BOSTON--(BUSINESS WIRE)--Fidelity Investments® today announced it has created the Fidelity Financial Wellness Score for people to measure their financial health, identify the areas where they need help and how they can improve.

Many employers realize their employees are struggling financially and need help beyond retirement, with 51 percent of people saying they are just breaking even or spending more than they earn each month1. As a result, 98 percent of Fidelity’s workplace clients have adopted its Financial Wellness solution2, which helps employees focus on their day-to-day financial status and prioritize the steps needed to improve their situation.

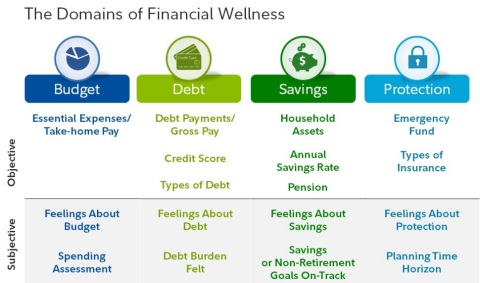

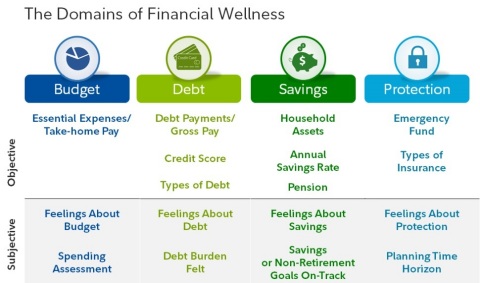

“To enhance our Financial Wellness program, Fidelity developed a way to measure Financial Wellness and offer a clear way to assess if a person is financially well. The score is based on what we believe are the four key domains of Financial Wellness: budget, debt, savings and protection, all of which are equally significant,” said Jeanne Thompson, senior vice president of Thought Leadership, Fidelity Investments. “The score is unique in that it accounts for objective criteria, such as how much savings a person has and how they manage expenses, and subjective criteria, like how they feel about their finances. We believe Financial Wellness means being well and feeling well.”

Fidelity’s Financial Wellness Score is based on a scale from 0 to 100, where 0 represents extreme financial distress and 100 indicates the maximum level of financial wellness.3

To assess how financially well workers are today, Fidelity conducted a survey of more than 6,0004 people to understand how they are doing in each of the Financial Wellness domains. Fidelity also examined the behaviors of the respondents within their retirement plan including savings rate and loan history.

Applying the Fidelity Financial Wellness Score, the results reveal 14 percent of those surveyed are financially “excellent” (a score between 81 and 100), 37 percent are “good” (a score between 61 and 80), 33 percent “fair” (a score between 41 and 60) and 16 percent “need attention” (a score between 0 and 40). Here are the observed attributes of respondents in each category.

The survey also reveals:

- Generation X is the most financially stressed: More than half of GenXers5 (52 percent) feel neutral or negative about their debt situation. By comparison, nearly two-thirds of Boomers6 (65 percent) feel like their debt is manageable.

- For many, money brings happiness: 57 percent of those surveyed said they could not be happy unless they are financially secure. Surprisingly, Millennials7 are more likely to feel this way than other generations with 66 percent agreeing with the statement.

- People are most concerned about debt: 30 percent agree strongly that their household has too much debt and 11 percent say they think about debt “all the time.”

- Financial stress hits home for women: Women are twice as likely to report feeling worried or sick about their financial situation as men.

“When the Financial Wellness Score is made available this summer as part of Fidelity’s Money Checkup, it will be a wake-up call for some employees and for others it will bring peace of mind. The score will bring clarity to where they stand financially and put a spotlight on next steps,” added Thompson. “We’ll be working with employers on how they can incorporate this Financial Wellness measure as part of their strategy to give employees the financial confidence and control they need.”

In the past year, there have been more than 1.9 million visits8 to Fidelity’s Financial Wellness content by people looking for help with establishing emergency savings, managing college debt, claiming Social Security, retirement, paying for health care and other helpful financial topics.

For more information:

Fidelity Viewpoints and webcasts have more on how to increase your Financial Wellness. For those concerned about where they stand when it comes to retirement objectives, Fidelity has introduced a retirement score to enable anyone to quickly and easily estimate whether they’re on track to meet their retirement goals as well as tips to improve, simply by answering a few key questions. In addition, Fidelity’s Women’s Investing site has help for people managing life’s events.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $6.0 trillion, including managed assets of $2.2 trillion as of February 28, 2017, we focus on meeting the unique needs of a diverse set of customers: helping more than 26 million people invest their own life savings, 23,000 businesses manage employee benefit programs, as well as providing more than 12,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for 70 years, Fidelity employs 45,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

796198.1.0

© 2017 FMR LLC. All rights reserved.

1 Data are based on 296,773 visitors to Fidelity's Money

Checkup Financial Wellness assessment from June through December 2016.

2

Fidelity internal data

3 All four domains contribute 25%

each to the overall score, for a total of 100%. Overall, the objective

factors are assigned a total weight of 70% and overall subjective

factors are weighted at 30%. However, the objective and subjective

subscores are weighted differently across domains to reflect the fact

that some domains are inherently more objective than others. For

example, measures of debt and savings/investment are relatively

clear-cut and straightforward (e.g., debt-to-income ratio and projected

retirement replacement rate). The objective aspects of budget and

protection are relatively more difficult to quantify (e.g., whether an

individual’s health insurance plan is optimal) and the subjective

factors may play a greater role (e.g., whether an individual is

comfortable with his/her level of protection). As a consequence, the

objective subscores are weighted higher for the debt and

savings/investment (20%) versus the budgeting and protection (15%). The

subjective subscore for each domain is the complement of the 25% domain

score (5% or 10%, respectively).

4 Fidelity Financial

Wellness Score developed by Fidelity Strategic Advisors Inc., a

registered investment adviser and a Fidelity Investments Company. The

score is based on insight from the Financial Wellness Research Survey of

6k+ active Defined Contribution (DC) plan participants recordkept by

Fidelity, who have input into household financial decisions. The score

is based on a comprehensive review of the households’ financial

situation including their incomes, spending, savings, debts, insurances,

etc. and was conducted in partnership with CMI Research, an independent

third-party research firm. July 2016.

5 Generation X is

defined as those born between 1965 – 1980, based on research from the

Pew Research Center

6 Boomers are defined as those born

between 1946 – 1964, based on research from the Pew Research Center

7

Millennials are defined as those born between 1981 – 1997, based on

research from the Pew Research Center

8 Fidelity

internal data