OMAHA, Neb.--(BUSINESS WIRE)--Trading right up until the closing bell, four students from University of North Carolina at Chapel Hill ("UNC-Chapel Hill") turned in a 127 percent total portfolio gain in four weeks, outperforming nearly 2,500 others to win the third annual thinkorswim® Challenge by TD Ameritrade, Inc. (“TD Ameritrade”)1. This year's virtual trading competition had a record number of participants: 726 teams of students from 233 colleges and universities across 49 states put their best investing ideas to the test.

The 2016 thinkorswim Challenge ran from Oct. 10 through Nov. 4, 2016, and was open to all students at post-secondary educational institutions in the U.S. Participating teams started with $500,000 in virtual money to invest in real time using the paperMoney® program on TD Ameritrade’s thinkorswim platform. Prizes were awarded to the top three teams with the highest overall percentage gain in their portfolios at the close of the competition, and to their respective schools. There were also prizes awarded to teams whose portfolios had the highest percentage gains in aggregate value at the end of each trading week, and to the team that collected the most badges for its trading activity.

"There are no Monday morning quarterbacks at the end of the thinkorswim Challenge," said Steven Quirk, executive vice president of trading at TD Ameritrade. “Experience is often the best educator, so our competition is designed to give young people unparalleled exposure to navigating the market amid the real time events that ultimately influence the performance of their investments."

During the competition, students remained optimistic about the market overall, with 49 percent of trades being bullish and 40 percent bearish. The remainder were volatility plays or other trades.

Top Prize Goes to Team All for Tony, Tony for All

Team All

for Tony, Tony for All from UNC-Chapel

Hill won the Challenge, placing trades in the final hour of the

four-week competition to edge out others and win with a 127 percent

portfolio gain and a portfolio value of $1,133,492. The team consisted

of four UNC-Chapel Hill undergraduates: senior Alex Bryan, an economics

and Portuguese double major; sophomore Nyatefe Mortoo, a business

administration major; sophomore Dhru Patel, a computer science and

pre-business double major; and senior Grahme Taylor, a health policy and

chemistry double major. All for Tony was one of 17 teams from UNC-Chapel

Hill competing in this year’s Challenge.

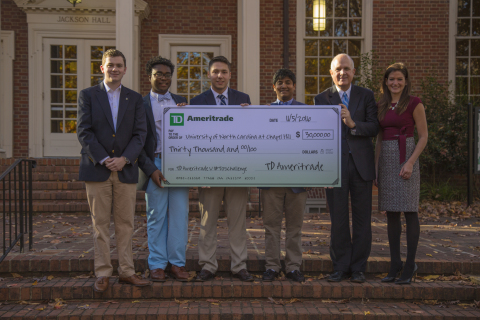

Each member of the Challenge's overall winning team received $3,000 to be deposited into his own TD Ameritrade brokerage account. As the school affiliated with the overall winning team, UNC-Chapel Hill received $30,000 from TD Ameritrade for its role in educating students on the importance of investing.

“Our team had a diverse collection of interests and skill sets, which worked well for us. In fact, by the end of the Challenge we had deployed a four-tiered strategy for researching investment ideas and executing trades,” said Grahme Taylor, All for Tony team member. “It was an intense and exhilarating learning experience and those of us who are here next year absolutely plan to do it again.”

Less than $13,000 separated the competition's overall winner from the second place team, which was Team CattleDrive from the University of Idaho. With its 124 percent gain and a portfolio valued at $1,121,232, team Cattle Drive brought in $20,000 for its school and each team member won $2,000 deposited into individual TD Ameritrade brokerage accounts. Third place went to BSIF Elite from Truman State University, which ended up with a 90 percent gain and a portfolio value of $950,568. The team won $10,000 for its school, and each team member won $1,000 for placing third in the competition overall and $500 for winning week four of the competition, deposited into individual TD Ameritrade brokerage accounts.

