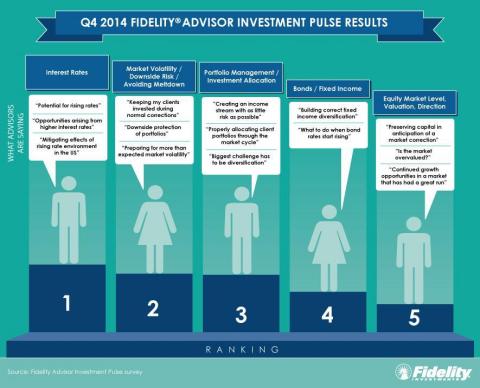

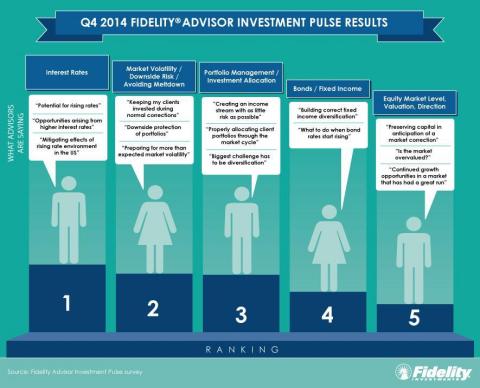

BOSTON--(BUSINESS WIRE)--Fidelity Financial Advisor Solutions today announced the Q4 2014 results of the Fidelity® Advisor Investment Pulse. Interest rates took the No. 1 spot during the quarter – up from No. 3 in Q3 2014. According to the survey results, many advisors were anticipating a rise in interest rates, at the same time, they were focused on how to generate a steady income stream for clients in the current low interest rate environment.

In addition to interest rates being top-of-mind, the Q4 survey revealed advisors’ continued focus on market volatility, which took the No. 2 spot.

“The prospect of rising interest rates has been a big area of focus for well over a year,” said Scott E. Couto, president, Fidelity Financial Advisor Solutions. “Even in an uncertain interest rate environment, there are some immediate actions advisors may take to help their clients generate income, particularly those clients in retirement.”

Couto suggests that advisors look at how fixed income can play a crucial role in their clients’ portfolios, particularly during periods of volatility and continued uncertainty over interest rates.

Three key considerations:

1. Interest rates may settle at lower levels than many predict – The global macro environment remains uncertain and bond yields outside the U.S. remain low. When examining the fundamentals, there is no extraordinary pressure for interest rates to go up rapidly, so in the long term, rates may settle in at lower levels – and for a longer time – than many predict.

2. Core bond funds – Treasuries, mortgages and investment-grade corporate bonds, the main building blocks of most core bond funds, are some of the only assets with negative correlation to equity returns, thus helping to provide diversification in a portfolio. Investors’ recent fears of rising interest rates have caused them to shun these core holdings and invest in unconstrained and absolute return bond funds. As a result, investors may be exposing themselves to unintended risks as these strategies have a strong correlation to equity returns, thus limiting their ability to provide diversification. The U.S. economy is in its mid-cycle phase, which tends to favor equity and high-yield investments, but the economy will eventually move into the late cycle, creating an environment in which credit-intensive bonds historically underperform against core fixed income. This is why core bond funds can be a good choice for clients’ portfolios – they can provide diversification, offer principal protection and meet an investor’s need for income.

3. Keeping short-term volatility in perspective – Fixed income assets can play an important role in a diversified portfolio, and advisors should put short-term market events in context so their clients can stay invested to participate fully in the market’s long-term upward trend.

Regarding advisors’ concerns over market volatility, Couto suggested looking at the returns of the S&P 500 index since 1969, a period when stocks have experienced bull markets, corrections, bear markets and even crashes. For those investors who can maintain a long-term investment horizon, equity returns may offer a very attractive way to build wealth.

“Significant market fluctuations occur more often than clients realize, and providing them with the historical context can help. It’s not unusual to have more than one correction in the course of a bull market,” explained Couto. “By understanding their clients’ goals and risk tolerance, advisors can work to help their clients focus on developing and maintaining a sound investment plan.”

