EL SEGUNDO, Calif.--(BUSINESS WIRE)--Women who plan to leave the workforce at any given point in their careers now have a clearer understanding of how much it may impact their financial picture and how they can minimize that impact. The 2016 Gender Gap in Financial Wellness Study, published by Financial Finesse, a workplace financial wellness provider, has quantified the potential impact that leaving the workforce at different points in a woman’s career can have on retirement savings to help them better plan for the myriad of obstacles they face in the future.

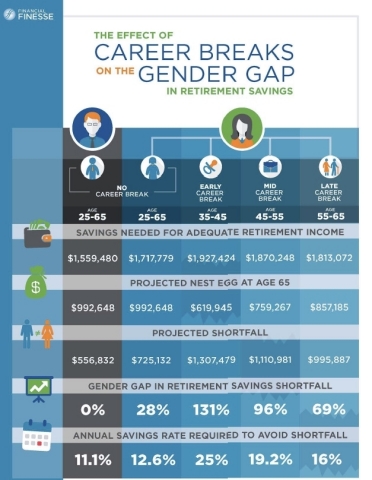

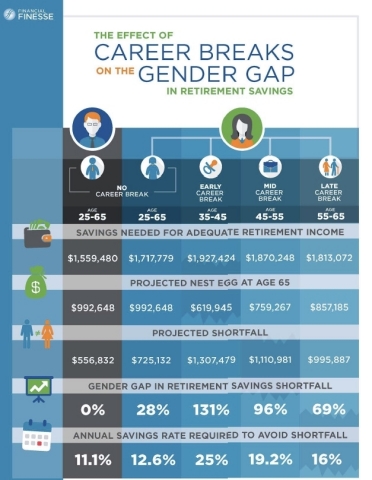

Liz Davidson, CEO and founder of Financial Finesse, says there is already a significant retirement gap between Millennial men and women. “Although we assume pay parity for the typical 25 year old,” explains Davidson, “there is a 28 percent gap in the additional retirement savings needed to cover estimated retirement expenses primarily due to women’s greater life expectancy.”

Davidson notes the firm has seen great progress with employers working to close the gender gap in financial wellness, which is commendable, but Millennial women need to save an estimated 12.6 percent of pay to be on track to meet estimated average expenses in retirement. She notes that “when you add a career break on top of that, the gender gap in financial security is huge.” She adds, “Women need to know this so they can take steps to minimize the financial impact of important life decisions.”

According to the study, women who take breaks early in their careers face a potential retirement savings shortfall of nearly $1.3 million dollars. Financial Finesse identified the gap between women who remain in the workforce their entire careers and women who take breaks for such events as raising children, taking on passion projects that provide little to no pay, or caring for aging parents.

Kelley Long, CPA/PFS, CFP©, resident financial planner with Financial Finesse and lead researcher on gender issues for the firm’s Think Tank, says Millennial women are at highest risk of falling short because they face longer career spans. That said, they are also best positioned to proactively plan for any breaks so that these breaks don’t have a crippling effect on their finances.

“As financial educators, we’re having these conversations proactively with women,” says Long. “We help them understand that even if all else is equal, healthcare costs and life expectancy will likely be higher, so they will have to save more for retirement.” She adds, “If they’re going to take a career break, they need to prepare for it as soon as possible.”

According to Long, a recent Wells Fargo survey found that 44 percent of Millennial women say they have not started saving for retirement, yet many expect to experience a break in pay at some point along their career.

“The gender gap in retirement preparedness is real,” says Davidson. “Employers are at the forefront of this issue which is why they are uniquely suited to address it. They can help women—especially Millennial women—close this gap by offering early financial mentorship to help them prepare for what might be ahead so they can make life choices without jeopardizing their retirement security.”

About Financial Finesse

Financial Finesse is the leading provider of unbiased workplace financial wellness programs in the country, reaching over 2.4 million employees at 600 organizations with holistic financial coaching and guidance that helps employees improve their financial wellness. The firm’s programs cover every area of financial planning – from basic money management to advanced estate planning – and cost employees nothing out of pocket, since they’re offered as fully subsidized benefits by their employers. Financial Finesse’s programs are proven to change lives, provided through a variety of channels such as live workshops, webcasts, one-on-one financial counseling sessions and a financial helpline by CERTIFIED FINANCIAL PLANNER™ professionals who do not sell any financial products or manage assets. www.financialfinesse.com