NEW YORK--(BUSINESS WIRE)--PIRA Energy Group, a NYC-based energy markets consulting firm, has announced the launch of a new multi-client study entitled “Shale Crude’s Growing Global Impact: Consequences for Trade Flows and Pricing Within and Beyond North America’s Borders.” The study focuses on the implications of North America’s growing shale crude/condensate production on world crude and product trade, and regional crude and product pricing and shipping. Detailed data will be provided by country for refinery runs, and crude (by quality) and product trade.

“PIRA’s new study will incorporate the insights from its very popular top, middle and bottom of the barrel studies, creating the most comprehensive analysis of the implications of North American shale on global crude and product markets that the industry has seen. It will be an invaluable resource for the industry” stated Dr. Gary Ross, CEO.

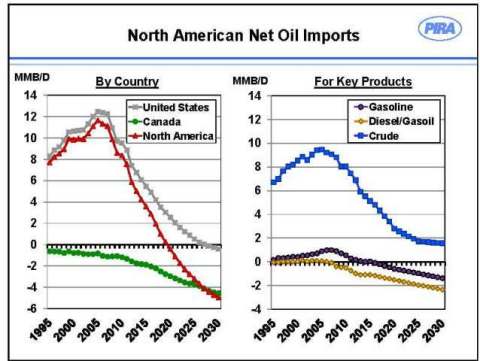

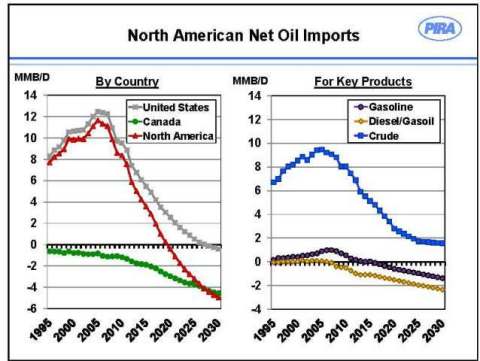

U.S. crude imports have already fallen by 25% from their peak and net U.S. product exports turned positive in 2011 and continue to expand. Global crude and product flows are being drastically altered as demand for imported crude in North America declines while net product exports continue rising. Some of PIRA’s study findings include:

- As the U.S. has already cut back sharply on light crude imports, future production growth will displace medium/heavy imported grades with U.S. refiners accommodating through modest capital projects and operational changes (e.g., blending). Crude/condensate exports from the U.S., if allowed, would ease the transition for refiners and help stabilize prices.

- U.S. refineries processing local crude or imports priced competitively with local crude will see strong margins. Utilization rates will stay high, particularly in PADDs II and III. Overall runs in the U.S. will grow, but will be capacity limited. Product export growth will slow as runs growth slows, but will ultimately increase due to lower gasoline demand due increasing vehicle efficiency and substitution of natural gas for diesel in trucking.

- Refinery capacity and runs will increase most rapidly in China (local demand growth), the Middle East (demand growth and government policy) and India (demand growth and efficient export refineries). Growth will also take place in the United States (advantaged crude pricing) followed by Brazil (demand growth) and Russia (tax subsidies). European refinery runs will decline sharply pressured by declining demand and imports from Russia, the United States, and the Middle East. Runs in Japan and Australia will also decline.

- U.S. product exports of both gasoline and diesel will be targeted primarily to Latin America and eventually to West Africa. Middle East product exports will also surge, mostly middle distillates bound for Asia, East Africa and Europe. Russian exports of light products will increase mostly to Europe but VGO/feedstock exports will plunge.

With this new study, PIRA Energy Group continues its tradition of providing comprehensive, timely and commercially significant research. The study will be available in late May and includes a written report, a live client forum on June 12, 2014 at Four Seasons Hotel in Houston and an online database covering:

- Shale crude production by formation and by U.S. state and Canadian province in North America

- Production by country outside North America

- Regional oil product demand and refinery production of key products

- Supply/demand balances for major global regions and select countries for crude oil by quality grade and major oil products

- Inter-regional net crude and product balances and trade flows by product covering all global regions

- Gross trade balances for key countries/regions

- Price forecasts for key crude and product markets in North America and globally

For more information on the study, you can click the following Shale Crude’s Growing Global Impact: Consequences for Trade Flows and Pricing Within and Beyond North America’s Borders.

About PIRA Energy Group

The PIRA Energy Group, founded in 1976 and based in New York City, is an international energy consulting firm specializing in global energy market analysis, intelligence, and forecasting oil/energy prices. Currently, more than 550 entities spread across some 65 countries — including international and national integrated oil and gas companies, independent producers, refiners, marketers, oil and gas pipelines, electric and gas utilities, industrials, trading companies, financial institutions and government agencies — use PIRA’s research and price forecasting services.

PIRA

Energy Group

Sales Department

3 Park Avenue, 26th

Floor

New York, NY 10016

212-686-6808

sales@pira.com