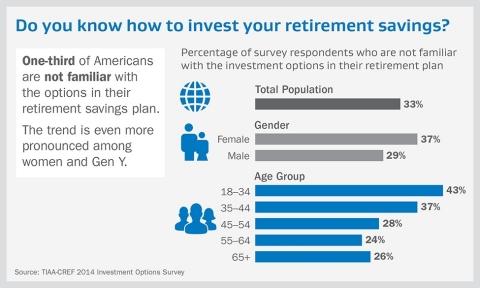

NEW YORK--(BUSINESS WIRE)--One-third (33 percent) of Americans who participate in an employer-sponsored retirement plan say they are not familiar with the investment options in their plan, according to a survey released today by TIAA-CREF. The research also shows a pronounced difference between male and female respondents, with 37 percent of women stating they are not familiar compared to 29 percent of men. Generational differences also are apparent, with 43 percent of Gen Y respondents stating they are not familiar with their plan options.

The survey was conducted by an independent research firm and polled a random sample of more than 1,000 adults nationwide on their retirement plans.

Understanding plan options tied to more saving

Most experts recommend saving at least 10-15 percent of annual income for retirement, and people who are familiar with their investment options are almost twice as likely to follow this guidance: 39 percent of people who are familiar with their options save more than 10 percent of their annual income for retirement, compared to 21 percent of people who are not familiar with their options. But there is still a tremendous need for communication, education and advice to increase that 39% figure.

“Everyone wants to have a comfortable and secure retirement. To get there, it’s critically important for people to understand all of the investment options in their retirement plan, and how those options will translate to income in their retirement,” explains Teresa Hassara, executive vice president of TIAA-CREF’s Institutional Business. “This research shows that plan sponsors—supported by their plan providers—must continue to engage and educate employees about these options and how they work, so that employees are not leaving their financial well-being to wishful thinking and guesswork.”

Making the right investment decision for you

Twenty-eight percent of survey respondents stated they do not understand all of their choices for how to invest their money in their retirement plan. More than one-third (36 percent) feel they have either too many or too few investment choices.

The number of investment choices in a retirement plan makes a critical difference in employees’ confidence regarding the adequacy of their retirement savings. Those who feel they have the wrong amount of investment choices are far more likely to be concerned about running out of money in retirement. Nearly two-thirds (65 percent) of those who think they have too many investment choices are very or somewhat concerned about running out of money in retirement, as are 55 percent of those who don’t think they have enough choices. By contrast, 40 percent of respondents who feel they have the right number of investment choices are “not at all concerned” about running out of money in retirement.

Plan sponsors can be the reliable resource employees seek to help them navigate their investment options. The survey also revealed that 81 percent of respondents trust financial information offered by their employer, a greater percentage than those who trusted financial information offered by a traditional financial institution, such as a bank or retirement plan provider (69 percent), or their family (63 percent).

“Plan sponsors can play a really powerful role in helping employees understand their retirement plans because employees trust them,” Hassara said. “Sponsors can encourage employees to take action through targeted communication, education, and advice that resonates with employees based on where they are in their lives. Our experience shows this approach can make a big difference. Individuals who received one-on-one advice via employer-sponsored TIAA-CREF plans have high confidence levels in their retirement savings.”

In addition to communications, advice, and education, plan sponsors can provide investment options that address employees’ concerns. Lifecycle funds, for example, are a common investment option that provide a simple solution for individuals who feel overwhelmed by choices, while offering a broad, diversified set of investments to those who want to ensure they are getting the most from their plans. These age-appropriate, professionally managed mutual funds shift their asset allocations within the fund automatically over time to become more conservative as retirement nears, yet provide the equity exposure necessary to portfolios as people live longer.

Lifecycle funds often can relieve employees of the need to make complicated investment, portfolio allocation and rebalancing decisions, making them appropriate for individuals at every life stage. They are also an excellent default option for participants who join the plan through auto-enrollment, though sponsors should consistently try to engage these participants as well.

To help employees select their investments best suited for their retirement goals, TIAA-CREF has been providing independent, personalized retirement planning advice since 2005 at no additional cost to clients. The advice offering includes special resources for women, such as the Woman to Woman Financial Empowerment Series of events, workshops and webinars, as well as a dedicated online community. TIAA-CREF also offers individuals online budgeting and savings calculators to help them reach their financial goals, including the TIAA-CREF Savings Simplifier iPhone App.

“It is important to stress that it is not just up to the plan sponsor to explain plan options; individuals need to do their part too,” said Hassara. “The best retirement plan results occur when all parties – employer, employee and plan provider – are actively engaged in planning for the future.”

For more information about the survey, read the executive summary. For more information on TIAA-CREF’s Advice and Guidance offerings, visit our Advice and Guidance Center, which includes information tailored for women, Gen Yers and all plan participants.

About TIAA-CREF

TIAA-CREF (www.tiaa-cref.org) is a national financial services organization with $564 billion in assets under management (as of 12/31/2013) and is the leading provider of retirement services in the academic, research, medical and cultural fields.

TIAA-CREF products may be subject to market and other risk factors. See the applicable product literature, or visit www.tiaa-cref.org for details.

You should consider the investment objectives, risks, charges and expenses carefully before investing. Please call 877-518-9161 or log on to www.tiaa-cref.org for product and fund prospectuses that contain this and other information. Please read the prospectuses carefully before investing.

Diversification is a technique to help reduce risk. There is no guarantee that diversification will protect against a loss of income.

Please note, the target date for lifecycle funds is the approximate date when investors plan to start withdrawing their money. The principal value of the fund(s) is not guaranteed at any time, including at the target date.

TIAA-CREF Individual & Institutional Services, LLC and Teachers Personal Investors Services, Inc., members FINRA, distribute securities products.

©2014 Teachers Insurance and Annuity Association-College Retirement Equities Fund, New York, NY 10017

C15380

Survey Methodology

The survey was conducted by KRC Research by phone among a national random sample of 1,017 adults, age 18 years and older, between January 3-5, 2014. The margin of error for the entire sample is plus or minus 3.1 percentage points.