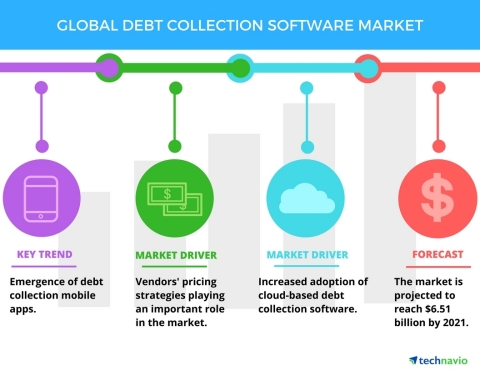

LONDON--(BUSINESS WIRE)--Technavio’s latest report on the global debt collection software market provides an analysis of the most important trends expected to impact the market outlook from 2017-2021. Technavio defines an emerging trend as a factor that has the potential to significantly impact the market and contribute to its growth or decline.

The major drivers contributing to the growth of the global debt collection software market include the need to increase debt recovery rates and reduce bad debts while managing multiple debt categories, improving cash flow, and optimizing collection costs. Other prominent factors that will enhance market growth include the growing demand for user-friendly interfaces for business users to execute their timeline and workflow strategies used in the various stages of debt collection. The need to build strong relationships with the customer is also a highlight of the new approach to debt collection.

This report is available at a USD 1,000 discount for a limited time only: View market snapshot before purchasing

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

The top three emerging trends driving the global debt collection software market according to Technavio ICT research analysts are:

- Rise in demand for integrated debt collection software solutions

- Emergence of debt collection mobile apps

- Introduction of analytics in debt collection software

Looking for more information on this market? Request a free sample report

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Rise in demand for integrated debt collection software solutions

End-users prefer vendors that provide integrated software suites over different software as it may lead to integration issues. Integrated products and software suites from the same vendor integrate with each other seamlessly and support other functions or processes.

“Integrated debt collection software completely automates the document and bill presentment. It also ensures adherence to regulations and e-compliance, while accelerating debt payment as well as managing accounts receivable and account information. Some of the vendors in the debt collection software market already provide software that is compatible and can be integrated with other software,” says Amrita Choudhury, a lead analyst at Technavio for research on enterprise application.

Emergence of debt collection mobile apps

Transitioning of businesses to mobile technology will not only give enterprises more accurate information but save hundreds of hours of human effort. The increasing adoption of mobile devices for professional purposes is a major trend in the global debt collection software market. Law firms, collection departments, and accounts receivable management agencies are increasingly focusing on adopting debt collection mobile apps because it provides them the flexibility to access their credit score and credit report, and also receive details about factors affecting their credit score whenever and wherever they need.

“End-users are using debt collection mobile apps to keep themselves up-to-date with debt accounts and track progress toward meeting debt goal. Most importantly, it provides an update on how long will it take to get out of a debt based on details about debt and payment amounts. These mobile apps provide real-time visibility into debt collection activities and performance with industry-specific dashboards, reports, and productivity metrics,” adds Amrit.

Introduction of analytics in debt collection software

Analytics in debt collection software helps to predict debtor and agent behavior. Predictive analytics analyzes the current and historical account data as well as the relationships between these data to generate a predictive behavior score. This helps to identify which debtors are most likely to pay and which further extend the debt collection cycle.

The analytics inbuilt in debt collection software helps to optimize the debt operations by reducing the average credit collection period, streamlining quality assurance monitoring processes, and improving agent retention and overall agent performance. The debt collection software automatically determines the optimal way to handle each customer and customer interaction with embedded predictive analytics and decisioning engine.

Browse Related Reports:

- Global Mainframes Market 2017-2021

- Global Complex Event Processing Market 2017-2021

- Global Interior Design Software Market 2017-2021

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 10,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

If you are interested in more information, please contact our media team at media@technavio.com.