LOS ANGELES--(BUSINESS WIRE)--American Apparel, Inc. (NYSE MKT: APP), a vertically integrated manufacturer, distributor, and retailer of branded fashion-basic apparel, announced financial results for its first quarter ended March 31, 2013.

Financial Performance Highlights for the First Quarter of 2013

- Net sales increased 4% to $138.1 million on an 8% increase in comparable store sales and a 1% increase in wholesale net sales

- Adjusted EBITDA improved by $1.4 million to a loss of $0.7 million from a loss of $2.1 million in the first quarter 2012

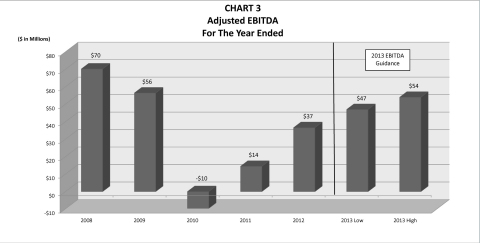

John Luttrell, Chief Financial Officer of American Apparel, Inc. stated, “Today we reported a $1.4 million improvement in Adjusted EBITDA to a loss of $ 0.7 million for the three months ended March 31, 2013 from a loss of $2.1 million for the three months ended March 31, 2012. Though the first quarter is historically the slowest quarter of the year, retail and online sales growth and the related leveraging of fixed costs helped us reduce our EBITDA loss. These results were substantially in line with plan and, accordingly, we reiterate our adjusted EBITDA guidance of $47 to $54 million for the full year 2013. We expect key initiatives in the areas of merchandise planning, supply chain, and inventory control to drive further sales and expense improvements for the balance of the year.”

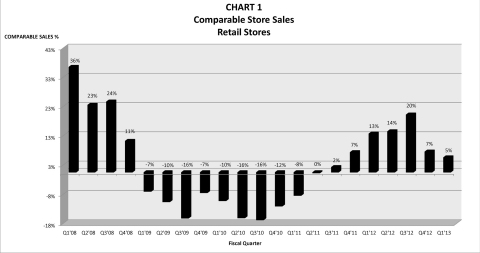

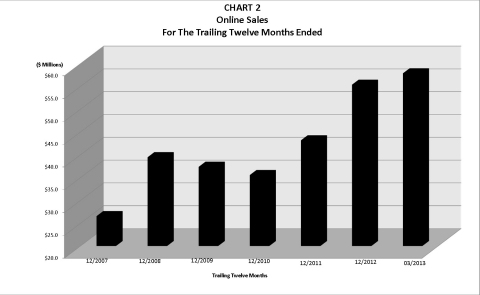

Dov Charney, Chairman and CEO of American Apparel, Inc. stated: “Although we are pleased with our first quarter performance, we will not be satisfied until we exceed prior productivity levels in our stores (see Chart 1), significantly increase our online sales penetration levels (see Chart 2), and drive additional volume through our wholesale channel. Despite some liquidity challenges over the past two years, we have made the necessary investments that should allow us to exceed our prior EBITDA levels (see Chart 3). We have significantly improved our store presentation, responsibly added stores when it was appropriate to do so, improved technology in all three channels, increased inventory productivity and substantially improved the effectiveness of our supply chain operation.”

Explanation of non-cash charges

Two non-operating and non-cash items substantially explain the increase in net loss from $7.9 million or $0.07 per diluted share in the first quarter of 2012 to $46.5 million or $0.42 per diluted share for the first quarter of 2013:

(1) Lion Capital holds 21.6 million warrants at $0.75 per share and as our share price increases the warrants become more valuable and we have to book an expense to recognize the increase in value of warrants. Conversely, when our share price decreases we have to book a gain to recognize decrease in the value of warrants. Therefore, as our share price increased during the first quarter of 2013, we booked a non-cash charge of $23.6 million as a result of a mark-to-market adjustment to our warrants. These charges do not represent a change in cash obligations of the company.

(2) A non-cash gain of $11.6 million due to an amendment to a prior credit agreement with Lion Capital during the first quarter of 2012.

Although the charges associated with the warrants are appropriate and required under GAAP, they do not impact the operating performance of the company. Also, they do not represent obligations that will be settled with cash. Instead, warrants will be reclassified to equity when exercised.

