CHICAGO--(BUSINESS WIRE)--Coeur Mining, Inc.’s (“Coeur” or the “Company”) (NYSE: CDE)(TSX: CDM) President and Chief Executive Officer, Mitchell J. Krebs, and other members of senior management will present at the Denver Gold Forum at the Hyatt Regency Denver at 2:50 p.m. MST (4:50 p.m. EST) on September 24, 2013. The presentation will be webcast on the Company’s website at www.coeur.com and a PDF of the slide presentation is posted there as well. The Denver Gold Forum is an invitation-only investment conference for fund and portfolio managers, institutional investors and analysts and executive management of the world’s leading mining companies.

In addition to the three-year operational outlook, highlights of the Company’s presentation include:

- Recent increases in reserves at Rochester and plans to expand capacity to further extend the mine’s life

- An overview of the La Preciosa silver and gold project located in Durango, Mexico

- A summary of ongoing cost reduction initiatives

- Highlights of the Company’s ongoing cash flow protection program

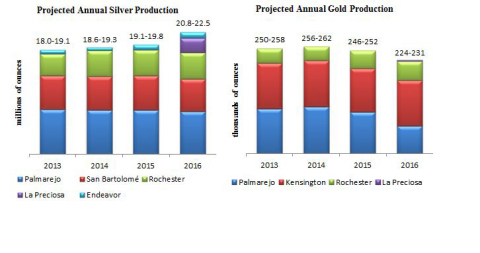

Coeur has narrowed its full-year 2013 projected consolidated silver and gold production within the original guidance range as shown in Tables 1 and 2. In addition, Coeur is providing a mine-by-mine outlook of key operational metrics, including expected production through 2016. This outlook indicates modest growth in both silver and gold ounces compared to 2012. The forecast incorporates current mine plans, which are based solely on reserves, other than La Preciosa’s expected 2016 production, and does not take into account any drilling data from the Company’s 2013 $37 million exploration program. These plans will continue to evolve and will be updated as additional drill data is incorporated into the Company’s resource models.

|

Table 2: Production Outlook Detail1 |

|||||||||||||||||

|

(silver ounces in millions, gold ounces in thousands) |

|||||||||||||||||

|

|

2013 | 2014 | 2015 | 2016 | |||||||||||||

| Silver | Gold | Silver | Gold | Silver | Gold | Silver | Gold | ||||||||||

| Palmarejo | 7.7 - 8.3 | 108 - 110 | 7.7 - 7.9 | 113 - 115 | 7.8 - 8.0 | 100 - 102 | 7.5 - 7.7 | 66 - 68 | |||||||||

| San Bartolomé | 5.9 - 6.0 | - | 5.9 - 6.1 | - | 5.9 - 6.1 | - | 5.7 - 5.9 | - | |||||||||

| Rochester | 3.7 - 4.0 | 34 - 36 | 4.5 - 4.7 | 33 - 35 | 4.5 - 4.7 | 42 - 44 | 4.6 - 4.8 | 45 - 47 | |||||||||

| Kensington |

|

108 - 112 | - | 110 – 112 | - | 104 - 106 | - | 110 – 112 | |||||||||

| Endeavor2 | 0.7 - 0.8 | - | 0.5 - 0.6 | - | 0.9 - 1.0 | - | 1.0 - 1.1 | - | |||||||||

| La Preciosa | - | - | - | - | - | - | 2.0 - 3.0 | 3 - 4 | |||||||||

| Total | 18.0 - 19.1 | 250 - 258 | 18.6 - 19.3 | 256 - 262 | 19.1 - 19.8 | 246 - 252 | 20.8 - 22.5 | 224 - 231 | |||||||||

|

1. |

See Cautionary Statements below and the Technical Reports for each of Coeur’s properties available at www.sedar.com, including the assumptions and qualifications contained therein. |

