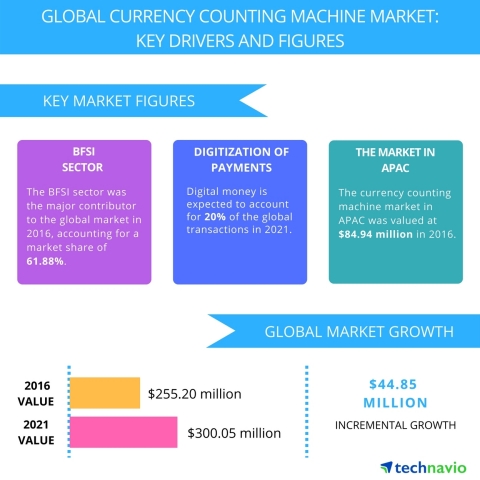

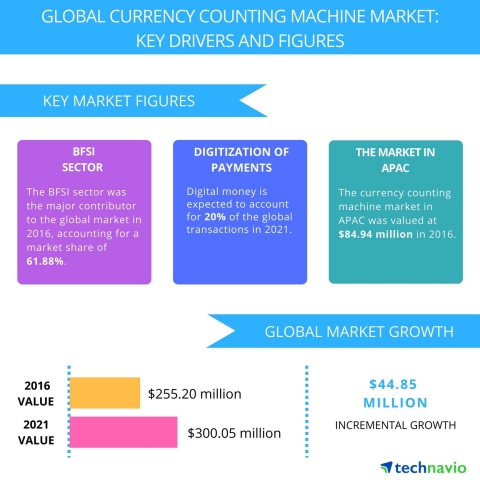

LONDON--(BUSINESS WIRE)--Technavio’s latest report on the global currency counting machine market provides an analysis of the most important trends expected to impact the market outlook from 2017-2021. Technavio defines an emerging trend as a factor that has the potential to significantly impact the market and contribute to its growth or decline.

The global currency counting machine market is highly influenced by the increase in the number of bank branches as it directly impacts the sales of currency counting machines. To handle cash deposits, banks install currency counting machines with features, such as LED displays. The machine counts money, displays denominations on the LED display, and identifies counterfeit currency. Currency counting machines speed up the entire process of cash deposition. The growth of bank branches in developing countries, such as India and China, is rapidly rising because of the large rural and semi-urban customer base.

This report is available at a USD 1,000 discount for a limited time only: View market snapshot before purchasing

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

The top three emerging trends driving the global currency counting machine market according to Technavio hardware and semiconductor research analysts are:

- Growing need for weight-based currency counting machines

- Increasing use of multi-currency forex cards

- Digitization of payments

Looking for more information on this market? Request a free sample report

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Growing need for weight-based currency counting machines

The global shift toward polymers is compelling governments of various countries to adopt plastic bills. Polymer banknotes are 2.5 times more durable than the current cotton-based paper notes. These notes are manufactured using a transparent plastic film coated with an ink layer. It allows clear portions in designs and improves the security against counterfeits. The switch to polymer-based banknotes will lead to fewer rejections by cash processing machines and lower destruction rates, resulting in better ROI.

“Polymer-based banknotes are technologically advanced and durable. Therefore, they are useful in enterprises that deal with large amounts of cash. This will create a demand for weight-based cash counters, which are efficient in counting polymer-based banknotes. A weight-based cash counter picks bills or coins in batches. The machine compares this against a stored weight for each coin or bill and divides the total weight on the machine by this stored weight. The machine calculates the amount of cash within seconds and is highly efficient,” says Sunil Kumar Singh, a lead analyst at Technavio for research on semiconductor equipment.

Increasing use of multi-currency forex cards

“Forex cards are prepaid cards that can be loaded with multiple currencies. These cards act as a replacement for single-currency denominated travel currency cards. Contactless multi-currency forex cards are also available, which provide a fast and convenient way to pay for daily purchases. They use contactless chip technology and reduce the time spent at cash counters,” adds Sunil.

Forex cards are generally used by travelers for hassle-free traveling worldwide. With locked exchange rates, customers are protected against currency fluctuations. These cards reduce the need to carry cash, which is a trend that is expected to affect the market during the forecast period negatively.

Digitization of payments

The digitization of payments is expected to pose a challenge as it is likely to hinder the growth of the currency counting machine market. With the digitization of the economy, the use of payment methods, such as e-wallets, direct fund transfers, and payments banks, is on the rise. The increased transparency, improved security and control, high speed, and timely delivery are the major factors that are driving the digitization of payments.

Digital money is expected to account for 20% of the global transactions in 2021. Payment services, such as PayPal, Paytm, and Google Wallet, have been witnessing continuous growth. With the increased use of these payment methods, the use of cash for large-value transactions is declining. This is expected to lead to a decline in the demand for currency counting machines.

Browse Related Reports:

- Global Mixed Signal IC Market 2017-2021

- Global Contact Probers Market 2017-2021

- Global Wafer Dicing Saws Market 2017-2021

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 10,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

If you are interested in more information, please contact our media team at media@technavio.com.