Excluding these non-operating/non-cash items from both periods, net loss would have been $22.9 million in the first quarter 2013 compared to $18.8 million in the first quarter 2012.

Operating Results - First Quarter 2013

Comparing the first quarter 2013 to the corresponding period last year, net sales increased 4% to $138.1 million on an 8% increase in comparable store sales in the retail and online business and a 1% increase in net sales in the wholesale business. The following delineates the components of the increases for the quarterly period ended March 31, 2013 and March 31, 2012 as compared to the corresponding quarter of the prior year:

| 2013 First Quarter | 2012 First Quarter (1) | |||||

| Comparable Store Sales | 5 | % | 13 | % | ||

| Comparable Online Sales | 24 | % | 23 | % | ||

| Comparable Retail & Online | 8 | % | 14 | % | ||

| Wholesale Net Sales | 1 | % | 17 | % | ||

| Total Net Sales | 4 | % | 14 | % | ||

(1) Comparable store sales has been adjusted to exclude impact of extra leap-year day in 2012.

Gross profit of $72.9 million for the first quarter 2013 represented an increase of 4% from $70.1 million reported for the first quarter 2012. Gross margin remained unchanged at 52.8% for the quarters ended March 31, 2013 and 2012. Higher margins from an improved sales mix were offset by higher freight costs.

Operating expenses of $83.3 million for the first quarter 2013 represented an increase of 4% from $79.9 million for the first quarter 2012. As a percent of revenue, operating expenses remained unchanged at 60% for both quarters. The increase in operating expenses was primarily due to higher share-based compensation costs of $1.7 million. Additionally, we incurred higher rent expenses of $1.6 million related to higher CAM (common area maintenance) charges and lease termination costs, as well as rent for our new distribution center and $0.8 million in higher expenses associated with RFID-related supplies and travel for other store refurbishment activities. This increase was offset by lower store payroll of $1.1 million and lower advertising expenses of $1.1 million.

Operating loss for the first quarter 2013 was $10.5 million compared to $9.8 million in the first quarter 2012.

Adjusted EBITDA loss in the first quarter of 2013 improved to $0.7 million from a loss of $2.1 million in the first quarter of 2012. For a reconciliation of consolidated adjusted EBITDA, a non-GAAP financial measure, to consolidated net income or loss, as applicable, please refer to the Table A attached to this press release.

Other expense for the first quarter 2013 was $35.6 million as compared with other income of $2.2 million in the prior year quarter. The $37.8 million change in non-operating expenses was primarily the result of an increase in the market value of our outstanding warrants: the unrealized losses on the change in fair value of our warrants were $23.6 million and $0.7 million for the 2013 and 2012 quarters, respectively. Additionally, during the first quarter 2012, we recognized a gain on extinguishment of debt of $11.6 million.

Income tax provision in the first quarter 2013 was $0.5 million versus $0.3 million in the 2012 first quarter. In accordance with U.S. GAAP, we have discontinued recognizing potential tax benefits associated with current operating losses. As of March 31, 2013, we had available federal net operating loss carry forwards of approximately $95.6 million and unused federal and state tax credits of $24.5 million.

Net loss for the first quarter of 2013 was $46.5 million, or $0.42 per common share, compared to net loss for the first quarter of 2012 of $7.9 million, or $0.07 per common share. The 2013 first quarter includes a non-cash/non-operating income statement charge of $23.6 million ($0.22 per common share) associated with an increase in the fair value of outstanding warrants. The 2012 first quarter includes a similar non-cash/non-operating charge of $0.7 million ($0.01 per common share) for the increase in the fair value of such warrants and a non-cash/non-operating gain of $11.6 million on the extinguishment of debt. Excluding these non-cash/non-operating charges from both periods, net loss for the first quarter 2013 would have been $22.9 million, or $0.21 per share, compared to $18.8 million, or $0.18 per share, in the first quarter 2012.

Fully-diluted weighted average shares outstanding were 109.9 million in the first quarter of 2013 versus 105.7 million for the first quarter of 2012. As of May 1, 2013 there were approximately 107.8 million shares outstanding.

Cash used in operating activities was $6.0 million in the first quarter of 2013 as compared with cash used in operating activities of $8.6 million in the 2012 quarter primarily as a result of improvements in sales.

