LOS ANGELES--(BUSINESS WIRE)--Virtual Piggy, Inc. (OTCQB: VPIG), provider of the award-winning payment technology Oink, today announced the release of its new and improved app, which will include peer-to-peer functionality allowing teens to receive deposits to their accounts for work or gifts from family and friends.

“The mobile peer-to-peer market is expected to reach $86Bn in the US as it solves a real pain point for consumers,” said Dr. Jo Webber, CEO and founder of Oink. “The 11 to 21 year-old audience needed a more modern banking solution, with real-time access and control, and we have delivered it.”

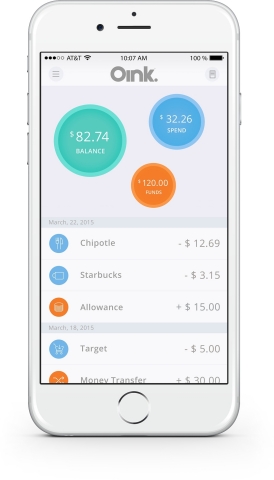

The Oink app allows consumers to manage their mobile wallet and acts as a standalone mobile account. From their mobile account, users have the option to auto-load an Oink card or manually load as needed. Parents and guardians can set up a weekly allowance that is automatically deposited into their teen’s mobile account. The new peer-to-peer capability allows for deposits that can be utilized as payments for tasks such as babysitting or lawn work in addition to gifts from family and friends for any occasion.

For the first time, teenagers have full and immediate visibility of their finances, helping them learn financial management in real time. The Oink app syncs with the Oink card offering broad spending use at over 7 million locations within the US, all while under parental control.

The Oink 2.0 App is available at https://itunes.apple.com/us/app/oink/id773021178

Oink empowers millennials and generation Z to make their own purchasing, saving and other money management decisions, within set boundaries. The award-winning technology serves as a digital wallet and card that allows for safe, secure and legal transactions.

For information about Oink visit www.oink.com.

About Virtual Piggy, Inc.

Virtual Piggy is the provider of Oink, a secure online and in-store teen wallet. Oink enables teens to manage and spend money within parental controls while gaining valuable financial management skills. The technology company also delivers payment platforms designed for the under 21 age group in the global market and enables online businesses the ability to function in a manner consistent with the Children’s Online Privacy Protection Act (COPPA) and similar international children’s privacy laws. The company, based in Hermosa Beach, CA, is on the Web at: www.virtualpiggy.com and holds three technology patents, US Patent No. 8,762,230, 8,650,621 and 8,812,395.

Safe Harbor Statement

All statements herein other than statements of historical facts are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. Such statements are not guarantees of future performance and are subject to known and unknown risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements. Such factors include, but are not limited to, our ability to raise additional capital, our limited operating history and revenue, our ability to attract and retain qualified personnel, our dependence on third party developers, our ability to develop new services, market acceptance of our services, legislative, regulatory and competitive developments, enforcement of our intellectual property, general economic conditions, as well as other factors set forth under the caption "Risk Factors" in our Forms 10-K filed with the SEC, and other filings with the SEC.