”). The terms of the agreement with Cartier are summarized in Table two. The Property is comprised of fourty two mineral claims totaling approximately 1,660 hectares. Wilson is located in Verneuil Township fifteen kilometres east of the town of Lebel-sur-Quévillon and 150 kilometres northeast of the mining city of Val d’Or.

Two major government-maintained roads cross the Property. One of these roads leads to Hawkmoon’s Romeo Property (“Romeo”). Hawkmoon can access and work on the Wilson all year. With proximity to infrastructure, a qualified workforce and access to several local drill contractors and assay labs Hawkmoon can easily work both Wilson and Romeo at the same time. This decreases logistics and costs. The location of Wilson reinforces Hawkmoon’s focus on gold in Quebec.

Wilson Property Geology and Mineralization

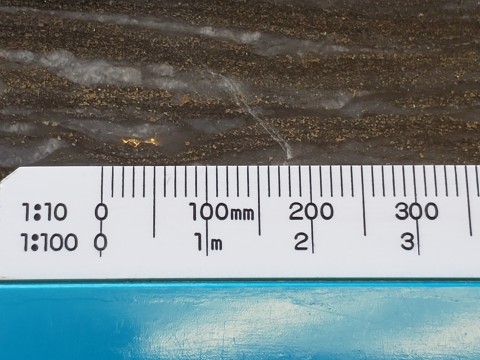

The geology of Wilson is composed of felsic to intermediate volcanic flows and tuffs and a gabbroic sill. The primary gold showing on Wilson is the Toussaint Showing (“Toussaint”). The Toussaint generally occurs where volcanic tuffs contact the gabbroic sill. The Toussaint is characterized as a highly altered, strongly sheared schist set within an intermediate volcanic tuff. Alteration is primarily calcite, sericite, chlorite and ankerite. The Toussaint is described as pale grey to beige with numerous injections of quartz veins as well as sulphide minerals (pyrite-pyrrhotite ± chalcopyrite) and local grains of visible gold in drill core. Refer to figures one (photograph of Toussaint), two (visible gold in drill core) and three (boxes of drill core).

Gold Mineralization of the Toussaint Showing

A historical assessment report 1suggested the Toussaint has a head grade of 7.1 grams per tonne gold. This was calculated in 1994, before the implementation of NI 43-101. Hawkmoon is treating the data as historical and a Qualified Person has not yet done the work necessary to verify the data and the data should therefore not be relied upon. Hawkmoon considers the historical data relevant to assessing the exploration potential of Wilson. A total of 126 diamond drill holes have been completed on Wilson totalling approximately 24,000 metres. This diamond drilling was completed intermittently from 1956 to 2017. Highlights of this drilling is shown in Table 1.