Capital expenditures during the first quarter of 2013 increased by $3.7 million to $7.4 million as compared with $3.7 million in the 2012 quarter as we neared completion of our RFID implementation activities. In addition, we continued to make other improvements to our stores and make additional investments in manufacturing equipment.

2013 EBITDA and Sales Guidance

For 2013, we are reiterating our outlook for adjusted EBITDA to be in the range of $47 million to $54 million. This outlook assumes net sales between $652 million and $660 million. Raw material costs are estimated at current prices and foreign currency exchange rates are estimated to remain at current levels.

For a reconciliation of the forecasted guidance range of adjusted EBITDA to net loss, please refer to our earnings press release for the fourth quarter and full year 2012.

About American Apparel

American Apparel is a vertically integrated manufacturer, distributor and retailer of branded fashion basic apparel based in downtown Los Angeles, California. As of May 1, 2013 American Apparel had approximately 10,000 employees and operated 248 retail stores in 20 countries, including the United States, Canada, Mexico, Brazil, United Kingdom, Ireland, Austria, Belgium, France, Germany, Israel, Italy, Netherlands, Spain, Sweden, Switzerland, Australia, Japan, South Korea and China. American Apparel also operates a global e-commerce site that serves over 60 countries worldwide at http://www.americanapparel.net. In addition, American Apparel also operates a leading wholesale business that supplies high quality T-shirts and other casual wear to distributors and screen printers.

Safe Harbor Statement

This press release, and other statements that the Company may make, may contain forward-looking statements. Forward-looking statements are statements that are not historical facts and include statements regarding, among other things, the Company's future financial condition, results of operations and plans and the Company's prospects, expectations, goals and strategies for future growth, operating improvements and cost savings, and the timing of any of the foregoing. Such forward-looking statements are based upon the current beliefs and expectations of American Apparel's management, but are subject to risks and uncertainties, which could cause actual results and/or the timing of events to differ materially from those set forth in the forward-looking statements, including, among others: the ability to generate sufficient liquidity for operations and debt service; changes in the level of consumer spending or preferences or demand for the Company's products; increasing competition, both in the U.S. and internationally; the evolving nature of the Company's business; the Company's ability to hire and retain key personnel and the Company's relationship with its employees; suitable store locations and the Company's ability to attract customers to its stores; the availability of store locations at appropriate terms and the Company's ability to identify and negotiate new store locations effectively and to open new stores and expand internationally; effectively carrying out and managing the Company's strategy, including growth and expansion both in the U.S. and internationally; disruptions in the global financial markets; failure to maintain the value and image of the Company's brand and protect its intellectual property rights; declines in comparable store sales and wholesale revenues; financial nonperformance by the Company's wholesale customers; the adoption of new accounting pronouncements or changes in interpretations of accounting principles; seasonality of the business; consequences of the Company's significant indebtedness, including the Company's relationships with its lenders and the Company's ability to comply with its debt agreements, including the risk of acceleration of borrowings thereunder as a result of noncompliance; the Company's ability to generate cash flow to service its debt; the Company's liquidity and losses from operations; the Company's ability to develop and implement plans to improve its operations and financial position; costs of materials and labor, including increases in the price of yarn and the cost of certain related fabrics; the Company's ability to pass on the added cost of raw materials to its wholesale and retail customers; the Company's ability to improve manufacturing efficiency at its production facilities; the Company's ability to effectively manage inventory and inventory reserves; location of the Company's facilities in the same geographic area; manufacturing, supply or distribution difficulties or disruptions; risks of financial nonperformance by customers; investigations, enforcement actions and litigation, including exposure from which could exceed expectations; compliance with or changes in U.S. and foreign government laws and regulations, legislation and regulatory environments, including environmental, immigration, labor and occupational health and safety laws and regulations; costs as a result of operating as a public company; material weaknesses in internal controls; interest rate and foreign currency risks; loss of U.S. import protections or changes in duties, tariffs and quotas and other risks associated with international business including disruption of markets and foreign supply sources and changes in import and export laws; technological changes in manufacturing, wholesaling, or retailing; the Company's ability to upgrade its information technology infrastructure and other risks associated with the systems that are used to operate the Company's online retail operations and manage the Company's other operations; adverse changes in its credit ratings and any related impact on financing costs and structure; general economic and industry conditions, including U.S. and worldwide economic conditions; disruptions due to severe weather or climate change; and other risks detailed in the Company's filings with the Securities and Exchange Commission, including the Company's Report on Form 10-K for the year ended December 31, 2012 and Form 10-Q for the quarter ended March 31, 2013. The Company's filings with the SEC are available at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. The forward-looking statements speak only as of the date on which they are made and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

