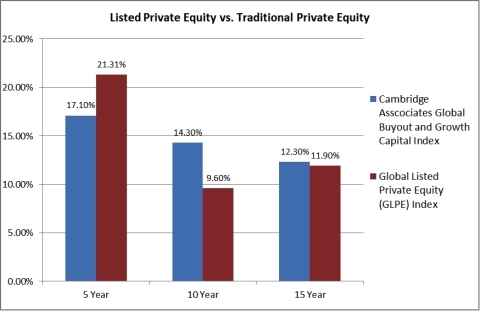

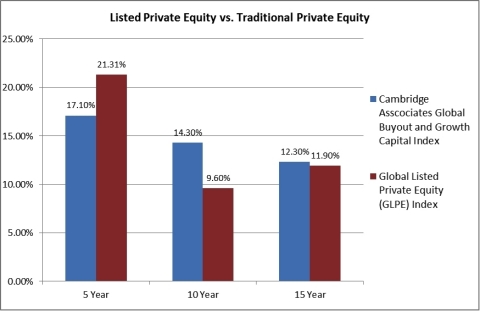

GOLDEN, Colo.--(BUSINESS WIRE)--Red Rocks Capital, an asset management firm specializing in listed private equity securities, announced today that the performance of its Global Listed Private Equity (GLPE) continues to provide long-term performance comparable with the Cambridge Associates Global Buyout & Growth Equity Index®.

The Cambridge Associates Global Buyout & Growth Equity Index® is a widely followed private equity benchmark and is an end-to-end calculation based on data compiled from 1,728 global (U.S. & ex U.S.) buyout and growth equity funds including fully liquidated partnerships, formed between 1986 and 2014.

| Annualized Returns as of 6/30/2014 | 5 YEARS | 10 YEARS | 15 Years | ||||||

| Cambridge Associates Global Buyout & Growth Equity Index® | 17.10% | 14.30% | 12.30% | ||||||

| Global Listed Private Equity (GLPE) Index | 21.31% | 9.60% | 11.90% | ||||||

“Listed private equity as an asset class continues to grow and become more widely used by asset allocator/investment model builders, defined contribution plan sponsors, multi-asset alternative funds, and variable annuity product sponsors,” said Mike Trihy, GLPE Index Manager at Red Rocks Capital. “Over longer investment horizons, listed private equity provides performance comparable to traditional private equity with the added benefit of liquidity and the ability to be part of investment vehicles that require daily liquidity.”

ABOUT THE RED ROCKS CAPITAL GLOBAL LISTED PRIVATE EQUITY (GLPE) INDEX

The GLPE Index is the largest, most widely followed private equity index, with more than $500 million in ETF tracking assets, and was the first U.S.-based investable index to monitor global listed private equity companies. With its global scope, GLPE puts an emphasis on direct private equity investing. The GLPE Index is designed to track the performance of private equity firms which are publicly traded on any nationally recognized exchange worldwide. Index constituents are selected from a universe of over 300 firms with aggregate market capitalization of over $300 billion that invest in, lend capital to, or provide services to privately-held businesses and provide a meaningful subset of the $3.5 trillion AUM global private equity market. The Index is comprised of 40 to 75 public companies representing a means of diversified exposure to private equity firms. The securities of the Index are selected and rebalanced quarterly per modified market capitalization weights.

ABOUT RED ROCKS CAPITAL, LLC

Red Rocks Capital is an asset management firm specializing in listed private equity securities. The Red Rocks Listed Private Equity portfolio gives investors access to an asset class that has historically had high barriers to entry due to investor qualification, long lock-up periods, and high initial investment minimums. Established in 2003 by Founders and Co-Portfolio Managers, Adam Goldman and Mark Sunderhuse, Golden, CO-based Red Rocks Capital was one of the first companies to offer access to private equity through a liquid mutual fund structure. It is currently the largest asset management firm that is focused exclusively on listed private equity, with approximately $1.4 billion in assets for advisor-sold mutual funds and variable annuities for institutions and investors. For more information, visit the firm’s website, www.redrockscapital.com, or call 303.679.8252.

IMPORTANT CONSIDERATIONS WHEN COMPARING PRIVATE MARKET VS. PUBLIC MARKET PERFORMANCE

The Cambridge Associates Global Buyout & Growth Equity Index® is an end-to-end calculation based on data compiled from 1,728 global (U.S. & ex U.S.) buyout and growth equity funds including fully liquidated partnerships, formed between 1986 and 2014. Returns are pooled end-to-end return, net of fees, expenses, and carried interest.

The periodic pricing or valuations of private equity limited partnerships are established by the general partners of a limited partnership investment vehicle and may not reflect the actual value of an investment if transacted between a willing buyer and seller. In contrast, the pricing of global listed private equity vehicles are established through actual buy/sell transactions on stock exchanges throughout the world.

The return calculations for private equity limited partnerships include only the time period from when capital is called by the general partner to when it is returned to limited partners, and may ignore the opportunity cost to the investor of holding cash, and may overstate the actual return to the limited partner. In contrast, return calculations for listed private equity includes the costs of holding cash, albeit on the balance sheet of the listed private equity company.

The Cambridge Associates Global Buyout & Growth Equity Index® may experience reporting and survivorship bias and may skew performance results higher, as only partnerships which were successful enough to survive until the end of the reporting period are included.

IMPORTANT DISCLOSURES

This information has been prepared by Red Rocks Capital from data believed to be reliable, but no representation is made as to accuracy or completeness. GLPE returns are based on a simulated index from October 1, 1995 to September 27, 2007 and an actual index from September 28, 2007 to Present. Red Rocks Capital calculated the hypothetical results by taking a snapshot of the index as of September 28, 2007 and back-testing performance to October 1, 1995. The hypothetical performance results are back-tested and are shown for illustrative purposes only and do not represent decisions made by the adviser during the period described. Such results were compiled after September 27, 2007 and do not reflect the impact that material economic and market factors might have had on the adviser’s decision-making if the adviser was actually maintaining the index during that time. Hypothetical back-tested performance has inherent limitations. It does not reflect actual market activity and it is not indicative of future results. The performance of the index for the period from September 28, 2007 to present was actual. The results portrayed reflect the reinvestment of dividends and other earnings. The index included securities that track the performance of private equity firms that are publicly traded. Past performance is no guarantee of future results. Index returns shown are not reflective of actual investor performance nor do they reflect fees and expenses applicable to investing.

One cannot invest directly in an index.

None of the information contained here constitutes a solicitation, offer, opinion, or recommendation by Red Rocks Capital LLC to buy or sell any security, or to provide legal, tax, accounting, or investment advice or services regarding the profitability or suitability of any security or investment.