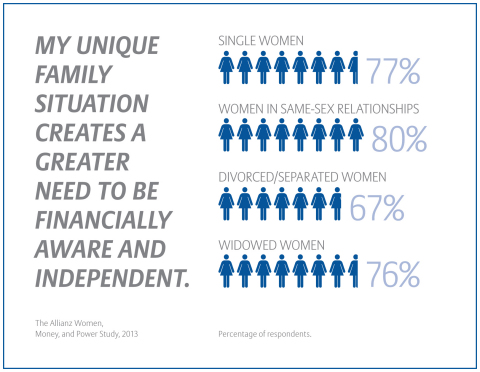

MINNEAPOLIS--(BUSINESS WIRE)--Because the so-called traditional family of mom/dad/kids is no longer a reflection of today’s modern family, women today say they face more pressure to attain financial independence, according to the 2013 Women, Money & Power Study* from Allianz Life Insurance Company of North America (Allianz Life). Sixty-seven percent of women in today’s modern family – including single moms, divorced, widowed, and same sex couples – say that their family situation creates a “whole new level of need to be financially aware and independent.” Similarly, 59% of respondents believe their unique family structure has made them become “more active and involved in financial planning.”

The 2013 study, conducted with more than 2,000 women ages 25-75 with a minimum household income of $30,000 a year, found that married women are now the minority group in terms of current relationship status at 39% of respondents. The majority of respondents (82%) identified themselves as women who are currently or have been divorced (32%), are currently single (24%), are currently partnered/not married (17%) and are currently or have been widowed (9%).

“New social structures are increasingly placing women in roles where they need to take control of not only their own financial security, but also that of their family,” said Katie Libbe, vice president of Consumer Insights for Allianz Life. “We found women that are part of the new modern family are feeling a great deal of pressure to be more engaged with financial planning, so our industry needs to step up and help them feel more confident about their financial future.”

Currently, only 38% of women in the survey noted they work with a financial professional. Among members of the modern family, widowed women were the highest percentage working with financial professionals at 51%, followed by divorced women at 42%, women in same-sex relationships at 42% and single moms at only 33%.

Single Moms and Same-Sex Couples Feel Greatest Pressure

Single parenthood seems to have the strongest effect on women’s financial outlook among members of the modern family. The burden of kids for never married single moms is massive, with 92% saying their family situation “creates a whole new level of need to be financially aware and independent.” Although 77% said that being a single mom has made them become “more active and involved in financial planning,” about one half (52%) said they believe that between raising kids and caring for families, “women feel too busy to handle financial planning.” This is significant as 29% of single, un-partnered women have children under 18 years old at home and 74% of these women are working full-time, outside the home.

Another group that demonstrated a keen understanding of how their unique family situation is impacting their need for financial awareness and planning was same-sex couples. More than three quarters of same-sex couple respondents (80%) said that being in a same-sex relationship “creates a whole new level of need to be financially aware and independent” with only 19% of them believing their situation allows them to “put off any serious thinking about financial planning,” the lowest response among relationship status categories.

Same-sex couples also appear to have healthier relationships when it comes to money. When asked if they have a secret stash of money their partner/spouse doesn’t know about, only 8% of same-sex respondents agreed, half the amount that responded affirmatively for married (16%) and partnered (19%) respondents.

Divorce and Widowhood Spur Financial Crisis

The study found that divorce remains a major factor in how women view money. Nearly half (48%) of divorced respondents said that divorce plunged them into a financial crisis. In addition, two thirds (64%) noted that divorce made them realize how important it is to always be financially aware and independent and 45% said their divorce was a real wake-up call for them financially.

Widowhood tells an even stronger version of the same story, with a full 50% of widowed respondents saying that becoming a widow created a financial crisis for them. More than eight in ten (84%) noted becoming a widow made them realize how important it is to always be financially aware and independent and 61% said losing their husband was a real wake-up call for them financially.

Today’s Modern Family Looks Different

The 2013 Women, Money & Power Study found the majority of women have at least one “non-traditional” element representing their family. Some characteristics of the modern family picture include:

- About 17% of all women have chosen to live with their partners (non-married);

- Twenty-seven percent of currently married women have been divorced;

- Of the partnered (non-married) women, 33 percent are in a same-sex couple;

- One in five women with children (21%) have adult kids (18+) living at home, with that percentage rising to over a third (36%) among widows;

- Forty-two percent of women who have been divorced at some point, never remarried or partnered.

About Allianz Life

Allianz Life Insurance Company of North America, one of FORTUNE’s 100 Best Companies to Work For in 2013, has been keeping its promises since 1896. Today, it carries on that tradition, helping Americans achieve their retirement income and protection goals with a variety of annuities and life insurance products. As a leading provider of fixed index annuities, Allianz Life is part of Allianz SE, a global leader in the financial services industry with 142,000 employees worldwide. More than 78 million private and corporate customers rely on Allianz knowledge, global reach, and capital strength to help them make the most of financial opportunities.

*The 2013 Allianz Life Women, Money & Power Study was conducted by Larson Research + Strategy in December 2012 with more than 2,000 women, ages 25-75, with household income of $30,000/year or higher. The results presented represent the percentage of the women who responded to each respective question or set of questions.