| AMERICAN APPAREL, INC. AND SUBSIDIARIES | |||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||

|

(Amounts and shares in thousands, except per share amounts) |

|||||||||

|

(unaudited) |

|||||||||

| Three Months Ended March 31, | |||||||||

| 2013 | 2012 | ||||||||

| Net sales | $ | 138,060 | $ | 132,660 | |||||

| Cost of sales | 65,192 | 62,604 | |||||||

| Gross profit | 72,868 | 70,056 | |||||||

| Operating expenses | 83,345 | 79,851 | |||||||

| Loss from operations | (10,477 | ) | (9,795 | ) | |||||

| Interest expense | 11,214 | 9,553 | |||||||

| Foreign currency transaction loss (gain) | 713 | (950 | ) | ||||||

| Unrealized loss on change in fair value | |||||||||

| of warrants | 23,645 | 651 | |||||||

| Gain on extinguishment of debt | — | (11,588 | ) | ||||||

| Other (income) expense | (5 | ) | 128 | ||||||

| Loss before income taxes | (46,044 | ) | (7,589 | ) | |||||

| Income tax provision | 467 | 302 | |||||||

| Net Loss | $ | (46,511 | ) | $ | (7,891 | ) | |||

| Loss per share, basic and diluted | $ | (0.42 | ) | $ | (0.07 | ) | |||

| Weighted average shares outstanding, basic and diluted | 109,918 | 105,707 | |||||||

| AMERICAN APPAREL, INC. AND SUBSIDIARIES | ||||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||||

|

(Amounts in thousands) |

||||||||

|

(unaudited) |

||||||||

| March 31, 2013 | December 31, 2012 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 5,688 | $ | 12,853 | ||||

| Trade accounts receivable, net of allowances | 23,042 | 22,962 | ||||||

| Prepaid expenses and other current assets | 9,295 | 9,589 | ||||||

| Inventories, net | 177,351 | 174,229 | ||||||

| Restricted cash | 2,678 | 3,733 | ||||||

| Income taxes receivable and prepaid income taxes | 259 | 530 | ||||||

| Deferred income taxes, net of valuation allowance | 426 | 494 | ||||||

| Total current assets | 218,739 | 224,390 | ||||||

| PROPERTY AND EQUIPMENT, net | 68,173 | 67,778 | ||||||

| DEFERRED INCOME TAXES, net of valuation allowance | 1,209 | 1,261 | ||||||

| RESTRICTED CASH | 1,629 | — | ||||||

| OTHER ASSETS, net | 37,201 | 34,783 | ||||||

| TOTAL ASSETS | $ | 326,951 | $ | 328,212 | ||||

| LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Cash overdraft | $ | 1,340 | $ | — | ||||

| Revolving credit facilities and current portion of long-term debt | 68,116 | 60,556 | ||||||