Michigan State University's Spartan Capital team earned the most badges for its trading activity, acquiring a total of 39 badges during the competition. Each member of Spartan Capital received $500 deposited into individual TD Ameritrade brokerage accounts for winning the 2016 badge award.

A list of the competition winners is below:

| Team Name | Associated School | |||||

| OVERALL | All for Tony, Tony for All | University of North Carolina | ||||

| Oct. 10-Nov. 4 | Chapel Hill, NC | |||||

| Week One | Theta Management | Slippery Rock University of | ||||

| Oct. 10 - Oct. 14 | Pennsylvania Slippery Rock, PA | |||||

| Week Two | LGBT Partners LLC | Wayne State University | ||||

| Oct. 17-Oct. 21 | Detroit, MI | |||||

| Week Three | Texas Aggies | Texas A&M University | ||||

| Oct. 24-Oct. 28 | College Station, TX | |||||

| Week Four | BSIF Elite | Truman State University | ||||

| Oct. 31-Nov. 4 | Kirksville, MO | |||||

| Badge Award | Spartan Capital | Michigan State University | ||||

| Oct. 10-Nov. 4 | East Lansing, MI | |||||

Students Used Options at All-Time High

The students in the

2016 Challenge had a healthy appetite for options early on, which

increased as the weeks passed. In week one, 77 percent of trades were

options, compared with 64 percent of trades at the start of last year's

competition, and 45 percent in 2014. In the final week of this year's

competition, 87 of trades placed were options, 12 percent were stock

trades, and less than one percent were ETF trades.

This year, students made more trades in the technology sector than in any other sector. Apple (AAPL) was the most frequently traded stock option and Twitter (TWTR) was the most frequently traded stock.

Consistent with last year, 36 percent of trades during the 2016 Challenge were placed through a mobile device, compared with 21 percent of trades placed on mobile by TD Ameritrade clients. The iPhone was the most frequently used mobile device for trading in the competition.

Bringing Financial Literacy to Life

The thinkorswim

Challenge is offered every year through TD

Ameritrade U, an educational program for professors and college-run

organizations that provides free access to virtual trading through

paperMoney® on the thinkorswim trading platform. TD Ameritrade developed

the program in 2014 to help students prepare for the real world of

personal finance by giving them the ability to put classroom theory into

real-life investing practice. The firm believes that access to

leading-edge investment resources and education is the first step in

helping young people form investing habits that can last a lifetime.

“What's most important about the thinkorswim Challenge is that the students expand their investing horizons," said Quirk. “We're happy to hit a new high in participation, but what excites us even more is to watch the students grow savvier about the market with each passing year.”

For more information about TD Ameritrade U or the thinkorswim Challenge, visit www.tdameritradeu.com or www.thinkorswimchallenge.com. To receive updates on the 2017 thinkorswim Challenge, interested students and educators can email support@tdameritradeu.com.

For the latest news and information about TD Ameritrade, follow the Company on Twitter, @TDAmeritradePR.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell or hold.

Past performance of a security, strategy or index is no guarantee of future results or investment success. Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

Trading options can involve substantial risks and are not suitable for all investors. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options.

thinkorswim Challenge subject to full official rules available at www.thinkorswimchallenge.com.

The paperMoney® software application is for educational purposes only. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

Source: TD Ameritrade Holding Corporation

About TD Ameritrade Holding Corporation

Millions of

investors and independent registered investment advisors (RIAs) have

turned to TD Ameritrade’s (Nasdaq: AMTD) technology,

people

and education

to help make investing and trading easier to understand and do. Online

or over the phone. In a branch or with an independent RIA. First-timer

or sophisticated trader. Our clients want to take control, and we help

them decide how — bringing Wall Street to Main Street for more than 40

years. An official

sponsor of the 2014 and 2016 U.S. Olympic and Paralympic Teams, TD

Ameritrade has time and again been recognized

as a leader in investment services. Please visit TD Ameritrade’s newsroom

or www.amtd.com

for more information.

1. Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) /SIPC (www.SIPC.org)