NEW YORK--(BUSINESS WIRE)--A new survey from TIAA-CREF reveals that Americans understand the importance of receiving guaranteed monthly income in retirement. However, their strategy for achieving that goal may be missing the mark: The vast majority of Americans (84 percent) said that having a guaranteed monthly paycheck in their post-career years is important, yet only 14 percent have taken steps to ensure lifetime income with the purchase of an annuity. Overall, these results underscore the need for more education about options that provide an income stream retirees can’t outlive.

The TIAA-CREF 2015 Lifetime Income Survey was conducted by an independent research firm and polled a random sample of 1,000 adults nationwide to assess their attitudes, preferences and behaviors about lifetime income.

The survey showed that Americans could be missing out on options in their retirement plan that may help them meet their long-term goals – 44 percent, for example, were not sure if receiving monthly income in retirement was an option in their plan. Even fewer (31 percent) are actively seeking advice on how to translate their retirement savings into lifetime income, indicating that they may not be as proactive as they could be about planning for the future.

More alarming, the survey found that an increasing number of Americans are saving nothing at all for their retirement (29 percent versus 21 percent in 2014), even though 46 percent are concerned that they will run out of money.

“More Americans need to not only set savings goals, but consider how their retirement savings will translate into an income stream that they cannot outlive,” said Ed Van Dolsen, president, Retirement and Individual Financial Services at TIAA-CREF. “Individuals will feel more confident in their retirement plans if they know that their basic expenses will be covered by guaranteed income. Therefore, any retirement-planning conversation should include a discussion of strategies for generating lifetime income, and how annuities can help create financial security.”

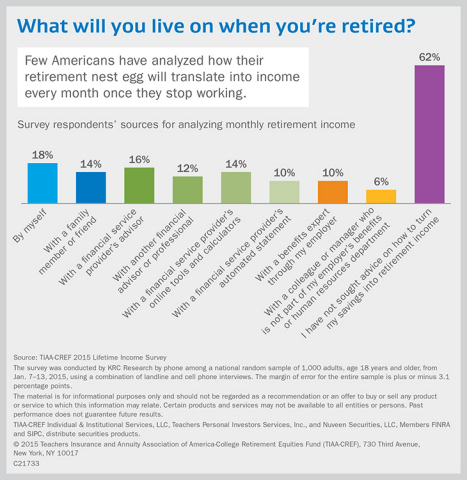

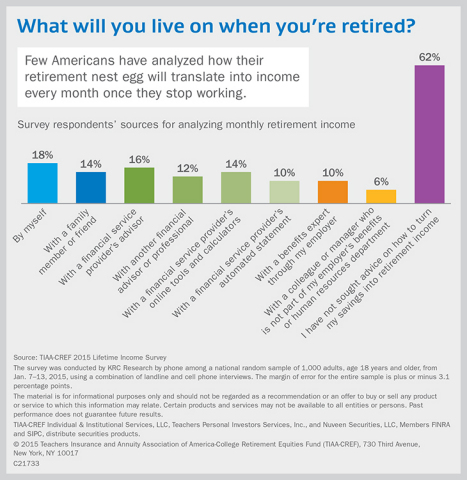

Yet, few are engaging in that conversation. When asked whether they’ve analyzed how their savings will translate into monthly income in retirement, only 38 percent had done so, and a number had done this analysis without the help of a financial professional: 18 percent said they’ve done the math themselves, 14 percent relied on a family member or a friend for the analysis, and 6 percent turned to a colleague or manager for guidance.

That could explain the disconnect between what people want versus what they actually plan for: Even though 49 percent of respondents would be willing to commit a portion of their savings to a product that would provide them a monthly income, like an annuity, only 34 percent of Americans are familiar with annuities; 29 percent have purchased one or are planning to do so; and 28 percent have a favorable impression of annuities.

“For many Americans, annuities are often unknown or misunderstood, which is unfortunate since they are the only way to generate retirement income that cannot be outlived,” said Van Dolsen. “People should consider working one-on-one with a financial advisor to learn more about the investment solutions that can help them achieve their long-term financial goals.”

Young Americans most likely to need information about income options

The survey also found that 84 percent of Americans aged 18-34 (the same percentage as in the general population) prioritize having a guaranteed source of monthly income in retirement, but are much less likely to be familiar with annuities than older Americans (26 percent versus 48 percent for Americans ages 55-64, for example).

“This is an opportunity for employers to advise young people about the value of purchasing an annuity during their prime savings years, not just when they’re ready to retire,” said Van Dolsen. “Taking advantage of this option early on could help younger people prepare for a secure retirement.”

TIAA-CREF helps individuals plan for their financial well-being and build their confidence by offering a variety of resources and interactive tools related to financial advice and goal-setting. In addition to its online Advice and Guidance Center, TIAA-CREF offers educational programs focusing on trending financial issues and organizes financial empowerment workshops for women. The company offers access to financial consultants via phone and at more than 100 offices across the country.

For more information on the survey, please read the 2015 TIAA-CREF Lifetime Income Survey Executive Summary. For more information on TIAA-CREF’s Advice and Guidance offerings, visit our Advice and Guidance Center.

Survey Methodology

The survey was conducted by KRC Research by phone among a national random sample of 1,000 adults, age 18 years and older, from Jan. 7-13, 2015, using a combination of landline and cell phone interviews. The margin of error for the entire sample is plus or minus 3.1 percentage points.

About TIAA-CREF

TIAA-CREF (www.tiaa-cref.org) is a national financial services organization with $851 billion in assets under management (as of 12/31/2014) and is a leading provider of retirement services in the academic, research, medical and cultural fields.

Disclosures

Guarantees are based on the claims-paying ability of the issuer.

Annuity contracts contain exclusions, limitations, reductions of benefits and may contain terms for keeping them in force. Your financial advisor can provide you with costs and complete details.

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Not all income options are available at all institutions or for all contracts. Income options will vary by investment provider. There may be liquidity and other withdrawal restrictions. You should contact your provider for details.

TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC, Members FINRA and SIPC, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF), New York, NY. Each of the foregoing is solely responsible for its own financial condition and contractual obligations.

TIAA-CREF products may be subject to market and other risk factors. See the applicable product literature, or visit www.tiaa-cref.org for details.

© 2015 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017

C21730