SMITHFIELD, R.I.--(BUSINESS WIRE)--Despite risk management being their top concern and many with closed or frozen pensions, more than half (55%) of U.S. mid-market corporations stated they intend to maintain or increase their current risk profile, according to new research by Pyramis Global Advisors®, a Fidelity Investments® company and leading institutional multi-asset class investment manager with nearly $200 billion in assets under management and more than 600 institutional clients.

This was one of the key findings from 2013 Pyramis US Corporate Mid-Market Pulse Poll. In September and October 2013, Pyramis Global Advisors surveyed executives from 166 mid-sized corporations to better understand the concerns, challenges and future intentions for their defined benefit plans. The pensions these executives represent, which range from $50 million to $500 million, cumulatively total more than $32 billion in assets under management.

In addition to risk management, survey respondents cite two other top concerns related to their investment portfolios: a low return environment and market volatility. The Pyramis survey also reveals that while the majority of corporate mid-market pensions plan to maintain or increase their risk profile, nearly one-third (30%) plan to implement a de-risking strategy but have not established the criteria (e.g., improvement in funding status, rise in interest rates) for doing so. An additional 15 percent of plans also intend to de-risk, but already have a formal de-risking strategy with established criteria in place.

“While risk management is stated as a top concern, the combination of rising equity markets and an unprecedented low return environment is motivating investors to consider increasing risk to generate higher returns,” said Chuck McKenzie, head of Institutional Solutions, Pyramis Global Advisors. “That said, by taking on more risk, investors need to remain diligent about plan oversight, including the potential impact on their funding status in the event of a market decline.”

Matching Assets and Liabilities is Key Challenge

The biggest challenge in the investment decision-making process cited by mid-market pension plans is matching assets and liabilities (31%), followed by controlling costs (27%) and executing timely investment decisions (13%). The asset liability matching challenge is also reflected in the results that show, while many have a desire to de-risk, only 25 percent of survey respondents currently hedge their pension liabilities through a Liability Driven Investing (LDI) strategy.

The Pyramis survey reveals that for plans that aspire to de-risk, the leading event to initiate a de-risking program would be an improvement in their plans’ funding status, cited by one third (32%) of respondents. This is followed by a rise in interest rates (17%) and a shift in focus to managing volatility (15%). Nearly one in six (16%) indicated nothing would cause them to adopt a de-risking program.

Pyramis Publishes New Liability Transfer Paper

Pyramis recently launched a new report on pension & longevity risk, “Liability Transfer Using Annuity-in-Kind Portfolios: An Effective Risk-Management Approach for Plan Sponsors.” The paper explains how defined benefit pension plans can reduce risk through permanent liability transfers.

Lack of Time and Resources

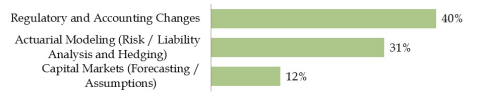

According to the Pyramis survey, 61 percent of respondents say the time spent overseeing all aspects of defined benefit plans has increased over the past five years, and nearly two-thirds (71%) of those respondents expect this trend to continue. Regulatory and accounting changes take up the most time (40%), followed by actuarial modeling (31%).

To help overcome the time management challenge, it is no surprise that the vast majority (81%) of U.S. corporate mid-market plans use a consultant for manager selection, asset allocation, risk oversight or performance review. However, an additional 49% of survey respondents have also entered into an outsourced chief investment officer (OCIO) arrangement.

“Driven by a lack of plan resources and expertise, many institutional investors are recognizing that external managers, particularly those that manage multi-asset class strategies, may be better positioned to evaluate and execute asset allocation decisions to help generate more consistent returns and manage risk,” said McKenzie.

Mid-Market Pensions Increase Global Investments, Reduce Domestic Market Exposure

U.S. mid-market pension plans expect to increase their allocation to emerging market and global investments in the next one to two years, while reducing exposure to domestic markets. The Pyramis survey reveals that plans sponsors expect net increases to their asset allocations: emerging market equity (17%), global equity (16%), liquid alternatives (12%), emerging market debt (10%), illiquid alternatives (9%), global fixed income (7%) and U.S. fixed income (2%). Conversely, one in 10 (8%) say they will decrease net U.S. equity allocation and leave exposure to non-U.S. developed market equity unchanged.

Funding Status Improves, End States Remain Uncertain

Driven mainly by rising equity markets, funding status among U.S. corporate mid-market plans has improved, with 55 percent funded at 90 percent or better, and among them 21 percent funded at 100 percent or more. But uncertainty around the end status of mid-market plans remains an issue, with 24 percent of respondents stating that they are undecided on the end state of their defined benefit plan (e.g., remain open to new and existing employees, freeze, close to new employees but accrue for existing participants, terminate).

About the Survey

In September and October 2013, Pyramis conducted an online survey of US corporate mid-market institutional investors. The 166 respondents have plan assets under management between $50 million and $500 million. The cumulative assets under management represented by respondents totaled more than $32 billion. The survey was executed in association with the Asset International, publisher of PLANSPONSOR magazine and aiCIO magazine. Investment, executive or HR benefits and plan administrators responded to an online questionnaire1. A report on the survey is available at www.pyramis.com/us/mid-market.

About Pyramis Global Advisors

Pyramis Global Advisors, a Fidelity Investments company, delivers asset management products and services designed to meet the needs of institutional investors around the world. Pyramis is a multi-asset class manager with extensive experience managing investments for, and serving the needs of, some of the world’s largest corporate and public defined benefit and defined contribution plans, endowments and foundations, insurance companies, and financial institutions. The firm offers traditional long-only and alternative equity, as well as fixed income and real estate debt and REIT investment strategies. As of Sept. 30, 2013, assets under management totaled nearly $200 billion USD. Headquartered in Smithfield, RI, USA, Pyramis offices are located in Boston, Toronto, Montreal, London, and Hong Kong.

Pyramis, Pyramis Global Advisors and the Pyramis Global Advisors A Fidelity Investments Company logo are registered service marks of FMR LLC.

673485.1.0

© 2013 FMR LLC. All rights reserved.

1 The results of this survey may not be representative of all the institutional investors meeting the same criteria as those surveyed for this poll.