JACKSONVILLE, Fla. & CHICAGO--(BUSINESS WIRE)--Acosta Sales & Marketing, a leading full-service sales and marketing agency in the consumer packaged goods (CPG) industry, and Technomic, a fact-based research and consulting firm in the food industry, today released The Why? Behind The Dine, a joint foodservice report that analyzes how consumers determine what’s for dinner. This research details the complexities of consumers’ “path to the plate,” including dining decision drivers, the price/value equation and digital dining tactics.

“Determining what to eat for dinner was once a simple decision, but today consumers’ ‘path to the plate’ is chock full of intricacies,” said Colin Stewart, Senior Vice President, Acosta. “As factors such as family and friends, convenience and value intersect with the exponential growth of meal solutions, diners are influenced by overlapping and interrelated variables at every meal.”

“Our research indicates dining decisions are both situational and budget driven,” added Bob S. Goldin, Executive Vice President, Technomic. “Without a common path across consumer groups, it’s more challenging than ever for foodservice operators to compete. However, by better understanding diners’ key behaviors, operators can not only maintain but grow their share of the plate.”

The Why? Behind The Dine report reveals that:

-

Diners are taking advantage of a variety of meal options. Consumers

are diversifying their meal sources as out-of-home choices continue to

grow.

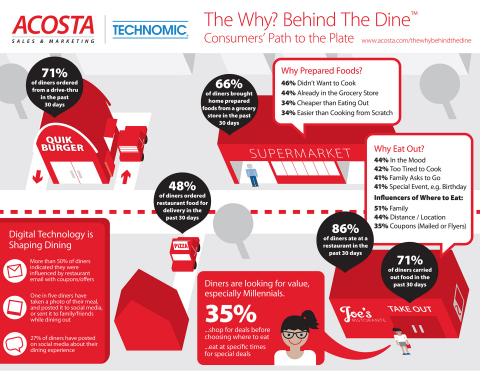

- In the past 30 days, 86% of diners ate at a restaurant; 71% ordered food for pick-up or carry out, or ordered from a drive-thru; 66% brought home prepared foods from a grocery store; and 48% ordered restaurant food for delivery.

-

State of mind drives dining decisions. The most influential

drivers behind bringing home prepared foods and determining when and

where to eat out are reflective of how consumers feel at the time.

- Not wanting to cook is the most important reason (46%) consumers brought home prepared foods from a grocery store, followed by convenience of already being in the grocery store (44%), cost compared to eating out (34%) and being easier than preparing foods from scratch (34%).

- Consumers cite mood as the biggest driver (44%) of going out to eat for dinner, followed by being too tired to cook (42%), family asking to go (41%) and special events such as birthdays or anniversaries (41%).

- When it comes to where to go out for dinner, family is the biggest influencer (51%), followed by location/travel distance (44%) and mailed coupons/flyers (35%).

-

Consumers are looking for value. Younger diners and those with

children are the most price-conscious and likely to engage in

promotions and savings strategies.

- Thirty-five percent of Millennials shop for meal deals before they choose where to eat, followed by 29% of Gen Xers, 21% of Boomers and 16% of Silents.

- Thirty-five percent of Millennials eat out at specific times to take advantage of meal discounts such as happy hour or early bird specials. Twenty-three percent of Gen Xers, 17% of Boomers and 12% of Silents do the same.

-

Digital technology is shaping the dining experience. Diners are

strategically leveraging digital tactics, from social media to mobile

technology, to facilitate their experience and especially save money.

- More than half of diners indicated they were influenced by restaurant email with coupons/offers when deciding what to eat or what they order.

- One in five diners have taken a photo of their meal and posted it to social media, or sent it to family/friends while dining out.

- Twenty-seven percent of diners have posted on social media about their dining experience.

The Why? Behind the Dine survey was fielded in July 2014 with a random sample of 1,500 U.S. consumers via Acosta’s proprietary ShopperF1rst™ methodology. To access the full report, visit www.acosta.com/thewhybehindthedine.

About Acosta Sales & Marketing

Acosta is the sales and marketing powerhouse behind most of the trusted brands seen in stores every day. The company provides a range of outsourced sales, marketing and retail merchandising services throughout the U.S. and Canada. For more than 85 years, Acosta has led the industry in helping consumer packaged goods companies move products off shelves and into shoppers’ baskets. For more information, visit www.acosta.com.

About Technomic

Only Technomic delivers a 360° view of the food industry. We drive growth and profitability for our clients by providing the most reliable, consumer-grounded, channel-relevant data with forward-looking strategic insights. Our services range from major research studies and management consulting solutions to online databases and simple fact-finding assignments. Our clients include food manufacturers and distributors, restaurants and retailers, other foodservice organizations, and various institutions aligned with the food industry. Visit us at technomic.com.