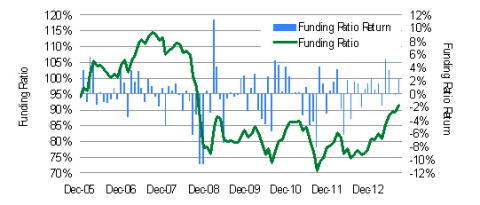

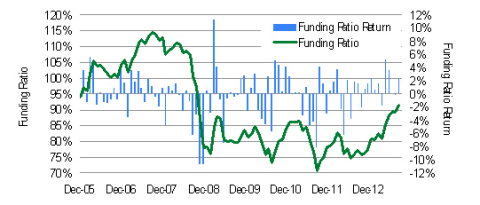

CHICAGO--(BUSINESS WIRE)--The funding ratio of the typical US pension plan increased again during the third quarter of 2013, rising by more than three percentage points to 91.4%, according to the UBS Global Asset Management US Pension Fund Fitness Tracker. Combined with gains in the first half of the year, the estimated year-to-date total improvement in funding ratio is close to 14 percentage points.

The improvement in funding ratio for the third quarter was driven primarily by a 3.6% increase in pension asset values. Liability values are estimated to have decreased by 0.2%, based on the average corporate plan’s reported asset allocation weightings from the UBS Global Asset Management Pension 500 Database and publicly available benchmark information.

The US equity market had a solid quarter, as the S&P 500 Index earned a total return of 5.2%. Through mid-September, there was a strong swing upward amid signs of a gradually improving economy. However, a selloff occurred late in the quarter, as the US Federal Reserve (Fed) surprised the market by delaying the reduction of its quantitative easing (QE) program due to continued concerns about the strength of the US economy. In Europe, no further government bailouts and signs of actual growth triggered a strong rally in equities. In dollar terms, the Euro Stoxx Index was up 16.4%. The slump in emerging markets appears to have subsided as well, as the MSCI Emerging Markets Index was up 5.9% in dollar terms. In particular, investors appeared less concerned about the outlook for China and other emerging markets.

Overall, the yield on 10-year US Treasury bonds increased by 12 basis points (bps), ending at 2.61%, after peaking at 2.98% during the quarter. The yield on 30-year US Treasury Notes increased by 18 bps, ending at 3.68%. High-quality corporate bond credit spreads, as measured by the Barclays Capital Long Credit A+ option-adjusted spread, ended the quarter 11 bps tighter. As a result, pension discount rates (which are based on the yield of high-quality investment grade corporate bonds) increased marginally, causing liabilities for a typical pension plan to end the quarter basically unchanged. (Please see disclosures for assumptions and methodology.)

Disclosures and methodology

Funding ratio

Funding ratios measure a pension fund’s ability to meet future payout obligations to plan participants. The main factors impacting the funding ratio of a typical US defined benefit plan are equity market returns, which grow (or shrink) the asset pool from which plan participants’ benefits are paid, and liability returns, which move inversely to interest rates.

Liability indices: Methodology

Pension Protection Act (PPA) liability returns are approximated by the Barclays Capital US Long Credit A-AAA Index. This index broadly reflects the duration and credit characteristics of the PPA discount curve that is used to discount expected pension benefit payments for US defined benefit pension plans.

Asset index: Methodology

UBS Global Asset Management approximates the return for the ”typical” US defined benefit plan using the reported asset allocation of the UBS Global Asset Management Pension 500 Database. The series is constructed using the aggregate asset allocation weightings and publicly available benchmark information, with geometrically linked monthly total returns.

Pension Fund Fitness Tracker: Methodology

The US Pension Fund Fitness Tracker is the ratio of the asset index over the liability index. Assuming all other factors remain constant, it combines asset and liability returns and measures the impact of a “typical” investment strategy on the funding ratio of a model defined benefit plan in the US due to interest rollup, change in interest rates and typical asset performance, but excludes unique plan factors, such as service cost and benefit payments.

The UBS Global Asset Management Pension 500 Database

The UBS Global Asset Management Pension 500 Database is a proprietary database that is based on the analysis of 500 public companies sponsoring large defined benefit plans. The information was extracted from the companies’ 10-K statements. The study may include figures for companies’ nonqualified and foreign plans, both of which are not subject to ERISA.

The aggregate asset allocation is based on an equally weighted average of the 500 companies included in the database. The aggregate asset allocation includes equities, fixed income, hedge funds, private equity, real estate and cash.