ATLANTA--(BUSINESS WIRE)--Nine in 10 life insurance underwriters believe e-cigarette users should be considered smokers, according to a survey by Munich American Reassurance Company, a unit of Munich Re, one of the world’s leading reinsurers. The survey of life insurance underwriters was conducted at the Association of Home Office Underwriters (AHOU) 13th Annual Conference, held May 4-7, 2014, in Indianapolis.

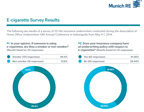

Among the more than 150 underwriters surveyed, nearly three-quarters (74 percent) categorize e-cigarettes as a tobacco product, followed by a quit-smoking aid (30 percent), drug delivery device (20 percent), and gateway drug (19 percent).

Additionally, 82 percent of life insurance companies with an underwriting policy in place for e-cigarettes classify them as tobacco products. Similarly, 76 percent of underwriters who work for an insurance company currently without a specific policy for e-cigarettes believe they should be treated as tobacco products.

“At the moment, there is no way to distinguish an e-cigarette user from a tobacco smoker via cotinine screening, a routine test for most insurance applicants,” said Bill Moore, Vice President of Underwriting and Medical for Munich American Reassurance Company. “While the long-term health risks associated with e-cigarettes remain unclear, most insurers are erring on the side of caution in order to appropriately price and manage risk.”

Underwriting Policies for E-Cigarettes

Of the life insurance companies represented, only 41 percent currently have an underwriting policy in place for e-cigarettes. For those respondents whose company have not yet instituted a policy, 60 percent expect their respective employer to develop one within the next 12 to 36 months, as e-cigarettes continue to gain popularity. Further, 29 percent believe it will take longer than 36 months to develop such a policy and only 11 percent feel it will take less than 12 months.

“As the e-cigarette industry continues to grow, it poses a number of major questions for the insurance industry, many of which do not have black and white answers,” said Moore. “Over the last several years, many life insurance companies have begun to adopt underwriting policies with respect to e-cigarettes, but as illustrated from our survey data, those companies are still in the minority.”

Methodology

The survey was conducted on-site at the Association of Home Office Underwriters (AHOU) 13th Annual Conference in Indianapolis from May 4-7, 2014, and is intended to represent the views of 150 underwriter attendees, primarily from life insurance companies, who participated in the in-person interviews.

Munich American Reassurance Company, founded in 1959, is one of the largest reinsurers in the U.S. offering life and disability reinsurance to insurance companies throughout the United States. The company also writes group, credit and other reinsurance products. Headquartered in Atlanta, with an office in Chicago, Munich American is licensed, accredited or authorized in all fifty states; Washington, D.C.; Guam; and Puerto Rico.

Munich Re stands for exceptional solution-based expertise, consistent risk management, financial stability and client proximity. This is how Munich Re creates value for clients, shareholders and staff. In the financial year 2013, the Group – which combines primary insurance and reinsurance under one roof – achieved a profit of €3.3bn on premium income of over €51bn. It operates in all lines of insurance, with almost 45,000 employees throughout the world. With premium income of around €28bn from reinsurance alone, it is one of the world’s leading reinsurers. Especially when clients require solutions for complex risks, Munich Re is a much sought-after risk carrier. Its primary insurance operations are concentrated mainly in the ERGO Insurance Group, one of the major insurance groups in Germany and Europe. ERGO is represented in over 30 countries worldwide and offers a comprehensive range of insurances, provision products and services. In 2013, ERGO posted premium income of €18bn. In international healthcare business, Munich Re pools its insurance and reinsurance operations, as well as related services, under the Munich Health brand. Munich Re’s global investments amounting to €209bn are managed by MEAG, which also makes its competence available to private and institutional investors outside the Group.

Disclaimer

This press release contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of our Company. The Company assumes no liability to update these forward-looking statements or to conform them to future events or developments.