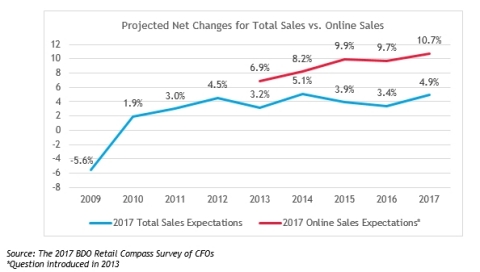

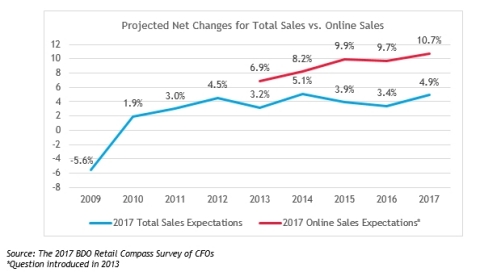

CHICAGO--(BUSINESS WIRE)--Bolstered by positive consumer indicators, retailers are largely optimistic for 2017. According to BDO USA’s 11th annual Retail Compass Survey of CFOs, retail CFOs predict a 4.9 percent bump in total sales this year, up from 3.4 percent in 2016. These bullish predictions are echoed by online sales projections, with a 10.7 percent increase expected for the year ahead—the highest in survey history. Still, with regulation and competition concerns mounting, there may be a bifurcation of industry performance this year.

“The 2016 holiday season was a moment of reckoning for many in the retail industry,” said Natalie Kotlyar, National Leader of BDO’s Consumer Business practice. “Some are fired up following record-breaking results, and others are catching their last sparks. 2017 holds promise, but there’s no room for coasting in a marketplace so saturated with new and legacy concepts.”

Regardless of whether retailers are riding high or playing catch up after the holidays, all are coming to terms with escalating competition in the industry. In fact, more than one-third (38 percent) of respondents cite competition and consolidation as their most concerning risk in 2017. As players of all sizes and sectors are working to maneuver their place in the market, 11 percent of surveyed CFOs plan to invest more capital in M&A activity this year.

Overall, 46 percent of retailers expect an uptick in deal activity, and just one percent project a decrease. Retail CFOs expect buyers will pay an average EBITDA multiple of 7.0, the highest in our survey’s history.

Additional findings of the 2017 BDO Retail Compass Survey of CFOs include:

Trump’s tax and regulatory priorities drive uncertainty. Retailers are closely watching signals from the Trump administration on tax and regulatory reform. When asked about potential tax changes, 61 percent of retailers say a reduction in the U.S. corporate tax rate would have the greatest impact on their business. Another 19 percent cite potential state income and franchise tax audits and 10 percent point to expanding sales and use taxes as having the greatest impact. Retailers are keeping a close eye on the fate of the highly impactful border-adjustment tax proposal, which could impact the price of imported goods and lead to increased costs for consumers.

“Although reduced corporate tax rates are at the top of retailers’ wish lists when it comes to reform, sweeping reforms with border adjustments could dictate whether they end up in the black or the red,” said Mike Metz, tax partner in BDO’s Consumer Business practice. “For an industry that relies heavily on global products, an import tax could be a game-changer, and retailers need to be prepared to evaluate and potentially reorient the business model as this evolves.”

Retailers integrate tech in pursuit of a perfected omnichannel recipe. It’s increasingly imperative that retailers move beyond a one-dimensional business model or risk becoming obsolete. This often means striking the right balance between brick-and-mortar and e-commerce offerings and capabilities. As retailers assess how to take their in-store experience to the next level, 52 percent plan to invest in redesigning and remodeling stores. At the same time, many are focusing online, resulting in more than two-thirds (68 percent) of retail CFOs planning to invest more capital in e-commerce and mobile channels in 2017. To help those channels communicate and improve operational efficiencies, 74 percent of retailers will invest in IT systems technology this year.

Focusing on building a bedrock, starting with the supply chain. Consumers seamlessly transition between online and off—and they expect retailers to enable these behaviors. Ensuring transactions can take place smoothly starts with the supply chain. Thus, 39 percent of retail CFOs intend to invest more capital in their supply chain in 2017. As supply chain networks and capabilities expand, so too do retailers’ risk exposures. In fact, 14 percent of retail CFOs are most concerned with issues involving U.S. and foreign suppliers this year.

Preparing for cyber risk and regulation. Because robust digital channels are a given, retailers are focused on strengthening and securing their platforms. This year 82 percent of retailers are EMV compliant, up from 76 percent last year. EMV aside, 70 percent expect cybersecurity regulation to increase at least somewhat in the next year, and just three percent believe regulation will decrease. To prepare for regulations and security risks alike, 57 percent of those surveyed noted they increased cybersecurity spending in the past 12 months.

The BDO Retail Compass Survey of CFOs is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly to chief marketing officers, using a telephone survey conducted within a scientifically-developed, pure random sample of the nation’s retailers.

About BDO USA

BDO is the brand name for BDO USA, LLP, a U.S. professional services firm providing assurance, tax, advisory and consulting services to a wide range of publicly traded and privately held companies. For more than 100 years, BDO has provided quality service through the active involvement of experienced and committed professionals. The firm serves clients through more than 60 offices and over 500 independent alliance firm locations nationwide. As an independent Member Firm of BDO International Limited, BDO serves multi-national clients through a global network of 1,408 offices in 154 countries.

BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms. For more information please visit: www.bdo.com.