Table 1: Highlights of Historical Diamond Drilling, Toussaint

Drill |

From |

To |

Length |

Gold Grade |

Hole |

(metres) |

(metres) |

(metres) |

g/t |

VP-11-11 |

174.0 |

177.0 |

3.0 |

33.2 |

including |

175.7 |

176.3 |

0.6 |

164.5 |

VP-11-18 |

76.0 |

143.0 |

67.0 |

1.5 |

including |

76.0 |

77.0 |

1.0 |

30.1 |

including |

106.0 |

107.0 |

1.0 |

12.5 |

including |

125.0 |

126.0 |

1.0 |

24.5 |

VP-93-22 |

101.8 |

143.2 |

41.4 |

2.0 |

including |

101.8 |

102.8 |

1.0 |

12.6 |

including |

138.0 |

143.2 |

5.2 |

11.7 |

VP-94-45 |

228.4 |

231.0 |

2.6 |

20.2 |

including |

228.4 |

229.5 |

1.1 |

32.2 |

VP-92-10 |

36.2 |

41.0 |

4.8 |

10.5 |

including |

36.2 |

37.0 |

0.8 |

34.3 |

including |

39.0 |

39.7 |

0.7 |

20.4 |

VP-11-05 |

28.0 |

35.0 |

7.0 |

6.3 |

including |

34.0 |

35.0 |

1.0 |

32.3 |

Six Additional Gold Showings on Wilson

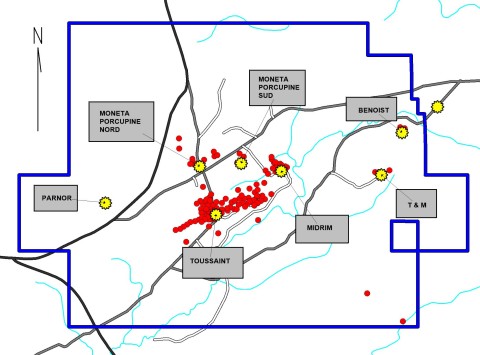

In addition to the Toussaint, there are six other gold showings on Wilson. These showings are: Midrim, Benoist, Moneta Porcupine North, Moneta Porcupine South, T&M and Parnor. The largest of these showings is the Midrim which is situated several hundred metres northeast of Toussaint. One goal for Hawkmoon is to explore the possibility of connecting the Toussaint and Midrim Showings. Figure four is a map showing the location of all gold showings and diamond drill holes completed on Wilson.

Table 2: Terms of the Option to Acquire 100% of the Wilson Property, Quebec

Time |

Cash Payments |

Shares Issued |

Work Program |

Drilled Metres |

Upon Execution |

$200,000 |

700,000 |

N/A |

N/A |

Year 1 Anniversary |

$150,000 |

700,000 |

$750,000 |

3,000 |

Year 2 Anniversary |

$150,000 |

800,000 |

$750,000 |

3,000 |

Year 3 Anniversary |

$250,000 |

800,000 |

$1,000,000 |

4,000 |

Year 4 Anniversary |

$250,000 |

1,000,000 |

$1,500,000 |

6,000 |

Year 5 Anniversary |

N/A |

1,000,000 |

$2,000,000 |

8,000 |

Totals |

$1,000,000 |

5,000,000 |

$6,000,000 |

24,000 |

Mr. Branden Haynes, President of Hawkmoon states “The option to acquire this property from Cartier Resources is an amazing opportunity for Hawkmoon. We intend to start work on this exciting new gold project shortly. It is excellent to work with Cartier Resources. Cartier has an excellent reputation as one of Quebec’s most esteemed junior miners.”

About Hawkmoon Resources

Hawkmoon recently completed its initial public offering and is focused entirely on its two Quebec gold projects in one of the world’s largest gold deposits, the Abitibi Greenstone Belt. Both these gold projects are accessed by government-maintained roads and are in close proximity to each other east of the town of Lebel sur Quévillon.

About Cartier Resources

Cartier Resources Inc., founded in 2006, is based in Val-d’Or, Quebec. This province has consistently ranked as one of the world’s best mining jurisdictions, primarily because of its favourable geology, attractive fiscal environment and pro-mining government. Cartier has a strong cash position with more than $10.0 million and a significant corporate and institutional endorsement, including Agnico Eagle Mines, Jupiter Asset Management and Quebec investment funds. Cartier’s strategy is to focus on gold projects with features that offer the potential for rapid growth. Cartier holds a portfolio of exploration projects in the Abitibi Greenstone Belt of Quebec, one of the world’s most prolific mining regions. Cartier’s focus is to advance its four key projects through drilling programs. All of the projects were acquired at reasonable costs in recent years and are drill-ready with targets along the geometric extensions of gold deposits. Exploration work is currently focused on the Chimo Mine and Benoist properties to maximize value for investors. Future exploration work is planned on the Fenton and Wilson properties.

Qualified Person

The technical information in this news release has been reviewed and approved by Thomas Clarke P.Geo., Pr.Sci.Nat. Mr. Clarke is a “Qualified Person” under NI 43-101 and a Director and the Vice President Exploration of Hawkmoon.

HAWKMOON RESOURCES CORP.,

ON BEHALF OF THE BOARD

"Branden Haynes"

Branden Haynes, Chief Executive Officer

Forward Looking Statements

This news release contains certain forward-looking statements. The use of the word “expected”, “projected”, “pursuing”, “plans” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this news release include statements regarding: the Company’s option to acquire the Wilson Gold Project and the Company’s expectations for exploration of that property and the Company’s Romeo property. The forward-looking statements are made as at the date hereof and the Company disclaims any intent or obligation to publicly update any forward-looking statements, where because of new information, future events or results, or otherwise, except as required by applicable securities laws.

For more information, please contact Branden Haynes, Chief Executive Officer and Director, Email: branden@hawkmoonresources.com; Telephone: 604-817-1595

1 number GM52557 titled “Report of diamond drilling, Verneuil Project” by Mark Fekete Dated May 25, 1994