FORT WORTH, Texas--(BUSINESS WIRE)--After more than a decade of dealing with the professional and personal challenges of wars in Iraq and Afghanistan, America’s career military families are now caught in the crossfire of a national financial conflict that threatens their quality of life at home.

The ongoing uncertainty over the deep military budget cuts of defense downsizing and sequestration is bringing new stresses to bear on the financial lives of middle-class servicemembers and their families, according to the latest findings of the First Command Financial Behaviors Index®. Seven out of ten middle-class military families (commissioned officers and senior NCOs in pay grades E-6 and above with household incomes of at least $50,000) expect to be financially affected by anticipated cuts to defense spending.

Military families are dealing with these concerns through financial preparedness, with 87 percent of survey respondents taking some type of action. In the latest monthly survey, the top methods for dealing with defense cuts were increasing savings (48 percent) and cutting back on everyday spending (40 percent).

“Today we see a career military under financial and emotional siege,” said Scott Spiker, CEO of First Command Financial Services, Inc. “As the general population begins to feel a financial lift from the ongoing economic recovery, our men and women in uniform are experiencing a new military-only recession. We are failing our career military families. Their homecoming from years of war is a tumultuous sequestration debate that has put them in a state of economic limbo, cutting them adrift from the rest of the Middle Class and leaving them feeling considerable financial insecurity. Four out of five families feel anxious about cuts to defense spending, and more than half are concerned about their job security in the coming months. Roughly half are responding to these concerns by increasing their already-strong savings rate, a strategy that requires squeezing even more money out of their household budgets by escalating their commitment to cut back on everyday spending. These belt-tightening behaviors put additional pressures on their middle-class lifestyles, intensifying the struggle to maintain the quality of life they enjoyed just a few years ago.”

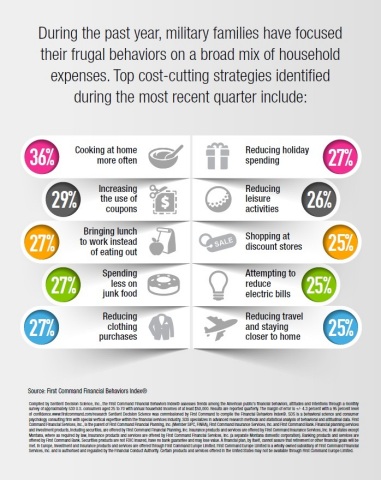

During the past year, military families have focused their frugal behaviors on a broad mix of household expenses. Top cost-cutting strategies identified during the most recent quarter include:

- Cooking at home more often (36 percent)

- Increasing the use of coupons (29 percent)

- Spending less on junk food (27 percent)

- Bringing lunch to work instead of eating out (27 percent)

- Reducing clothing purchases (27 percent)

- Reducing holiday spending (27 percent)

- Reducing leisure activities (26 percent)

- Shopping at discount stores (25 percent)

- Reducing travel and staying closer to home (25 percent)

- Attempting to reduce electric bills (25 percent)

These research findings are generated as part of a long-term effort at First Command to help servicemembers and their families better understand and respond to the ways sequestration and defense downsizing impacts their professional lives and financial futures. Since 2011, the company has been conducting regular surveys on this topic and how it impacts the financial attitudes, intentions and behaviors of America’s career military. First Command has launched a new sequestration webpage designed to equip military families with these survey findings and related news on the human side of sequestration.

“Our intent in sharing this information is not to heighten feelings of anxiety or create concerns where none exist,” Spiker said. “Through this initiative we are striving to help military families bridge the gap in their knowledge and understanding of the current uncertainties and future realities of defense downsizing and its impact on their way of life. We are committed to helping these families better understand the challenges that lie before them so they can take meaningful actions in pursuit of their own long-term financial security.”

First Command’s sequestration initiative is the latest addition to Squared Away®, the company’s ongoing program to assist past and present servicemembers and their families reeling from a decade of war, defense downsizings and economic turmoil. Specific, hands-on activities include:

- Addressing the career challenges of transitioning servicemembers: First Command has formed a partnership with the U.S. Chamber of Commerce Foundation’s Hiring Our Heroes initiative, which is dedicated to finding meaningful employment for 500,000 veterans and military spouses. In addition to monetary support, First Command is providing hands-on assistance at job fairs across the country, financial education sessions for servicemembers and face-to-face discussions about career transitioning.

- Supporting the stability and strength of military families: First Command has also partnered with Project Sanctuary, which provides therapeutic retreats enabling military families to reconnect and reintegrate into their communities. In addition to economic assistance, First Command provides financial coaching and mentorship to help families get back on their feet.

- Helping military families in their pursuit of financial security: First Command supports financial literacy and education through an ongoing, 30-year partnership with First Command Educational Foundation. The company’s donations help fund in-person and online financial literacy tools for servicemembers across the globe as well as increased scholarship opportunities for servicemembers and their families.

“America’s military families are struggling,” Spiker said. “Through our financial coaching, our research and our partnerships, we seek to help military members and their families get their professional, personal and financial needs squared away today, so they have the opportunity for the future they desire tomorrow.”

About the First Command Financial Behaviors Index®

Compiled by Sentient Decision Science, Inc., the First Command Financial Behaviors Index® assesses trends among the American public’s financial behaviors, attitudes and intentions through a monthly survey of approximately 530 U.S. consumers aged 25 to 70 with annual household incomes of at least $50,000. Results are reported quarterly. The margin of error is +/- 4.3 percent with a 95 percent level of confidence. www.firstcommand.com/research

About Sentient Decision Science, Inc.

Sentient Decision Science was commissioned by First Command to compile the Financial Behaviors Index®. SDS is a behavioral science and consumer psychology consulting firm with special vertical expertise within the financial services industry. SDS specializes in advanced research methods and statistical analysis of behavioral and attitudinal data.

About First Command

First Command Financial Services and its subsidiaries, including First Command Bank and First Command Financial Planning, assist American families in their efforts to build wealth, reduce debt and pursue their lifetime financial goals and dreams—focusing on consumer behavior as the first and most powerful determinant of results. Through knowledgeable advice and coaching of the financial behaviors conducive to success, First Command Financial Advisors have built trustworthy, lasting relationships with hundreds of thousands of client families since 1958.

First Command Financial Services, Inc., is the parent of First Command Financial Planning, Inc. (Member SIPC, FINRA), First Command Insurance Services, Inc. and First Command Bank. Financial planning services and investment products, including securities, are offered by First Command Financial Planning, Inc. Insurance products and services are offered by First Command Insurance Services, Inc., in all states except Montana, where as required by law, insurance products and services are offered by First Command Financial Services, Inc. (a separate Montana domestic corporation). Banking products and services are offered by First Command Bank. In certain states, as required by law, First Command Insurance Services, Inc. does business as a separate domestic corporation. Securities products are not FDIC insured, have no bank guarantee and may lose value. A financial plan, by itself, cannot assure that retirement or other financial goals will be met. First Command Educational Foundation is a 501(c)(3) public charity. It is not affiliated with First Command Financial Services, Inc., or any of its affiliated entities.