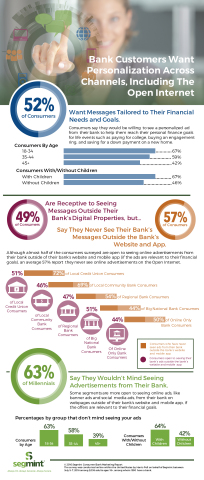

AKRON, Ohio--(BUSINESS WIRE)--One in two Americans who have a bank are open to receiving marketing communications and personalized advertising from their financial institutions, and that proportion increases among millennials and parents, according to newly released survey results from Segmint. Today, the global leader in active analytics and Always On℠ cross-channel marketing released the results of a survey conducted online in July by Harris Poll on behalf of Segmint. The Segmint Consumer Bank Marketing Report: Part I surveyed over 1,900 U.S. adults who use a bank to gauge their experiences with and attitudes toward bank marketing and advertising.

The survey found that Millennials are willing to see ads about financial products that will help them reach life milestones. According to the results, 67 percent of Millennials (ages 18 – 34) who have a bank would be willing to see a personalized ad from their bank to help them reach their personal finance goals for life events (e.g., paying for college, buying an engagement ring, saving for a down payment on a new home). This is compared to only 42 percent of those aged 45 and older. Similarly, parents of children under 18 are significantly more likely than those without children to be willing to see a personalized ads from their bank to help reach financial goals: 67 percent vs. 46 percent respectively.

“Now more than ever, savvy banks have an enormous opportunity to forge stronger relationships with current customers and attract new ones through a broad mix of hyper-targeted online marketing campaigns,” said Rob Heiser, CEO of Segmint. “Millennials in particular are in a stage of financial growth and planning, so they are more receptive to receiving guidance.”

The new report suggests that financial customers are open to ads that reach them in new and different places. In fact, more than half of bank users in the U.S. (57 percent) report that they never see online advertisements from their bank outside of the company website and mobile app. Furthermore, just under half of bank users (49 percent) wouldn’t mind seeing online advertisements from their bank on webpages outside of their bank’s website and mobile app, if those offers were relevant to their financial goals.

“Personalization can take many forms but digital personalization is where most investment is taking place today,” according to a recent report* by Mick MacComascaigh, analyst at Gartner. “Master data management — particularly when coupled with a digital personalization engine — can lead to a better online customer experience by indicating an understanding of the customer and the context of the interaction, typically leading to more online sales, whereas better knowledge management can increase the number of first-call resolutions. Customer loyalty, brand recognition and profit can all be increased.”

Segmint customer, Talmer Bank and Trust, began using the SegmintOne platform at the end of April this year. Previously, the bank served three rotating promotional messages to a slider on their homepage. Talmer now serves personalized ads to customers on the majority of pages on Talmerbank.com.

Segmint’s technology offers a robust taxonomy of Key Lifestyle Indicators (KLIs) that reveal an individual’s spending patterns, transactional behavior, unique lifestyle attributes and more. Using Segmint’s marketing platform, SegmintOne, banks can target customers with offerings that will help them reach their financial goals.

“Through our partnership with Segmint we are now able to identify subsets of our customers that we wouldn’t have known before,” said Mary Weiss, Digital Marketing Manager at Talmer Bank and Trust. “For example, we identified a group of customers who have teenagers and college students and we’ve been able to serve those customers personalized ads that feature our student checking offering.”

SegmintOne has capabilities to securely deliver data-driven messages over the Open Internet, through its real-time bidding capabilities. The Open Internet has proven to increase customer engagement by 4.5 times more than on a bank’s own digital properties.

“We’ve only just scratched the surface of Segmint’s capabilities," continued Weiss. “In the first three months, the solution reported that 1,195 products and services sales were influenced by messages served by the platform. Given the success we have seen in a short timeframe, we are evaluating moving funds from other digital ad platforms to deliver SegmintOne campaigns on the Open Internet.'”

Talmer Bank previously tracked the success of talmerbank.com ads by click-through rates. Before using SegmintOne, rates were at 1 percent. After delivering personalized customer communications, Weiss said she was able to see click-through rates increase to 5.7 percent for the new ads.

To explore additional results from the Segmint Consumer Bank Marketing Report: Part I, including an infographic and breakdowns by gender and financial institution type, visit https://segmint.com/Media-Resources/Consumer-Report-2016. Segmint will release the results of the Segmint Consumer Bank Marketing Report: Part II, at Money20/20 in October, which will explore consumers’ banking and personal finance habits and preferences.

Survey Methodology

The survey was conducted online within the United States by Harris Poll on behalf of Segmint between July 5-7, 2016 among 2,038 adult’s ages 18+, among whom 1,930 have a bank relationship. Please contact us for complete methodology.

*Gartner, The Eight Building Blocks of CRM: Customer Experience, Mick MacComascaigh, 17 August 2016

About Segmint

Segmint, Inc. is a global leader in active analytics and Always On℠ cross-channel marketing. The company’s solution securely activates enterprise data to intelligently deliver personalized engagements attributed across all channels (both digital and physical). Segmint offers a patented technology platform that leverages actual consumer transaction data to help marketers truly understand and even anticipate the needs of their target audience and serve them highly relevant and personalized advertisements at the precise moment they’re considering a purchase. The platform delivers messages to consumers and small businesses across mobile, public and private websites, the Open Internet as well as assisted channels (contact center, branch, direct mail, etc.) while adhering to strict privacy and security standards. Segmint, which is headquartered in Akron, Ohio, is focused on such industries as financial services, healthcare, insurance, retail and IT solutions both directly and through strategic partnerships.

For more information, please visit www.segmint.com or follow the company on Twitter at @Segmint.