NEW YORK--(BUSINESS WIRE)--Pavilion Holdings Group, LLC (PHG), an emerging medical technology leader revolutionizing the way that products are developed, financed and commercialized, provided an update today on progress in advancing its pipeline, as well as corporate plans to launch a new entity that will unite five promising medical technology products and additional early-stage projects into one vehicle.

PHG deploys a virtual business model, with outsourced best-in-class process expertise that maximizes operational and capital efficiency. In contrast to bio-pharmaceutical technologies, medical devices can potentially move from concept to commercialization to large exits with modest capital and time investments, leading to attractive rates of return for early investors if companies use their capital efficiently. Hallmarks of companies created in accordance with the Pavilion Model include:

- Smallest single funding round necessary to reach commercialization

- Minimal baseline capital burn rate

- Credible path to self-commercialization or early acquisition by a strategic

“PHG’s mission is to bring cutting-edge products targeting attractive markets to commercial stage as quickly as possible, while preserving investor equity. Our truly virtual corporate structure and disciplined focus on time and capital efficiency, has allowed us to accelerate value creation for investors and future strategic partners,” said Michael Glennon, PHG Partner/Co-Founder and CEO of Saphena Medical and Cruzar Medical.

The PHG team, which includes industry veteran Glennon and renowned cardiac surgeons/entrepreneurs, Lishan Aklog, and Brian deGuzman, sold their first company, Vortex Medical, Inc. and its revolutionary AngioVac® technology to Angiodynamics, Inc. in late 2012 for $55 million and additional earn-outs estimated to be worth at least $20 million. The team demonstrated the unique value of their model by moving Vortex from concept to commercialization to acquisition in less than five years, following a single $3.5M funding round, while generating a minimum 800% return to their investors.

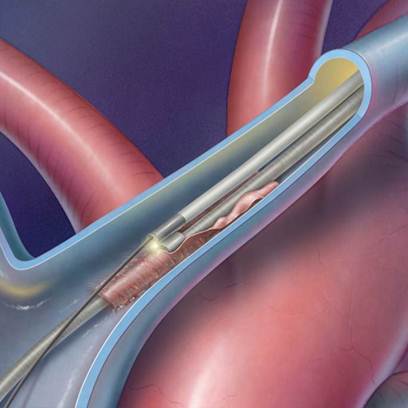

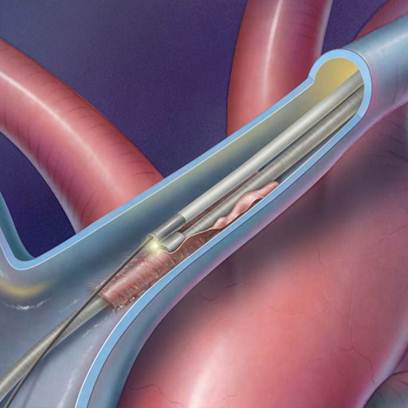

In the past ten months PHG has spun out three additional venture/angel backed companies from its incubator. These companies are following the same model and also moving rapidly towards regulatory clearance, commercialization and/or exit. Kaleidoscope Medical, LLC has developed the first vena caval filter which can be left permanently, retrieved or reversed at a later date. Saphena Medical, LLC’s advanced endoscopic saphenous vein harvesting technology for coronary bypass surgery is more efficient and less traumatic than the current standard of care. Finally, Cruzar Medical, Inc. is taking an exciting, radically new approach to the persistent challenge of crossing chronic total occlusions (CTO’s) in blood vessels.

“It has been gratifying to confirm that our well-honed Pavilion model, which worked so impressively with Vortex, can be successfully applied to new products in different markets. If anything, Kaleidoscope, Saphena and Cruzar are moving more rapidly and efficiently than Vortex,” said Brian deGuzman, MD, PHG Partner/Co-Founder and CEO of Kaleidoscope Medical.

Looking ahead, PHG is seeking even more efficient ways to advance its robust pipeline. This pipeline includes five mature projects (nearly all with issued patents, proof of concept and/or working prototypes) targeting pacemaker/defibrillator lead extraction, transcatheter mitral valve repair, reversible endoscopic treatment of obesity, tissue ablation including renal denervation for hypertension and disposable infusion pumps. It also includes a six to eight additional projects addressing important clinical needs which are in the early, conceptual stage.

To this end, PHG is announcing the launch of Pavilion Ventures to aggregate its entire current project pipeline, as well as future projects under one corporate entity. Pavilion Ventures plans to raise approximately $10 million to fund this pipeline and will operate and manage the emerging portfolio collectively according to the Pavilion Model. This consolidation should provide immediate additional benefits compared to a series of single-product start-ups by providing multiple shots on goal, economies of scale, expanded capacity and much greater flexibility to deploy capital based on a project’s real trajectory, not a forecast.

“We plan to offer the opportunity to participate in the growth of a diversified portfolio of companies that is balanced between shorter-term, lower-risk projects and longer-term projects with much higher projected exits. Our intent is to deploy the proven Pavilion Model on a broader scale to maximize medium and long-term return. We believe this approach overcomes many of the shortcomings of the current financing landscape for new medical technologies,” said Lishan Aklog, PHG Partner/Co-Founder and CEO of Pavilion Ventures.

About Pavilion Holdings Group (PHG) LLC

Pavilion Holdings Group was founded by cardiac surgeons Lishan Aklog MD and Brian deGuzman MD and medical device executive Michael Glennon to build a portfolio of medical device companies which provide commercially successful, innovative tools to alleviate human suffering. PHG portfolio companies are built and operate with a focus on rapidly bringing cutting edge products into large markets. Its unique virtual business model, with outsourced best-in-class process expertise, maximizes operational and capital efficiency, preserving founder and investor equity and facilitating strategic partnerships or acquisitions. PHG's first company, Vortex Medical, Inc, progressed from a modest initial capitalization round, through successful commercialization to acquisition by Angiodynamics, Inc. in less than five years, providing its early investors with an attractive return. It co-founded an incubator Pavilion Medical Innovations which has spun out three companies and continues to feed a pipeline of exciting medical device products.