HOUSTON--(BUSINESS WIRE)--Horizontal well refracturing technologies will likely remain a niche market in the U.S. until significant technical and financial risks can be reduced. That’s the finding of new research from IHS (NYSE: IHS), which says this trend will continue despite significant interest from both E&P and oilfield service companies hoping the technology will reinvigorate drilling activity in the U.S. onshore plays.

By 2020, refractured wells will account for as much as 11 percent of horizontal wells fractured in the U.S., says the new IHS Energy Insight Report, To Frac or Refrac: Prospects for Refracturing in the United States from IHS, the leading global source of critical information and insight.

The IHS report reviewed current horizontal refracturing technologies and approaches, as well as economics and effectiveness, then established baseline criteria and assessed the future potential of the technology using primary intelligence, rigorous research and proprietary data. IHS drew from two databases as the foundation for its analysis -- from the IHS Energy U.S. Well and Production database, which contains in excess of one million wells, and from IHS Energy proprietary database of fractured wells.

“In response to lower oil prices, E&Ps and service companies in particular, have shown increasing interest in horizontal well refracturing,” said Christopher Robart, managing director, unconventional resources at IHS Energy, and the report’s lead author. “However, while refracturing has potential to leverage improved completion techniques to increase production while avoiding drilling and facilities costs associated with a new well, IHS research indicates there is a great deal of uncertainty about the viability of large-scale refracturing that must first be overcome.”

The IHS researchers examined the entire population of U.S. onshore horizontal wells fractured since 2000 in an effort to identify all refracturing operations. Through a robust search and filter methodology, IHS researchers were able to identify nearly 600 horizontal wells refractured.

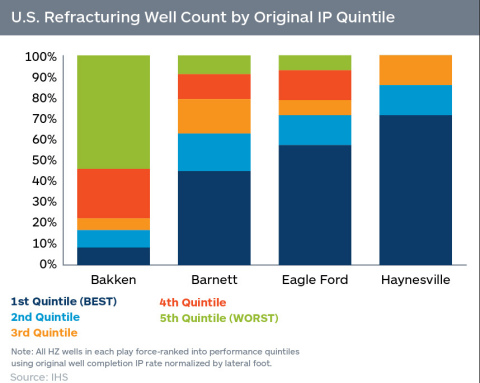

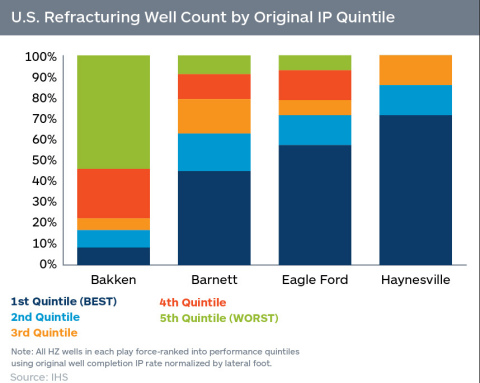

According to IHS, the Bakken has the greatest number of refractured wells in U.S. plays, followed by the Barnett and Marcellus plays. Unsurprisingly, the largest number of refractured wells is located in the plays with the oldest wells.

Refracturing success, said IHS, as measured by comparing refracturing initial production (IP) rates to original IP rates, is mixed. With the exception of the Bakken wells studied, most refractured wells have IP rates lower than the original IP rates. The Bakken anomaly, noted IHS, is likely due to sub-optimal well specifications chosen for the original completion (not surprising, since the Bakken play was one of the early testing grounds for the initial horizontal drilling and fracturing technologies that have since been significantly improved).

Yet, due to the Bakken refracturing results, and some over-performers in the Eagle Ford, IHS said, the overall average refractured well IP is equivalent to 98 percent of the original well IP. As for decline rates, the refractured wells had slightly better 12-month decline rates than the original well completions (refractured wells declined at a rate of 56 percent compared to 64 percent for original well completions).

According to the analysis, three refracturing techniques, including diversion, coiled tubing (CT), or mechanical isolation, were most often employed in the wells studied. However, each method has benefits and limitations, and it is unclear which technique will dominate in the future.

Refracturing costs vary widely by method and job size, IHS noted, with the diversion method offering the lowest cost, but also limited control. Conversely, mechanical isolation is the most costly of the three approaches, due, in part, to increases in surface and downhole costs. As for applying the refracturing technologies, Robart said the popularity of refracturing will grow if E&P companies gain more confidence in one or more techniques and costs recede.

Due to the technical challenges, uncertainties and costs associated with current refracturing methods, Robart said E&Ps that have a better portfolio of new well prospects are likely going to pursue those opportunities first, and save older assets for later, when improved technologies make those wells a more attractive investment for refracturing.

“The companies with superior acreage for new well development are not presently the prime candidates for refracturing,” Robart said. “Operators with less attractive assets will likely be more interested in advancing this technology in the near-term.”

Said Robart, “Refracturing technology is in its infancy, and a large-scale refracturing program is the most important step that can be taken to advance it; however, most E&P operators are cautious about investing significant capital before they see more positive results from others first. To get better at something you have to repeat it and refine processes—you have to experiment. What refracturing needs now is a new innovator to step up, invest capital, and take risks to refine the technologies and lower costs. For refracturing to advance significantly, we need the next George Mitchell to come forward.”

To speak with Christopher Robart regarding the IHS Energy Insight Report: To Frac or Refrac: Prospects for Refracturing in the United States,” please contact Melissa Manning at melissa.manning@ihs.com. For information on the IHS Energy report itself, please contact Cristian Muresan at cristian.muresan@ihs.com.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs more than 8,800 people in 32 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and product names may be trademarks of their respective owners. © 2015 IHS Inc. All rights reserved.