RADNOR, Pa.--(BUSINESS WIRE)--Lincoln Financial Group (NYSE: LNC) today released a new set of results from its 2017 Dental Research Series – a new body of research focused on dental insurance and dental care. The first installment of the series, released in June, looked at a variety of dental-related topics from a consumer perspective, while these subsequent results uncover dentists’ and employers’ points of view. The latest findings reveal several gaps – differences in perspectives among these groups – highlighting some key opportunities for dental offices to gain and retain patients, and providing guidance for employers to better meet their employees’ expectations.

“Comparing consumers’ dental needs and wants to the reality of what they’re getting today provides an interesting look at the opportunity dentists and employers have to differentiate themselves in the market,” said Christopher Stevens, head of Dental Product Management at Lincoln Financial Group. “Dentists can shape their practices to deliver a customer experience that will attract new patients and keep them coming back. Employers can boost employee retention and satisfaction by offering the right dental benefits, and by proactively communicating about those benefits. And consumers benefit in the end – they’ll get the right information they need to leverage dental insurance benefits and be proactive about their oral health.”

Patient Expectations vs. Dentist Perceptions

Lincoln Financial’s consumer study found that patients’ criteria for choosing and staying with a dentist goes beyond the basics. While quality of care, office environment and being in-network for insurance are all important, the study found that technology and user experience are becoming increasingly critical, particularly among Millennials. The problem is, many dentists aren’t necessarily providing the experience younger consumers say they want.

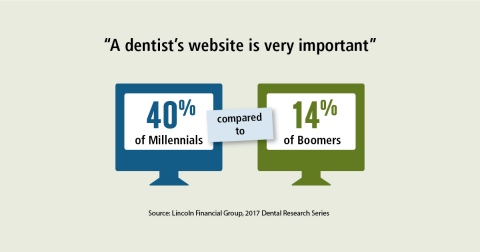

Websites are key for this audience. Forty percent of Millennials say a dentist’s website is “very” important, compared to 14 percent of Baby Boomers. Most dentists today do have websites (84 percent) – but, they aren’t always providing the information patients are looking for, such as:

- A list of accepted insurance carriers: 74 percent of Millennials want to see this on a dentist’s website, but just 43 percent of dental offices feature this information online.

- The ability to make/change appointments: 71 percent of Millennials want to do this online. Only 47 percent of dental offices currently offer this feature.

- Average costs of procedures: 65 percent of Millennials want this information, but a mere 18 percent of dental offices offer it on their websites today.

In addition to a robust web experience, the study found that consumers would greatly appreciate guidance from their dentists on understanding and using dental insurance. A whopping 96 percent of consumers and 99 percent of Millennials say they would find it valuable if their dental office provided guidance or help understanding dental insurance plans. However, just 34 percent of dental offices strongly agree that they currently help guide patients on treatments with their insurance coverage in mind.

Click here for an infographic overview of these findings.

Employee Needs vs. Employer Views

Employers also play a major role in consumers’ dental experiences. Seventy-five percent of employees say they expect their employer to provide education about their dental coverage, but only half say their employer is a good resource in helping them understand their benefits.

To educate employees on dental benefits, about half of employers provide opportunities to meet with human resources (50 percent), 45 percent send emails and 32 percent host health/wellness fairs.

Primarily, employees are looking for general information about what’s covered under their plans (65 percent) and they would also appreciate a list of in-network dentists with contact information (54 percent).

“It’s clear that consumers are looking for information and help – in understanding their dental coverage and how it works when actually visiting the dentist. In today’s environment, they want a lot of that information available at their fingertips,” said Stevens. “Employers and dentists can help facilitate this understanding by providing the information consumers want, where they want it. By taking this approach, employers and dentists may help their employees and patients, respectively, get the dental care they need.”

About Lincoln Financial’s 2017 Dental Research Series

Results of the Consumer study are based on an online survey of 1,000 adults 18 years of age or older across the United States, conducted in 2017 by Lincoln Financial Group and PSB. The margin of error is +/- 3% at the 95% confidence level. • Results of the Dental Professional study are based on an online survey of 400 dentists and dental office staff members across the United States, conducted in 2017 by Lincoln Financial Group and PSB. The margin of error is +/- 5% at the 95% confidence level. • Results of the Employer study are based on an online survey of 400 employers (human resources professionals) across the United States, conducted in 2017 by Lincoln Financial Group and PSB. The margin of error is +/- 5% at the 95% confidence level.

For more information about the findings cited here, visit this link.

About Lincoln Financial Group

Lincoln Financial Group provides advice and solutions that help empower people to take charge of their financial lives with confidence and optimism. Today, more than 17 million customers trust our retirement, insurance and wealth protection expertise to help address their lifestyle, savings and income goals, as well as to guard against long-term care expenses. Headquartered in Radnor, Pennsylvania, Lincoln Financial Group is the marketing name for Lincoln National Corporation (NYSE:LNC) and its affiliates. The company had $241 billion in assets under management as of June 30, 2017. Learn more at: www.LincolnFinancial.com. Find us on Facebook, Twitter, LinkedIn and YouTube. To sign up for email alerts, please visit our Newsroom at http://newsroom.lfg.com.

LCN-1910411-092917