WASHINGTON--(BUSINESS WIRE)--InsideNGO and the International Non-Governmental Organization (INGO) Impact Investing Network published today Amplify Impact Investing: The INGO Value Proposition for Impact Investing, an in-depth study of the current impact investing landscape among INGOs in the international development sector. The report reveals that the development sector’s impact investing activity is growing, with INGO-managed or -founded impact investing funds encompassing more than $545 million in assets.

While the traditional development funding model has relied upon government grants and contracts, foundations, and philanthropic giving, the impact investing model seeks solutions to economic and social challenges that result in a financial return for the investors. The INGO Impact Investing Network was formed last year by InsideNGO, the Aspen Network of Development Entrepreneurs, Pact, Mercy Corps, and GOAL as a consortium of more than 40 INGOs that are working together to gather and share knowledge about how INGOs are using private investment capital to advance their work in solving pressing global development challenges.

“It is exciting to see how international NGOs are engaging in impact investing solutions across the entire sector,” said Tom Dente, President and CEO of InsideNGO, the membership association of international relief and development organizations. “They are complementing traditional development funding mechanisms and approaching impact investing with a long-term view, collaborating with existing and new partners to help them deliver on their missions while also providing a financial return on investment.”

Stephanie Marienau Turpin, Director, Social Enterprise Development at Pact Ventures, added, “This report outlines the unique value that INGOs offer the impact investing ecosystem, including their deep networks throughout the developing world, sector expertise, and ability to both make and measure impact.”

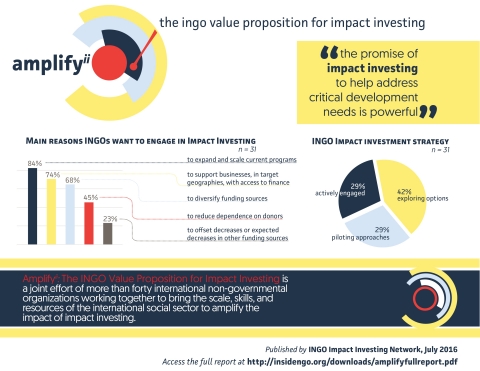

The members of the INGO Impact Investing Network collectively represent more than $8.5 billion in annual revenue and more than 100,000 employees. The new report is compiled from a survey of 31 member organizations conducted earlier this year. It provides a detailed self-assessment of the network’s impact investment activity, maps INGO approaches to making and receiving investments, explores the role INGOs are playing in providing training and support to social entrepreneurs and impact investors alike, and examines opportunities for future growth. Among the key findings:

- Nearly a third of the NGOs surveyed are actively engaged in impact investing, with an established fund or approach with documented impact and performance. The remaining majority is studying opportunities and developing their engagement strategy.

- The INGOs active in the sector tend to be “impact-first” investors—citing social and environmental returns as their primary goals, with financial returns a secondary consideration.

- The average reported size of investment is just under $450,000.

- Respondents are most actively involved in impact investing activities in South and Southeast Asia, East Africa, and West Africa, funding projects predominantly in livelihoods, agriculture, and financial inclusion.

In addition to the NGOs cited above, other organizations in the INGO Impact Investing Network contributing to the report include: ACDI/VOCA, ACRE, Education Development Center (EDC), FHI 360 and the FHI Foundation, Habitat for Humanity, Land O’Lakes, Mennonite Economic Development Associates (MEDA), Oxfam, Palladium, PSI, and World Vision, among others. Case studies provided by the NGOs underscore how NGOs are already influencing the impact investing arena.

Citing the current lack of research and literature on the assets that INGOs bring to impact investing, more than a dozen leading institutions in the impact investing arena, including Accenture Development Partnerships, Calvert Foundation, the Global Impact Investing Network, and the Overseas Private Investment Corporation, have formally endorsed the report, calling it a key first step toward increasing dialogue and engagement between potential investors and the NGO community.

Amplify Impact Investing: The INGO Value Proposition for Impact Investing will be shared with members of the INGO community tomorrow at InsideNGO’s annual conference, Achieving Global Impact, taking place at the Walter E. Washington Convention Center in Washington DC. Presenting the findings of the report will be leaders from Pact, Mercy Corps, GOAL, and The Nature Conservancy.

InsideNGO is a membership association of 330 international non-governmental organizations and sector experts in the international development and relief community working together to achieve global impact. We provide training and learning opportunities, peer-to-peer exchange, sector expertise, and links to industry partners to help our members build their operational and management capacity. Learn more at www.insidengo.org