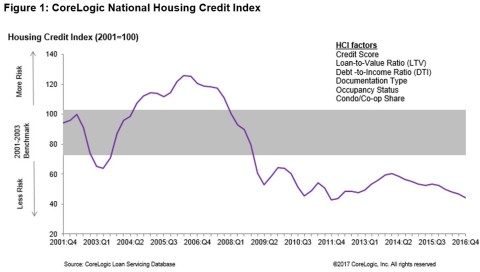

IRVINE, Calif.--(BUSINESS WIRE)--CoreLogic® (NYSE:CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its Q4 2016 CoreLogic Housing Credit Index (HCI™) that measures variations in home mortgage credit risk attributes over time, including borrower credit score, debt-to-income ratio (DTI) and loan-to-value ratio (LTV). A rising HCI indicates that new single-family loans have more credit risk than during the prior period, while a declining HCI means that new originations have less credit risk.

The current HCI shows mortgage loans originated in Q4 2016 continued to exhibit low credit risk consistent with the previous quarter and tighter than in Q4 2015. In terms of credit risk, Q4 2016 loans are among the highest-quality home loans originated since 2001.

“Mortgage loans closed during the final three months of 2016 had characteristics that contribute to relatively low levels of default risk,” said Dr. Frank Nothaft, chief economist for CoreLogic. “While our index indicates somewhat less risk than both a quarter and a year earlier, this partly reflects the large refinance share of fourth-quarter originations. Refinance borrowers typically have a lower LTV and DTI than purchase borrowers.”

Nothaft observed that mortgage rates have moved higher since November and are anticipated to rise even further during 2017. “Refinance volume will decline with higher mortgage rates, and lenders generally will respond by applying the flexibility in underwriting guidelines to make loans to harder-to-qualify borrowers. As this occurs, we should observe our index signaling a gradual increase in default risk. The evolution to a more purchase-dominated lending mix is also likely to increase fraud risk.”

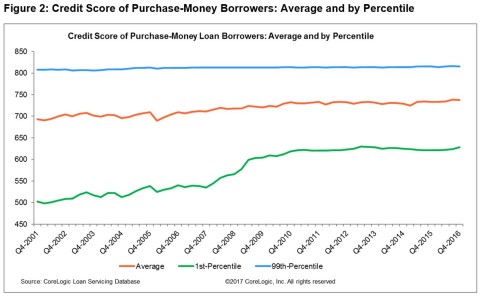

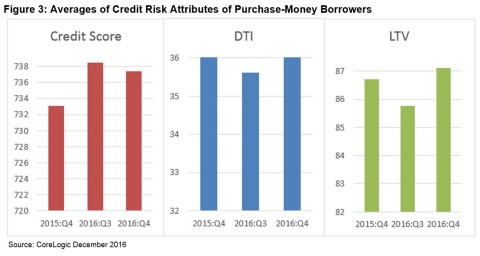

HCI Highlights as of Q4 2016 (Figures 2-3):

- Credit Score: The average credit score for homebuyers increased 4 points year over year between Q4 2015 and Q4 2016, rising from 733 to 737. In Q4 2016, the share of homebuyers with credit scores under 640 was about one-tenth of those in 2001.

- Debt-to-Income: The average DTI for homebuyers in Q4 2016 was similar to Q4 2015, remaining at 36 percent. In Q4 2016, the share of homebuyers with DTIs greater than or equal to 43 percent had increased slightly compared with 2001.

- Loan-to-Value: The LTV for homebuyers increased by less than 1 percentage point year over year between Q4 2015 and Q4 2016, rising from 86.7 percent to 87.1 percent. In Q4 2016, the share of homebuyers with an LTV greater than or equal to 95 percent had increased by more than one-fourth compared with 2001.

Figures 1 through 3 include originations through December 2016 (Q4 2016)

For ongoing housing trends and data, visit the CoreLogic Insights Blog: http://www.corelogic.com/blog.

Methodology

The CoreLogic Housing Credit Index (HCI) measures the variation in mortgage credit risk attributes and uses loan attributes from mortgage loan servicing data that are combined in a principal component analysis (PCA) model. PCA can be used to reduce a complex data set (e.g., mortgage loan characteristics) to a lower dimension to reveal properties that underlie the data set.

The HCI combines six mortgage credit risk attributes, including borrower credit score, loan-to-value (LTV) ratio, debt-to-income (DTI) ratio, documentation level (full documentation of a borrower’s economic conditions or incomplete levels of documentation, including no documentation), occupancy (owner-occupied primary residence, second home, or non-owner-occupied investment), and property type (whether property is a condominium or co-op). It spans more than 15 years, covers all loan products in both the prime and subprime lending segments and includes all 50 states and the District of Columbia, permitting peak-to-peak and trough-to-trough business cycle comparisons across the U.S. The CoreLogic prime and subprime servicing data include loan-level information, both current and historical, from servicers on active first-lien mortgages in the U.S. In addition, Inside Mortgage Finance (IMF) survey data and CoreLogic public records data for the origination share by loan type (conventional, government, jumbo, subprime) were used to adjust the servicing data to assure that it reflects primary market shares. These changes across different dimensions are reflected in the HCI. A rising HCI indicates increasing credit risk and a declining HCI indicates decreasing credit risk.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. These data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or web site. For questions, analysis or interpretation of the data contact Lori Guyton at lguyton@cvic.com or Bill Campbell at bill@campbelllewis.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. These data are compiled from public records, contributory databases and proprietary analytics, and its accuracy depends upon these sources.

About CoreLogic

CoreLogic (NYSE:CLGX) is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.