||||||||||||||||

|

2. |

2014-2016 production forecasts for Endeavor, which Coeur does not operate, are as contained in the most recent Technical Report for Endeavor filed on SEDAR at www.sedar.com. |

||||||||||||||||

Mitchell J. Krebs, Coeur’s President and Chief Executive Officer, said, “Operating consistently and efficiently represent the basic foundation of any successful mining company. This three-year outlook reflects progress we are making in our ability to plan and execute against that plan. It also demonstrates the strong and sustainable platform we believe we now have in place, which provides us with numerous opportunities to enhance revenues, reduce costs, and fund organic and external growth projects that meet our return criteria. Based on today’s silver and gold prices, we expect to generate significant after-tax operating cash flow and positive net cash flow through 2016.”

|

Table 3: Production Detail – Palmarejo, Mexico |

|||||||

| (tons and $ in millions) | 2014 | 2015 | 2016 | ||||

| Open-Pit Mined Ore, tons | 1.3 | 1.3 | 1.5 | ||||

| Underground Mined Ore, tons | 1.0 | 1.0 | 0.7 | ||||

| Milled Ore, tons | 2.3 | 2.3 | 2.3 | ||||

| Open-Pit Silver Grade, oz/ton | 3.9 | 3.8 | 4.0 | ||||

| Underground Silver Grade, oz/ton | 4.8 | 4.9 | 4.4 | ||||

| Open-Pit Gold Grade, oz/ton | 0.03 | 0.03 | 0.02 | ||||

| Underground Gold Grade, oz/ton | 0.09 | 0.08 | 0.07 | ||||

| Silver Recovery | 81% | 83% | 83% | ||||

| Gold Recovery | 84% | 85% | 85% | ||||

Palmarejo Highlights:

- Revenue enhancement projects are expected to enable higher recovery rates for both silver and gold compared to recent quarters.

- Drilling began at the Chapotillo and Tucson extensions in 2013, with encouraging early results suggesting the potential to extend the life of the open pit at Palmarejo beyond 2016.

- Guadalupe is expected to contribute approximately 1 million ounces of silver and 15,000 ounces of gold in 2014, the first year of production.

- After the completion of the development of the Guadalupe ore body, it is expected that Palmarejo will have the flexibility to mine from multiple underground and open pit deposits.

- The Las Animas open pit (located at the south end of Guadalupe) is expected to begin production in 2016.

- Early indications from drilling at El Salto (located adjacent to Guadalupe) indicate additional expansion opportunity for the Las Animas near-surface deposit.

- The La Patria gold-silver, near-surface deposit located approximately seven kilometers south-southwest of Palmarejo represents a potential source of production beyond 2016. La Patria holds 15.9 million short tons containing 9.8 million ounces of indicated silver resources (average grade 0.56 oz/ton) and 491,000 ounces of indicated gold resources (average grade 0.03 oz/ton) in addition to 6.7 million short tons containing 2.5 million ounces of inferred silver resources (average grade 0.33 oz/ton) and 178,000 ounces of inferred gold resources (average grade 0.02 oz/ton) effective December 31, 2012. There are no measured resources at La Patria.

|

Table 4: Production Detail – San Bartolomé, Bolivia |

|||||||

| (tons and $ in millions) | 2014 | 2015 | 2016 | ||||

| Mined Ore, tons | 3.4 | 3.4 | 3.4 | ||||

| Processed Ore, tons | 2.0 | 2.0 | 2.0 | ||||

| Silver Grade, oz/ton | 3.7 | 3.8 | 3.6 | ||||

| Silver Recovery | 83% | 83% | 83% | ||||

San Bartolomé Highlights:

- The forecast indicates continued production consistency at San Bartolomé through 2016, with little variance expected in ounces produced, grade, or recovery rate in the 2014-2016 forecast.

