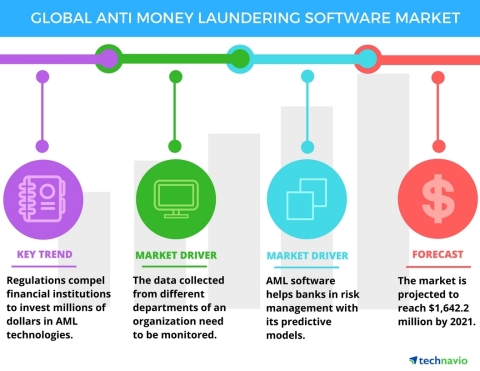

LONDON--(BUSINESS WIRE)--Technavio analysts forecast the global anti-money laundering (AML) software market to grow to USD 1,642.2 million by 2021, at a CAGR of more than 11% over the forecast period, according to their latest report.

The research study by Technavio on the global anti-money laundering software market for 2017-2021 provides detailed industry analysis based on the deployment model (on-premises and cloud based) and geography (the Americas, EMEA, and APAC).

Anti-money laundering (AML) software is an application used by financial firms to monitor and analyze customer data and detect suspicious transactions. APAC is expected to generate the maximum incremental growth for the market over the forecast period, driven by the stringent AML regulations in the region.

Request a sample report: https://www.technavio.com/request-a-sample?report=57332

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Technavio analysts highlight the following three factors that are contributing to the growth of the global anti-money laundering (AML) software market:

- Increased need for suspicious activity reporting (SAR)

- Increased need for automated transaction monitoring

- Increased need for risk management

Increased need for suspicious activity reporting (SAR)

Suspicious activity reporting has become an integral part of the fight against terrorist financing, money laundering, and other related financial crimes. SAR is an AML compliance process where reports containing data regarding any suspicious activity is sent to law enforcement authorities.

“Anti-money laundering software is used to detect and generate alerts for any suspicious activity based on set parameters. The software offers end-to-end coverage for detection, prioritizing, alerting, and reporting of suspicious activity,” says Ishmeet Kaur, a lead analyst at Technavio for enterprise application research.

Increased need for automated transaction monitoring

Large amounts of data are exchanged between various departments, and this information needs to be monitored thoroughly to avoid fraud related to online transactions. Manual monitoring is error-prone and time-consuming, which has resulted in the automation of transaction monitoring systems. Enterprises are deploying the AML software to detect and report any illegitimate activities.

AML software, such as SAS Anti-Money Laundering, uses analytics and out-of-the-box rules-based models to identify known risk scenarios, unknown money laundering risks, and hidden relationships between accounts, and ensure compliance to regulations. The software is customizable per user requirements, which makes it very attractive to end users.

Increased need for risk management

“The predictive models used in the AML software is used by banks to analyze historical data and match it with the outcomes of the alert, and be alert for non-obvious transaction patterns indicative of risk. This helps expose previously non-obvious risks and helps banks take necessary action,” says Ishmeet.

Advanced features of the AML software include automated investigation and efficient management of risk. AML software also incorporates the value of human intelligence into its risk management decisions, which makes it an extremely efficient and necessary tool in banking systems.

Browse Related Reports:

- Global Anti-Plagiarism Software Market for the Education Sector 2016-2020

- Global Mobile Anti-Malware Market 2016-2020

- Global Antivirus Software Package Market 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like IT hardware, cloud computing, and product lifecycle management. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, resellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.