ANN ARBOR, Mich.--(BUSINESS WIRE)--The restaurant scores are in, and there are mixed reviews.

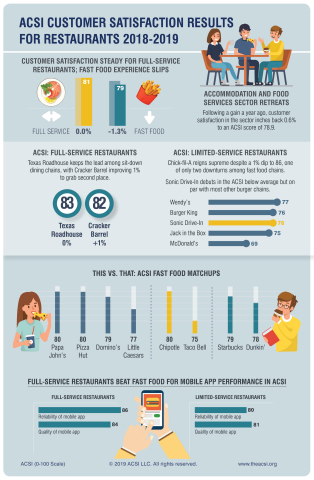

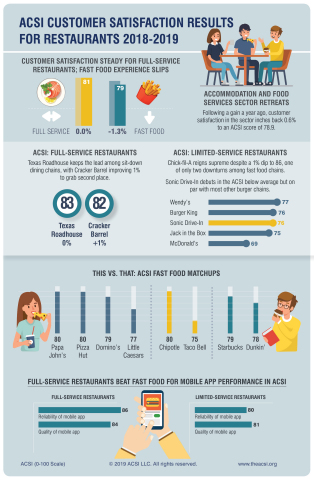

Customer satisfaction with the Accommodation and Food Services sector inches back slightly, down 0.6% to a score of 78.9 (on a scale of 0 to 100), according to the American Customer Satisfaction Index’s (ACSI®) Restaurant Report 2018-2019.

The full-service restaurant industry maintains high and stable customer satisfaction while fast food slips compared with a year ago. Regardless, stability marks both industries, with all chains either stable or moving by only 1% year over year.

“The restaurant industry faces challenges in everything from staffing shortages to competition from other vendors, like prepared foods from grocers and convenience stores,” says David VanAmburg, Managing Director at the ACSI. “Overall, foot traffic continues to decline, and restaurants are seeking to grow sales by relying on guests spending more per visit. Restaurants that focus on changing consumer tastes and preferences, however, could see the biggest boost in customer satisfaction.”

Delivery, technology, and healthier options are trending

As foot traffic slows, off-premises dining—projected to account for 37% of restaurant industry sales in 2018—plays an important role. According to ACSI data, full-service restaurant diners who order food for delivery are far more satisfied (83) than those who dine in (79). As such, the catering and delivery spaces will likely become even more competitive.

Taste and technology are evolving in large part thanks to millennials. Food is trending toward healthier options, such as plant-based burgers, local sourcing, fresh foods, and ethnic cuisines. Major operators are investing in mobile apps, digital kiosks, tableside ordering systems, and dedicated pick-up areas or drive-thru lanes for mobile orders.

Regardless of these shifts, customer satisfaction is vital to driving future sales. ACSI data demonstrate that the more satisfied guests are, the more willing they are to increase their restaurant spending in the coming year.

Texas Roadhouse leads full-service restaurants; Cracker Barrel makes strides

Following a 3.8% jump a year ago, customer satisfaction with full-service restaurants remains high and steady with an ACSI score of 81.

Texas Roadhouse – unchanged over the last year – retains the top spot at 83. After falling 4% last year, Cracker Barrel turns things around, up 1% to second place at 82. Its attempt to win over millennials appears to be working in one area as the chain’s mobile app scores best in class for quality.

LongHorn Steakhouse holds steady at 81, ahead of Darden sister brand Olive Garden, which slips 1% to 79 in a three-way tie with Outback Steakhouse and Red Robin.

Chili’s, Red Lobster, Ruby Tuesday, and TGI Fridays all score 78. Ruby Tuesday’s mobile app rates the lowest in terms of mobile quality.

Applebee’s (down 1%) and Denny’s (unchanged) are the bottom of the industry at 77. This is Denny’s highest ACSI score.

Chick fil-A remains the fast food favorite

Customer satisfaction with limited-service (fast food) restaurants trails the full-service industry again, declining 1.3% to 79.

Overall, the fast food customer experience shows some deterioration as major chains focus on technology and menu upgrades to meet shifting consumer preferences. Fast food customers tend to be more price sensitive as well, and the industry sees a weakening in guest perceptions of value.

Chick fil-A dips 1%, yet maintains a commanding lead across the entire sector with an ACSI score of 86. Panera Bread sits unchanged at 81, while four chains – Arby’s, Chipotle Mexican Grill, Papa John’s, and Pizza Hut – tie at 80.

The remaining chains are at or below the industry average. Domino’s (unchanged), Starbucks (up 1%), and Subway (down 1%) all score 79. Dunkin’ and KFC (Yum! Brands) score 78, followed by Little Caesars and Wendy’s, both steady at 77.

ACSI newcomer Sonic Drive-In scores 76, tying Burger King (unchanged). Both Jack in the Box and Taco Bell (Yum! Brands) inch up 1% to 75. Meanwhile, despite modernizing operations, including adding self-order kiosks, digital menu boards, and curbside pick-up for mobile orders, McDonald’s is stagnant at the low score of 69 for the fourth consecutive year.

Customer experience stable for full-service restaurants; fast food chains could use some work

Last year, full-service restaurants improved across nearly every aspect of the customer experience. This year, the industry holds fast, keeping most key elements stable.

Food order accuracy leads all areas of customer experience with an ACSI score of 89. Staff remains helpful and courteous (87) and food quality continues to be high at 87, but food variety dips to 85. Speed of service to the table is still significantly lower at 83.

Mobile apps, measured for the first time this year, score well for both reliability (86) and quality (84). Websites not so much, slipping to the bottom with an ACSI score of 82.

Meanwhile, fast food chains are doing worse across nearly all aspects of the customer experience. Beverage variety (80) is the only element to improve, yet sits at the bottom with food variety and mobile app reliability.

Food order accuracy drops 2% to 86, followed by staff courtesy and helpfulness (84), and beverage quality, food quality, and store layout and cleanliness, all dipping to 83.

Service speed—integral to the fast food experience—retreats 2% to 82, now lower than full-service restaurants (83). The fast food segment also struggles in the mobile app space compared to full-service restaurants, with scores of 81 for quality and 80 for reliability.

While some marks dip as low as 80, overall, it’s hard not to feel good about both restaurant segments. “These are mature industries that have been doing what they’re doing for a long time and they’ve been successful,” says VanAmburg. “To have these scores from a service industry is proof that the two restaurant categories are good at what they do.”

The ACSI Restaurant Report 2018-2019 on full-service and limited-service (fast food) dining chains is based on interviews with 23,468 customers, chosen at random and contacted via email between June 5, 2018 and May 27, 2019. Customers are asked to evaluate their recent experiences with the largest sit-down and fast food restaurants in terms of market share, plus an aggregate category consisting of “all other”—and thus smaller—restaurants in those industries. Download the full Restaurant Report.

Follow the ACSI on LinkedIn and Twitter at @theACSI.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About ACSI

The American Customer Satisfaction Index (ACSI®) has been a national economic indicator for 25 years. It measures and analyzes customer satisfaction with more than 400 companies in 46 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, ACSI scores are based on data from interviews with roughly 300,000 customers annually. For more information, visit www.theacsi.org.

ACSI and its logo are Registered Marks of the University of Michigan, licensed worldwide exclusively to American Customer Satisfaction Index LLC with the right to sublicense.