WASHINGTON--(BUSINESS WIRE)--CEOs report higher expectations for sales and hiring over the next six months, but lower expectations for capital investment, according to the Business Roundtable fourth quarter 2016 CEO Economic Outlook Survey.

For the fifth straight year, CEOs cited regulation as the top cost pressure facing their companies.

In their first GDP estimate for 2017, CEOs projected 2 percent growth next year. While the outlook for hiring is positive, the overall results suggest continued economic growth, albeit at a slow pace.

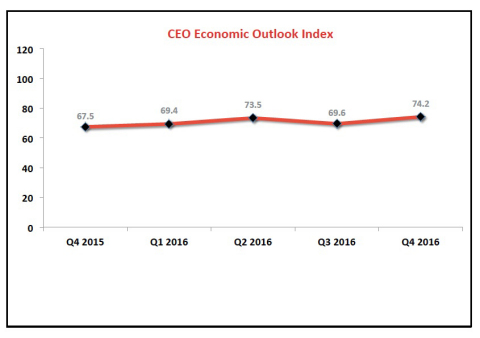

The Business Roundtable CEO Economic Outlook Index — a composite of CEO projections for sales and plans for capital spending and hiring over the next six months — rose by 4.6 points, from 69.6 in the third quarter to 74.2 in the fourth quarter. The Index remains below its historical average of 79.6.

CEO expectations for sales over the next six months increased by 4.5 points, and expectations for hiring increased by a more robust 14.8 points over last quarter. However, CEO plans for capital expenditures fell by 5.4 points relative to last quarter.

“America’s business leaders are encouraged by President-elect Trump’s pledge to boost economic growth,” said Doug Oberhelman, Chairman & CEO of Caterpillar Inc. and Chairman of Business Roundtable. “We will work with the incoming Administration and Congress to enact pro-growth policies such as modernizing the U.S. tax system, adopting a smarter approach to regulation, investing in infrastructure and focusing on the education and training people need to thrive in the 21st century economy.”

In response to a question posed annually in the fourth quarter, CEOs once again reported that regulation was the top cost pressure facing their businesses, followed by labor and health care costs.

“It’s telling that for the fifth year in a row CEOs name regulation as their greatest cost pressure,” said Oberhelman. “We are encouraged by the promise of a renewed focus to usher in a smarter regulatory environment that promotes job creation and economic growth and also protects safety, health and the environment.”

Survey Results

The survey’s key findings from this quarter and the third quarter of 2016 include:

| CEO Survey Results & Sub-Indices | 2016 Q3 | 2016 Q4 |

Quarter- Quarter Change in Sub-Index |

||||||||||||||||||||||||

| Increase |

No Change |

Decrease |

Sub- Index |

Increase |

No Change |

Decrease |

Sub- Index |

||||||||||||||||||||

|

How do you expect your company’s sales to change in the next six months? |

59% | 29% | 11% | 98.3 | 67% | 19% | 14% | 102.8 | +4.5 | ||||||||||||||||||

|

How do you expect your company’s U.S. capital spending to change in the next six months? |

38% | 43% | 19% | 69.6 | 35% | 43% | 21% | 64.2 | -5.4 | ||||||||||||||||||

|

How do you expect your company’s U.S. employment to change in the next six months? |

27% | 37% | 36% | 40.8 | 35% | 35% | 30% | 55.6 | +14.8 | ||||||||||||||||||

Fourth Quarter 2016 Business Roundtable CEO Economic Outlook Index

The Business Roundtable CEO Economic Outlook Index — a composite index of CEO plans for the next six months of sales, capital spending and employment — increased from 69.6 in the third quarter of 2016 to 74.2 in the fourth quarter of 2016. The long-term average of the Index is 79.6.

About the Business Roundtable CEO Economic Outlook Survey

The Business Roundtable CEO Economic Outlook Survey, conducted quarterly since the fourth quarter of 2002, provides a forward-looking view of the economy by Business Roundtable member CEOs.

The survey is designed to provide a picture of the future direction of the U.S. economy by asking CEOs to report their plans for their company’s sales, capex and employment in the next six months. The data are used to create the Business Roundtable CEO Economic Outlook Index and sub-indices for sales, capex and hiring expectations. All of these indices are diffusion indices that range between -50 and 150 — where readings at 50 or above indicate an economic expansion, and readings below 50 indicate an economic contraction. A diffusion index is defined as the percentage of respondents who report that a measure will increase, minus the percentage who report that the measure will decrease.

The fourth quarter 2016 survey was conducted between October 26 and November 16, 2016. Responses were received from 142 member CEOs. The percentages in some categories may not equal 100 due to rounding. Results of this and all previous surveys are available at brt.org/resources/ceo-survey.

Business Roundtable CEO members lead companies with more than $6 trillion in annual revenues and nearly 15 million employees. The combined market capitalization of Business Roundtable member companies is the equivalent of nearly one-quarter of total U.S. stock market capitalization, and Business Roundtable members invest $103 billion annually in research and development – equal to 30 percent of U.S. private R&D spending. Our companies pay $226 billion in dividends to shareholders and generate $412 billion in revenues for small and medium-sized businesses annually. Business Roundtable companies also make more than $7 billion a year in charitable contributions. Learn more at BRT.org