SAN DIEGO--(BUSINESS WIRE)--A new whitepaper from Javelin, made possible by ID Analytics®, LLC, a leader in consumer risk management, concluded that a community approach to sharing intelligence can provide significant advantages in the detection of synthetic identities and the rise of digital application fraud. The study, “Mitigating Application Fraud from Synthetic Identities,” finds that the shift to EMV in the U.S. is changing the nature of fraud as fraudsters move from point-of-sale (POS) fraud to card-not-present (CNP) fraud, and specifically new-account fraud. This requires a new approach to fraud protection.

Two Seismic Shifts: Synthetic Identities and New-Account Fraud

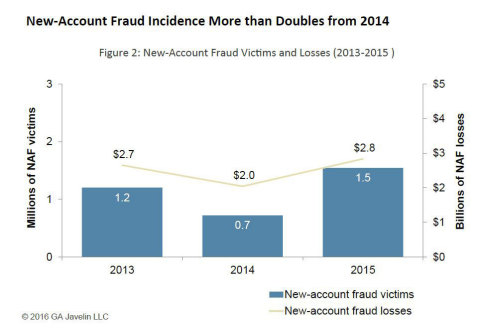

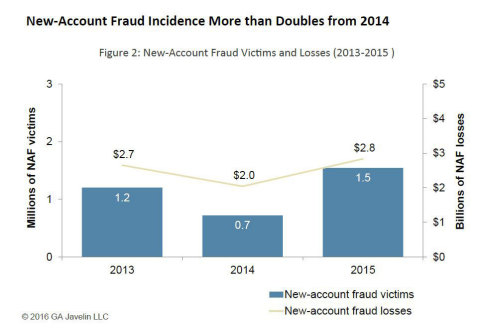

While digital account openings make the application experience easier and more convenient for consumers, they bring added risk for financial institutions (FIs) by providing fraudsters with increased anonymity and faster fraudulent application times. The rise in the creation and use of synthetic identities, a new, false identity that is not associated with a real person, is helping fuel this shift. Using a synthetic identity allows fraudsters to open and cultivate multiple accounts at once with high credit limits for maximum payouts. This leads to larger losses for FIs, who might not notice the fraud until they begin seeing charge-offs. The whitepaper from Javelin found that new-account fraud more than doubled from 2014 to 2015. Additionally, seven million individuals had their Social Security Numbers (SSNs) breached in 2015, an increase of more than 63 percent from the previous year.

“Our research is clearly signaling that fraudsters are moving to new-account fraud, and FIs that wait until they begin seeing fraudulent activity to bolster their response will pay the price,” said Al Pascual, Research Director and Head of Fraud & Security at Javelin. “Conventional approaches to fraud detection are suboptimal for mitigating the risk of synthetic identities because these applications are new and may lack historical device characteristics and account behavior, which is exactly what leveraging shared data via a consortium model helps to address.”

A Holistic Response: A Broader Consortium Approach to Fraud Mitigation

The consortium approach to mitigating new-account fraud gathers data elements from participating FIs and allows members to check these data points and experiences, both positive and negative, against applications they are receiving in near real-time. This not only lets members know that the core identity elements they are seeing on the application are unique to an individual, it also helps them determine if any combination of the data elements have been used for fraudulent or good account activity.

“Companies cannot fight fraudsters by themselves. We are all in this together. The consortium model makes it easier to find fraudsters because identifiers that can be linked to a number of identities and applications over a short period are more likely to be synthetic identities,” said Ken Meiser, Vice President of Identity Solutions at ID Analytics. “Spotting these identifiers is a sign to FIs to more closely monitor accounts associated with them for fraudulent activity. Monitoring identifiers over time is an effective way to manage synthetic identity fraud and mitigate risk.”

To learn more about the rise in application fraud and how to mitigate risk, download the whitepaper “Mitigating Application Fraud from Synthetic Identities.”

About ID Analytics, LLC

ID Analytics is a leader in consumer risk management with patented

analytics, proven expertise, and real-time insight into consumer

behavior. By combining proprietary data from the ID

Network®—one of the nation’s largest networks of

cross-industry consumer behavioral data—with advanced science, ID

Analytics provides in-depth visibility into identity risk and

creditworthiness. Every day, many of the largest U.S. companies and

critical government agencies rely on ID Analytics to make risk-based

decisions that enhance revenue, reduce fraud, drive cost savings, and

protect consumers. ID Analytics is a wholly-owned subsidiary of LifeLock,

Inc., please visit us at www.idanalytics.com.

ID

Analytics, ID Connect and ID Network are registered trademarks of ID

Analytics, LLC All other trademarks and registered trademarks are the

property of their respective holders.