CHARLOTTE, N.C.--(BUSINESS WIRE)--Wells Fargo, NextEra Energy Resources, and Duke Energy today announced a 20-year renewable energy purchase agreement, under which Wells Fargo will consume 100% of solar energy produced by the Blackburn Solar Project, a 58-megawatt 600-acre solar farm planned for Catawba County, North Carolina, under Duke Energy’s Green Source Advantage (GSA) program. The transaction announced today is Wells Fargo’s single largest to date and will supply approximately 8% of the company’s annual global electricity.

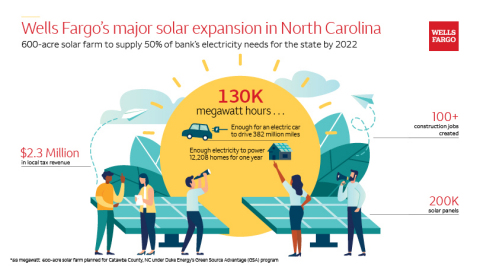

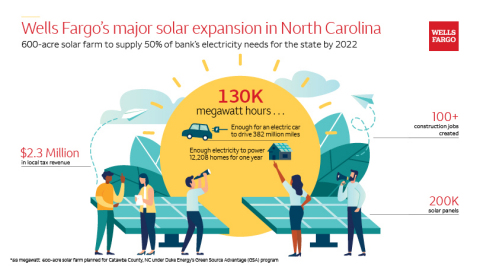

Energy provided under the agreement will allow Wells Fargo to meet more than 50% of total electricity needs and 100% of its eligible load within the Duke Energy Carolinas service area, where it maintains a real-estate footprint of 7.5 million square feet and employs about 36,000. The 130,000 megawatt-hours Wells Fargo will receive each year will be generated by about 200,000 solar panels. The facility will be developed, owned, and operated by a subsidiary of Florida-based NextEra Energy Resources, and is scheduled to come online in 2022. Wells Fargo will also retain the Renewable Energy Credits (RECs) associated with the project.

“The development of renewable energy projects close to employee and customer centers is one way Wells Fargo is working to meet our net-zero greenhouse gas emissions goal in a way that also contributes to the communities where we live and work. Investing in solar energy development in North Carolina will support job creation, tax revenue, reduced carbon emissions, and grid resiliency,” said Nate Hurst, head of Social Impact and Sustainability at Wells Fargo. “We appreciate the collaboration with Duke and NextEra to advance our enterprise sustainability goals in a way that benefits the local economy.”

“As large energy users look to expand their sustainability goals, many are finding Duke Energy’s Green Source Advantage program the perfect fit to make that happen,” said Stephen De May, Duke Energy’s North Carolina president. “The program’s flexibility allows the customer to modify it to best suit their needs. The state benefits by more renewable energy.”

Developer NextEra Energy Resources is working with community leaders and organizations to ensure the project meets local solar development requirements, as well as Wells Fargo’s needs. As part of the development, NextEra Energy Resources is negotiating a land grant with the Catawba Lands Conservancy to conserve lands along the Catawba River and expand a portion of the Carolina Thread Trail. According to the project website, community economic benefits include approximately $2.3 million in additional tax revenue for the local community as well as local employment opportunities, including up to 100 jobs to construct the project.

“We’re excited to work with Duke and Wells Fargo to provide more affordable, renewable energy through the Green Source Advantage program,” said Matt Handel, senior vice president of development for NextEra Energy Resources. ”The Blackburn Solar project will also provide significant benefits to the economy, creating good-paying construction jobs and generating millions of dollars in additional tax revenue for the local community.”

Wells Fargo has met 100% of its annual global electricity requirements with renewable energy since 2017, primarily through the purchase of RECs, which satisfied the first part of a two-pronged 2020 renewable energy goal set in 2016. The company is now working to fulfill the second part of that commitment — to transition to a higher mix of long-term renewable energy contracts for projects near its greatest load centers and significantly expand onsite solar generation in order to support the development of net-new sources of renewable energy and deliver community benefits associated with renewable energy development. In March, Wells Fargo announced its goal to achieve net-zero greenhouse gas emissions by 2050, including its financed emissions.

“Leveraging our annual energy spend to advance green infrastructure development in the U.S. and create new revenue streams for communities is one way we are helping contribute to more sustainable, equitable, and resilient communities,” said Richard Henderson, head of Wells Fargo’s Corporate Properties Group. “We will continue to look for opportunities to advance environmental and social sustainability through our operations as Wells Fargo drives toward its ambitious climate goals.”

Earlier this year, Wells Fargo announced a deal with Ameresco, Inc. to install approximately 30 megawatts of new, on-site solar generation assets at about 100 corporate and retail locations in seven states. As part of that agreement, Ameresco will install 2.6 megawatts of solar generation at two administrative buildings in North Carolina. To date, Wells Fargo’s Corporate Properties Group has entered into nearly 120 long-term contracts that support the development of over 750 megawatts of net-new renewable energy assets.

Aside from being one of the largest corporate users of renewable energy, Wells Fargo is a leader in financing large-scale wind, solar, and other renewable energy projects on behalf of its customers. The company recently reached the milestone of providing $10 billion in tax equity financing for utility-scale renewable energy projects. Since 2005, Wells Fargo has helped finance 12% of all wind and solar energy capacity in the U.S.

About Wells Fargo

Wells Fargo & Company is a leading financial services company that has approximately $1.9 trillion in assets and proudly serves one in three U.S. households and more than 10% of all middle market companies in the U.S. We provide a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending; Commercial Banking; Corporate and Investment Banking; and Wealth and Investment Management. Wells Fargo ranked No. 30 on Fortune’s 2020 rankings of America’s largest corporations. In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health and a low-carbon economy. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo.

News Release Category: WF-PESG