Fidelity offers a range of insights to help advisors navigate the market. For access to the insights and resources that Fidelity offers, advisors can visit: advisor.fidelity.com/investmentpulse. They include:

- Rate Outlook: Invest for Uncertainty – Investors seem certain that rates are about to jump—such confidence may be unwarranted. Fidelity’s fixed income experts explain why many investors may be overconfident about their ability to predict rate moves.

- Why Bond Investors May Benefit from Actively Managed Mutual Funds and ETFs – Fidelity’s portfolio managers describe how experienced managers of active bond mutual funds and exchange-traded funds (ETFs), drawing on expert research and trading support, can add value by discovering attractive investment opportunities caused by bond market inefficiencies.

- Practical Perspectives on Recent Market Volatility – Fidelity’s asset managers discuss factors that can drive a resurgence in financial market volatility and offer timeless insight for advisors and investors.

The Fidelity Advisor Investment Pulse is a survey that captures the investment topics on the minds of 250 advisors in order to share common concerns and deliver resources to help them navigate changing market conditions. Fidelity Financial Advisor Solutions has been tracking advisor sentiment about investing concerns and opportunities since April 2012. This proprietary research enables Fidelity to provide advisors with timely perspectives from their peers, and offer tools to take advantage of the investment opportunities that exist today.

About the Fidelity Advisor Investment Pulse

The Advisor Investment Pulse is an ongoing primary research effort that captures the views of more than 1,000 FFAS advisor clients annually. All FFAS advisor clients in the broker-dealer and registered investment advisor communities are asked to participate in the online survey. Respondents are asked an open-ended question: “Thinking about the investing environment and outlook, and the potential impact on your client portfolios, what investment challenge or opportunity would you say is top-of-mind for you right now?”

The survey reports “Top of Mind” themes of most concern to financial advisors in both their practices and in the financial markets. These themes are distilled from individual financial advisor comments. The chart reflects the most current five themes that represent the most widely held views. Given the variability of the number of responses over time, and the ongoing nature of this effort, confidence levels also will be variable.

Fidelity Financial Advisor Solutions has been tracking advisor sentiment about investing concerns and opportunities since April 2012. This proprietary research enables Fidelity to provide advisors with timely perspectives from their peers, and offer tools to take advantage of the investment opportunities that exist today.

About Fidelity Investments

Fidelity’s goal is to make financial expertise broadly accessible and effective in helping people live the lives they want. With assets under administration of $5.1 trillion, including managed assets of $2.0 trillion as of December 31, 2014, we focus on meeting the unique needs of a diverse set of customers: helping 23 million people investing their own life savings, 20,000 businesses to manage their employee benefit programs, as well as providing 10,000 advisory firms with technology solutions to invest their own clients’ money. Privately held for nearly 70 years, Fidelity employs 41,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit www.fidelity.com.

Before investing in any mutual Funds or exchange traded product, consider the funds' investment objectives, risks, charges, and expenses. Contact your investment professional or Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity Investments does not provide advice of any kind. You should conduct your own due diligence and analysis based on you and your firm’s specific needs.

ETFs are subject to market fluctuation, the risks of their underlying investments, management fees, and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments.

In general the bond market is volatile, and fixed-income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed-income securities also carry inflation, credit and default risks for both issuers and counterparties.

The registered trademarks and service marks appearing herein are the property of FMR LLC.

Fidelity Institutional Wealth Services provides brokerage products and services and is a division of Fidelity Brokerage Services LLC.

National Financial is a division of National Financial Services LLC through which clearing, custody and other brokerage services may be provided. Both members NYSE, SIPC. 200 Seaport Boulevard Boston, MA 02210

Products and services provided through Fidelity Financial Advisor Solutions (FFAS) to investment professionals, plan sponsors and institutional investors by Fidelity Investments Institutional Services Company, Inc., 500 Salem Street, Smithfield, RI 02917.

712612.1.0

© 2015 FMR LLC. All rights reserved.