| Accounts payable | 41,784 | 38,160 | ||||||

| Accrued expenses and other current liabilities | 40,675 | 41,516 | ||||||

| Fair value of warrant liability | 40,886 | 17,241 | ||||||

| Income taxes payable | 2,257 | 2,137 | ||||||

| Deferred income tax liability, current | 257 | 296 | ||||||

| Current portion of capital lease obligations | 1,737 | 1,703 | ||||||

| Total current liabilities | 197,052 | 161,609 | ||||||

| LONG-TERM DEBT, net of unamortized discount | 118,358 | 110,012 | ||||||

| CAPITAL LEASE OBLIGATIONS, net of current portion | 2,632 | 2,844 | ||||||

| DEFERRED TAX LIABILITY | 247 | 262 | ||||||

| DEFERRED RENT, net of current portion | 20,115 | 20,706 | ||||||

| OTHER LONG-TERM LIABILITIES | 10,932 | 10,695 | ||||||

| TOTAL LIABILITIES | 349,336 | 306,128 | ||||||

| STOCKHOLDERS' (DEFICIT) EQUITY | ||||||||

| Common stock | 11 | 11 | ||||||

| Additional paid-in capital | 180,627 | 177,081 | ||||||

| Accumulated other comprehensive loss | (4,229 | ) | (2,725 | ) | ||||

| Accumulated deficit | (196,637 | ) | (150,126 | ) | ||||

| Less: Treasury stock | (2,157 | ) | (2,157 | ) | ||||

| TOTAL STOCKHOLDERS' (DEFICIT) EQUITY | (22,385 | ) | 22,084 | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY | $ | 326,951 | $ | 328,212 | ||||

| AMERICAN APPAREL, INC. AND SUBSIDIARIES | ||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

|

(Amounts in thousands) |

||||||||

|

(unaudited) |

||||||||

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Cash received from customers | $ | 137,654 | $ | 133,818 | ||||

| Cash paid to suppliers, employees and others | (139,649 | ) | (141,724 | ) | ||||

| Income taxes refunded | 9 | 745 | ||||||

| Interest paid | (4,040 | ) | (1,376 | ) | ||||

| Other | 18 | (109 | ) | |||||

| Net cash used in operating activities | (6,008 | ) | (8,646 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Capital expenditures | (7,354 | ) | (3,690 | ) | ||||

| Proceeds from sale of fixed assets | 12 | 34 | ||||||

| Restricted cash | (622 | ) | (6,802 | ) | ||||

| Net cash used in investing activities | (7,964 | ) | (10,458 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Cash overdraft | 1,340 | 114 | ||||||

| Repayments of expired revolving credit facilities, net | — | (45,121 | ) | |||||

| Borrowings under current revolving credit facilities, net | 7,624 | 29,997 | ||||||

| (Repayments) borrowings of term loans and notes payable | (3 | ) | 35,785 | |||||

| Payments of debt issuance costs | (1,678 | ) | (4,696 | ) | ||||

| Repayments of capital lease obligations | (176 | ) | (271 | ) | ||||

| Net cash provided by financing activities | 7,107 | 15,808 | ||||||

| EFFECT OF FOREIGN EXCHANGE RATE ON CASH | (300 | ) | 305 | |||||

| NET DECREASE IN CASH | (7,165 | ) | (2,991 | ) | ||||

| CASH, beginning of period | 12,853 | 10,293 | ||||||

| CASH, end of period | $ | 5,688 | $ | 7,302 | ||||

| AMERICAN APPAREL, INC. AND SUBSIDIARIES | ||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (continued) |

||||||||

|

(Amounts in thousands) |

||||||||

|

(unaudited) |

||||||||

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| RECONCILIATION OF NET LOSS TO NET CASH USED IN OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (46,511 | ) | $ | (7,891 | ) | ||

| Depreciation and amortization of property and equipment, and other assets | 6,031 | 5,852 | ||||||

| Retail store impairment | 78 | — | ||||||

| Loss on disposal of property and equipment | 13 | 18 | ||||||

| Share-based compensation expense | 3,547 | 1,842 | ||||||

| Unrealized loss on change in fair value of warrants | 23,645 | 651 | ||||||

| Amortization of debt discount and deferred financing costs | 2,610 | 2,943 | ||||||

| Gain on extinguishment of debt | — | (11,588 | ) | |||||

| Accrued interest paid-in-kind | 4,564 | 5,234 | ||||||

| Foreign currency transaction loss (gain) | 713 | (950 | ) | |||||

| Allowance for inventory shrinkage and obsolescence | 254 | 128 | ||||||

| Bad debt expense | 139 | 41 | ||||||

| Deferred income taxes | — | (7 | ) | |||||

| Deferred rent | (448 | ) | (8 | ) | ||||

| Changes in cash due to changes in operating assets and liabilities: | ||||||||

| Trade accounts receivables | (545 | ) | 1,117 | |||||

| Inventories | (4,811 | ) | (93 | ) | ||||

| Prepaid expenses and other current assets | 220 | (1,668 | ) | |||||

| Other assets | (1,825 | ) | (583 | ) | ||||

| Accounts payable | 3,999 | 2,333 | ||||||

| Accrued expenses and other liabilities | 1,859 | (7,043 | ) | |||||

| Income taxes receivable/payable | 460 | 1,026 | ||||||

| Net cash used in operating activities | $ | (6,008 | ) | $ | (8,646 | ) | ||

| AMERICAN APPAREL, INC. AND SUBSIDIARIES | ||||||||||||||||||||

| BUSINESS SEGMENT INFORMATION | ||||||||||||||||||||

|

(Amounts in thousands) |

||||||||||||||||||||

|

(unaudited) |

||||||||||||||||||||

|

The following table presents key financial information for American Apparel's business segments before unallocated corporate expenses:

