LONDON--(BUSINESS WIRE)--Technavio has announced the top five leading vendors in their recent global residential water treatment equipment market report. This research report also lists 23 other prominent vendors that are expected to impact the market during the forecast period.

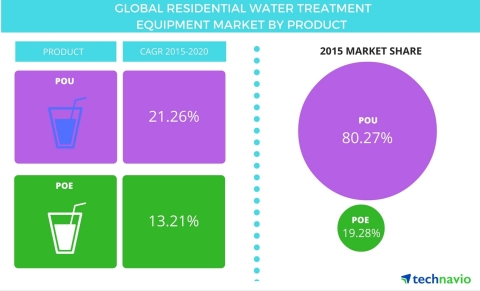

Technavio’s market research analyst predicts the global residential water treatment equipment market to grow at a CAGR of close to 15% between 2016 and 2020. Water treatment equipment is useful to provide small communities or remote colonies with safe drinking water. If the water quality does not meet local drinking water guidelines, then it is more economical to install POU devices in households, than to upscale a whole treatment plant in that locality. Decentralizing water treatment proves beneficial. Treating water at a central public facility is more expensive and not all water consumed in a household needs to be of high quality (water for drinking and cooking needs to be high quality, whereas water for bathing, lawn watering, and various other applications do not). Thus, implementing a POU or POE treatment strategy might be substantially less expensive than building, expanding, or upgrading a central treatment plant.

Competitive vendor landscape

Large number of players in the global residential water treatment equipment market makes it highly competitive and fragmented. There is a huge scope for development in this market because of the availability of a wide range of water treatment chemicals such as coagulants and flocculants, biocides and disinfectants, inhibitors, deformers and deforming agents, pH adjusters, and softeners. This has encouraged new players to enter the market, which is expected to grow rapidly in the future because of the rising demand for safe and clean water.

“Large players are offering products that are manufactured in Asian countries at lower costs, further intensify pricing pressures and making it difficult for the smaller participants to compete on the basis of price,” says Poonam Saini, a lead retail goods and services analyst from Technavio.

The residential water treatment equipment market is currently facing issues related to misleading claims. So, to build credibility, key players are investing in R&D to improve solutions in terms of user-friendliness and functionality. Players are competing on factors like pricing, technology, and quality.

Request a sample report: http://www.technavio.com/request-a-sample?report=54541

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Top five residential water treatment equipment market vendors

3M

3M engages in the manufacturing and sales of safety and graphics, electronics and energy, industrial, and consumer-related products to its customers. In FY2015, the company reported USD 30.27 billion in revenue.

3M has taken various strategic initiatives to increase its presence in the market. In August 2016, the company announced that it will supply bottled water and state-funded filtration systems to 80 homes in Washington County, Minnesota, US, as part of a contract with The Minnesota Department of Health. Such initiatives enable the company to increase its presence in the market.

EcoWater Systems

EcoWater Systems engages in the designing and manufacturing of residential water treatment systems. Its offerings include water softeners, refiners, conditioners, and filters. It offers residential and commercial water solutions. The key customers of the company include residential apartments, office buildings, hospitals, restaurants, office buildings, and shopping centers. It operates as the subsidiary of Berkshire Hathaway Company.

General Electric

General Electric engages in the manufacturing and sales of products that include aircraft engines, power generation products, water processing products, and household products. In FY2015, the company reported USD 108.8 billion in revenue. The company sells water treatment products to its customers through its subsidiary GE Appliances. In June 2016, the company announced that GE Appliances was acquired by Haier.

Mitsubishi Rayon

Mitsubishi Rayon offers water treatment products that include ultrapure water producing plant, process water treatment plant, standard equipment, separation and purification plant, ion exchange resin, and water treatment chemicals. Such a wide range of product offerings enables the company to gain a competitive advantage over its competitors.

Pentair

Pentair has taken several strategic initiatives to strengthen its position in the market. In February 2016, the company unveiled new water reuse solutions at the American Membrane Technology Association (AMTA) in Texas, US. In October 2015, the company presented its advanced filtration and water purification water treat technologies at Aquatech Amsterdam in the Netherlands. Such initiatives enable the company to enhance its brand image.

Browse Related Reports:

- Global Residential Drinking Water Treatment Equipment Market 2016-2020

- Global Commercial Water Treatment Equipment Market 2016-2020

- Global Portable Water Purification Systems Market 2016-2020

Do you need a report on a market in a specific geographical cluster or country but can’t find what you’re looking for? Don’t worry, Technavio also takes client requests. Please contact enquiry@technavio.com with your requirements and our analysts will be happy to create a customized report just for you.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.