NAPLES, Fla.--(BUSINESS WIRE)--A global fraud study of more than 6,100 consumers across 20 countries revealed that one in four consumers is a victim of card fraud in the last five years. The study, conducted by ACI Worldwide (NASDAQ: ACIW) and Aite Group, also highlighted that nearly 25 percent of consumers changed financial institutions due to dissatisfaction after experiencing fraud.

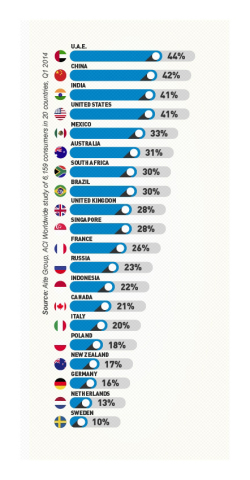

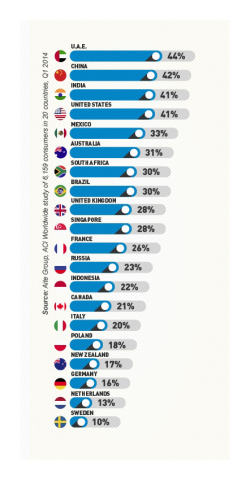

Card fraud is comprised of unauthorized activity on three types of payment cards—debit, credit and prepaid. Cardholders experience fraud at very different rates around the globe, and each type of card has unique fraud challenges. The U.A.E. has the highest rate of fraud overall at 44 percent, followed by China at 42 percent and India and the United States at 41 percent each.

- 63 percent of global consumers (respondents) who have experienced fraud are more likely to use their cards less

- 50 percent exhibit at least one risky behavior, which puts them at higher risk of financial fraud

- 55 percent are “very concerned” about reclaiming financial identity if they fall victim to identity theft

- More than 1 in 10 have experienced fraud multiple times during the past five years

“Given this latest data, financial institutions have their work cut out for them, both in terms of educational and preventative measures,” said Shirley Inscoe, senior analyst, Aite Group. “Consumers lack confidence in their bank’s ability to protect them from fraud, so banks must remain vigilant in their fraud migration efforts or face increased customer attrition.”

Confidence wavering in the face of fraud

With 1,367

confirmed data breaches1 in 2013 alone, the security of the

financial services value chain is top-of-mind. As organized fraud rings

relentlessly develop new methods of stealing funds and identities,

consumers are increasingly losing confidence that there is anything that

can be done to reverse this downward spiral.

- 23 percent changed financial institutions due to dissatisfaction after experiencing fraud

- Nearly 2 in 10 lack confidence that their financial institution can protect them against fraud

- 43 percent who received replacement cards as a result of data breach or fraudulent activity use their new card less than they used their original

“Consumers are increasingly concerned about fraud, and are losing confidence on a variety of levels,” said Mike Braatz, senior vice president, Payments Risk Management Solutions, ACI Worldwide. “They are unsure that their financial institutions can protect them against fraud; they use replacement cards less often due to a loss of confidence in the card or card issuer, after experiencing fraud; and post-fraud, they often change providers or their cards go to back of wallet. This has immediate and long-term implications on customer loyalty, revenue and fee income.”

A detailed analysis of the 2014 Global Consumer Fraud Report will be presented via webinar on June 26 at 10:00am ET. To register for the webinar and receive a complimentary copy of the two-part report, please click here or visit www.aciworldwide.com/2014fraudsurvey.

Survey Methodology

ACI Worldwide conducted online

quantitative market research via a March 2014 survey of 6,159 consumers;

approximately 300 consumers, divided equally between men and women,

participated in each of the 20 countries. Of the total, 6,041 own one or

more type of payment card (i.e., credit card, debit card, prepaid card).

The study was conducted in a total of 20 countries in the following

regions:

- The Americas (North and South America): Brazil, Canada, Mexico, and the United States

- EMEA (Europe, the Middle East, and Africa): France, Germany, Italy, the Netherlands, Poland, Russia, South Africa, Sweden, the United Arab Emirates, and the United Kingdom

- Asia-Pacific: Australia, China, India, Indonesia, New Zealand, and Singapore

About ACI Worldwide

ACI Worldwide, the Universal

Payments company, powers electronic payments and banking for more

than 5,000 financial institutions, retailers, billers and processors

around the world. ACI software processes $13 trillion each day in

payments and securities transactions for more than 250 of the leading

global retailers, and 21 of the world’s 25 largest banks. Through our

comprehensive suite of software products and hosted services, we deliver

a broad range of solutions for payment processing; card and merchant

management; online

banking; mobile, branch and voice banking; fraud

detection; trade finance; and electronic

bill presentment and payment. To learn more about ACI, please visit www.aciworldwide.com.

You can also find us on Twitter @ACI_Worldwide.

© Copyright ACI Worldwide, Inc. 2014.

ACI, ACI Payment Systems, the

ACI logo and all ACI product names are trademarks or registered

trademarks of ACI Worldwide, Inc., or one of its subsidiaries, in the

United States, other countries or both. Other parties’ trademarks

referenced are the property of their respective owners.

Product roadmaps are for informational purposes only and may not be incorporated into a contract or agreement. The development release and timing of future product releases remains at ACI’s sole discretion. ACI is providing the following information in accordance with ACI's standard product communication policies. Any resulting features, functionality, and enhancements or timing of release of such features, functionality, and enhancements are at the sole discretion of ACI and may be modified without notice. All product roadmap or other similar information does not represent a commitment to deliver any material, code, or functionality, and should not be relied upon in making a purchasing decision.

1. Verizon, 2014 Data Breach Investigations Report, http://www.verizonenterprise.com/DBIR/2014/