|

||||||||||||||||||||

| Three Months Ended March 31, 2013 | ||||||||||||||||||||

| U.S. Wholesale | U.S. Retail | Canada | International | Consolidated | ||||||||||||||||

| Net sales to external customers | $ | 43,826 | $ | 44,344 | $ | 12,357 | $ | 37,533 | $ | 138,060 | ||||||||||

| Gross profit | 12,021 | 29,191 | 7,420 | 24,236 | 72,868 | |||||||||||||||

| Income (loss) from segment operations | 5,165 | (2,447 | ) | (652 | ) | 1,031 | 3,097 | |||||||||||||

| Depreciation and amortization | 1,603 | 2,970 | 433 | 1,025 | 6,031 | |||||||||||||||

| Capital expenditures | 3,076 | 2,900 | 183 | 1,195 | 7,354 | |||||||||||||||

| Retail store impairment | — | 78 | — | — | 78 | |||||||||||||||

| Deferred rent expense (benefit) | 20 | (212 | ) | (131 | ) | (125 | ) | (448 | ) | |||||||||||

| Three Months Ended March 31, 2012 | ||||||||||||||||||||

| U.S. Wholesale | U.S. Retail | Canada | International | Consolidated | ||||||||||||||||

| Net sales to external customers | $ | 41,335 | $ | 42,609 | $ | 13,338 | $ | 35,378 | $ | 132,660 | ||||||||||

| Gross profit | 11,758 | 28,288 | 7,068 | 22,942 | 70,056 | |||||||||||||||

| Income (loss) from segment operations | 6,526 | (3,104 | ) | (2,714 | ) | 597 | 1,305 | |||||||||||||

| Depreciation and amortization | 1,738 | 2,645 | 339 | 1,130 | 5,852 | |||||||||||||||

| Capital expenditures | 1,093 | 1,444 | 512 | 641 | 3,690 | |||||||||||||||

| Deferred rent expense (benefit) | 49 | 117 | (48 | ) | (126 | ) | (8 | ) | ||||||||||||

