BOSTON--(BUSINESS WIRE)--BondLink, a financial technology company with headquarters in Boston that provides software solutions to governments in the $4 trillion municipal bond market, today announced an agreement with ICE Data Services, which is part of Intercontinental Exchange (NYSE:ICE), to bring real-time market data to its cloud-based debt management platform.

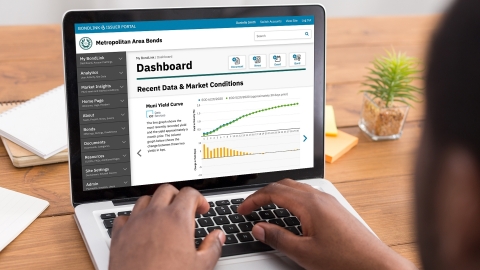

BondLink provides the municipal bond industry’s first fully-integrated technology platform for public sector CFOs to raise capital from institutional and retail investors. Market data sets such as interest rate yield curves, secondary market trades and real-time bond pricing provide critical information to issuers needed to properly gauge market conditions prior to a bond sale. This data is planned to be offered as a new tool within BondLink’s technology platform, starting with ICE Data Services’ daily interest rate curves, adding to the company’s existing functionality including investor intelligence & analytics, compliance solutions, and deal preparation.

“Issuers in the municipal market are significantly under-resourced relative to corporate CFO’s,” said Colin MacNaught, CEO and Co-Founder of BondLink. “Technology can provide massive efficiencies and cost-savings that benefit the issuers themselves, but also bond investors and taxpayers. Connecting issuers to critical market data from ICE Data Services can bring them out of the dark and provide tools to better manage their bond programs.”

“By working with BondLink, we’re able to leverage our strength in the fixed income markets and greatly expand the solutions we offer to municipal issuers,” said Mark Heckert, Chief Product Officer at ICE Data Services. “The additional transparency that we’re providing will help make the municipal market more efficient, and can assist issuers with their financing process and can help lower costs.”

BondLink and ICE Data Services plan to launch the municipal bond market data package in July 2020.

About BondLink

Led by founders Colin MacNaught, CEO, and Carl Query, CTO, BondLink’s cloud-based debt management platform is the $4 trillion municipal bond market’s first fully-integrated operating system for public sector CFOs to raise capital from institutional and retail investors. Since the launch of its first dent management platform approximately three and a half years ago, BondLink has expanded its network across more than 30 states, as well as the District of Columbia, Puerto Rico and the U.S. Virgin Islands. Headquartered in Boston, BondLink is backed by top investors, including Franklin Templeton Investments, one of the largest municipal bond fund managers in the country. For more information, please visit www.bondlink.com.

About Intercontinental Exchange

Intercontinental Exchange (NYSE: ICE) is a Fortune 500 company formed in the year 2000 to modernize markets. ICE serves customers by operating the exchanges, clearing houses and information services they rely upon to invest, trade and manage risk across global financial and commodity markets. A leader in market data, ICE Data Services serves the information and connectivity needs across virtually all asset classes. As the parent company of the New York Stock Exchange, the company is the premier venue for raising capital in the world, driving economic growth and transforming markets.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located at http://www.intercontinentalexchange.com/terms-of-use. Key Information Documents for certain products covered by the EU Packaged Retail and Insurance-based Investment Products Regulation can be accessed on the relevant exchange website under the heading “Key Information Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 -- Statements in this press release regarding ICE's business that are not historical facts are "forward-looking statements" that involve risks and uncertainties. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see ICE's Securities and Exchange Commission (SEC) filings, including, but not limited to, the risk factors in ICE's Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the SEC on February 6, 2020.