| AMERICAN APPAREL, INC. AND SUBSIDIARIES | ||||||||

|

BUSINESS SEGMENT INFORMATION (continued) |

||||||||

|

(Amounts in thousands) |

||||||||

|

(unaudited) |

||||||||

| Three Months Ended March 31, | ||||||||

| Reconciliation to Income (Loss) before Income Taxes | 2013 | 2012 | ||||||

| Income from segment operations | $ | 3,097 | $ | 1,305 | ||||

| Unallocated corporate expenses | (13,574 | ) | (11,100 | ) | ||||

| Interest expense | (11,214 | ) | (9,553 | ) | ||||

| Foreign currency transaction (loss) gain | (713 | ) | 950 | |||||

| Unrealized loss on warrants | (23,645 | ) | (651 | ) | ||||

| Gain on extinguishment of debt | — | 11,588 | ||||||

| Other income (expense) | 5 | (128 | ) | |||||

| Consolidated loss before income taxes | $ | (46,044 | ) | $ | (7,589 | ) | ||

| Three Months Ended March 31, | |||||||

| Net sales to external customers | 2013 | 2012 | |||||

| U.S. Wholesale | |||||||

| Wholesale | $ | 34,708 | $ | 33,920 | |||

| Online consumer | 9,118 | 7,415 | |||||

| Total | $ | 43,826 | $ | 41,335 | |||

| U.S. Retail | $ | 44,344 | $ | 42,609 | |||

| Canada | |||||||

| Wholesale | $ | 2,579 | $ | 2,855 | |||

| Retail | 9,112 | 9,920 | |||||

| Online consumer | 666 | 563 | |||||

| Total | $ | 12,357 | $ | 13,338 | |||

| International | |||||||

| Wholesale | $ | 1,941 | $ | 2,222 | |||

| Retail | 30,452 | 28,703 | |||||

| Online consumer | 5,140 | 4,453 | |||||

| Total | $ | 37,533 | $ | 35,378 | |||

| Consolidated | |||||||

| Wholesale | $ | 39,228 | $ | 38,997 | |||

| Retail | 83,908 | 81,232 | |||||

| Online consumer | 14,924 | 12,431 | |||||

| Total | $ | 138,060 | $ | 132,660 | |||

Table A

American Apparel, Inc. and Subsidiaries

Calculation

and Reconciliation of Consolidated Adjusted EBITDA

(Amounts in

thousands)

(unaudited)

In addition to its GAAP results, American Apparel considers non-GAAP measures of its performance. Adjusted EBITDA, as defined below, is an important supplemental financial measure of American Apparel's performance that is not required by, or presented in accordance with, GAAP. EBITDA represents net income (loss) before income taxes, interest expense and depreciation and amortization. Consolidated Adjusted EBITDA represents EBITDA further adjusted for other expense (income), foreign currency loss (gain), retail store impairment, and share based compensation expense. American Apparel's management uses Adjusted EBITDA as a financial measure to assess the ability of its assets to generate cash sufficient to pay interest on its indebtedness, meet capital expenditure and working capital requirements, pay taxes, and otherwise meet its obligations as they become due. American Apparel's management believes that the presentation of Adjusted EBITDA provides useful information regarding American Apparel's results of operations because they assist in analyzing and benchmarking the performance and value of American Apparel's business. American Apparel believes that Adjusted EBITDA is useful to stockholders as a measure of comparative operating performance, as it is less susceptible to variances in actual performance resulting from depreciation and amortization and more reflective of changes in pricing decisions, cost controls and other factors that affect operating performance.

Adjusted EBITDA also is used by American Apparel's management for multiple purposes, including:

- to calculate and support various coverage ratios with American Apparel's lenders

- to allow lenders to calculate total proceeds they are willing to loan to American Apparel based on its relative strength compared to its competitors

- to more accurately compare American Apparel's operating performance from period to period and company to company by eliminating differences caused by variations in capital structures (which affect relative interest expense), tax positions and amortization of intangibles.

In addition, Adjusted EBITDA is an important valuation tool used by potential investors when assessing the relative performance of American Apparel in comparison to other companies in the same industry. Although American Apparel uses Adjusted EBITDA as a financial measure to assess the performance of its business, there are material limitations to using a measure such as Adjusted EBITDA, including the difficulty associated with using it as the sole measure to compare the results of one company to another and the inability to analyze significant items that directly affect a company's net income (loss) or operating income because it does not include certain material costs, such as interest and taxes, necessary to operate its business. In addition, American Apparel's calculation of Adjusted EBITDA may not be consistent with similarly titled measures of other companies and should be viewed in conjunction with measures that are computed in accordance with GAAP. American Apparel's management compensates for these limitations in considering Adjusted EBITDA in conjunction with its analysis of other GAAP financial measures, such as net income (loss).

|

Table A (continued) |

||||||||

| American Apparel, Inc. and Subsidiaries | ||||||||

| Calculation and Reconciliation of Consolidated Adjusted EBITDA | ||||||||

|

(Amounts in thousands) |

||||||||

|

(unaudited) |

||||||||

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Net Loss | $ | (46,511 | ) | $ | (7,891 | ) | ||

| Income tax provision | 467 | 302 | ||||||

| Interest expense | 11,214 | 9,553 | ||||||

| Depreciation and amortization | 6,031 | 5,852 | ||||||

| Unrealized loss on change in fair value of warrants | 23,645 | 651 | ||||||

| Unrealized gain on extinguishment of debt | — | (11,588 | ) | |||||

| Share-based compensation expense | 3,547 | 1,842 | ||||||

| Foreign currency transaction loss (gain) | 713 | (950 | ) | |||||

| Retail store impairment | 78 | — | ||||||

| Other adjustments | 123 | 128 | ||||||

| Consolidated Adjusted EBITDA | $ | (693 | ) | $ | (2,101 | ) | ||