- Completion of the process plant expansion in 2013 is projected to increase throughput capacity 10%-15%, which should enable San Bartolomé to maintain silver ounces produced despite expected lower grades compared to 2013.

|

Table 5: Production Detail – Rochester, Nevada |

|||||||

| (tons and $ in millions) | 2014 | 2015 | 2016 | ||||

| Open-Pit Mined Ore, tons | 13.8 | 15.9 | 15.9 | ||||

| Ore on Leach Pads, tons | 13.1 | 15.3 | 16.1 | ||||

| Open-Pit Silver Grade, oz/ton | 0.58 | 0.43 | 0.43 | ||||

| Stockpile Silver Grade, oz/ton | 0.48 | 0.49 | 0.50 | ||||

| Open-Pit Gold Grade, oz/ton | 0.004 | 0.005 | 0.006 | ||||

| Stockpile Gold Grade, oz/ton | 0.002 | 0.003 | 0.003 | ||||

| Silver Recovery | 62% | 61% |

63% |

||||

| Gold Recovery | 85% | 86% | 90% | ||||

Rochester Highlights:

- The Company anticipates increasing annual crushing rates at Rochester to approximately 18.5 million tons beyond 2017.

- Recent investments in existing heap leach pads at Rochester have increased total capacity by 72 million tons, which Coeur expects will enable operations to continue into the second half of 2017.

- The Company is in the process of obtaining permits for 120 million tons of additional pad capacity, which are expected to be received by mid-2016. This expanded capacity is expected to further extend Rochester’s mine life based on existing reserves through at least 2023.

- The Company is also assessing the optimal scenario for a further expansion of Rochester, targeting opportunities to expand reserves from the Company’s measured and indicated resources totaling approximately 180 million tons.

|

Table 6: Production Detail – Kensington, Alaska |

|||||||

| (tons and $ in millions) | 2014 | 2015 | 2016 | ||||

| Mined Ore, tons | 0.62 | 0.62 | 0.62 | ||||

| Milled Ore, tons | 0.62 | 0.62 | 0.62 | ||||

| Gold Grade, oz/ton | 0.19 | 0.18 | 0.19 | ||||

| Gold Recovery | 95% | 95% | 95% | ||||

Kensington Highlights:

- The forecast demonstrates improved production consistency at Kensington through 2016 compared to recent quarters, with little variance expected in ounces produced, grade, or recovery rate.

- Recent encouraging exploration results are being pursued to expand the deposit and define new sources of proximal higher-grade mineralization

About Coeur

Coeur Mining, Inc. is the largest U.S.-based

primary silver producer and a growing gold producer. The Company has

four precious metals mines in the Americas generating strong production,

sales and cash flow. Coeur produces from its wholly owned operations:

the Palmarejo silver-gold mine in Mexico, the San Bartolomé silver mine

in Bolivia, the Rochester silver-gold mine in Nevada and the Kensington

gold mine in Alaska. The Company also has a non-operating interest in

the Endeavor mine in Australia. In addition, the Company has two

silver-gold feasibility stage projects – the La Preciosa project in

Mexico and the Joaquin project in Argentina. The Company also conducts

ongoing exploration activities in Mexico, Argentina, Nevada, Alaska and

Bolivia. The Company owns strategic investment positions in eight silver

and gold development companies with projects in North and South America.

Cautionary Statement

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding Coeur’s anticipated production levels and financial performance, initiatives to operate consistently and efficiently, enhance revenues, reduce costs, complete organic and external growth projects, expand capacity, increase reserve levels, expansion and development efforts, expectations as to recovery rates, metal grades, production consistency, receipt of permits, increased crushing rates and mine lives, and the ability to generate operating cash flow and after-tax net cash flow. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that permits necessary for the planned Rochester expansion may not be obtained, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of gold and silver ore reserves, changes that could result from Coeur's future acquisition of new mining properties or businesses, reliance on third parties to operate certain mines where Coeur owns silver production and reserves, the loss of any third-party smelter to which Coeur markets silver and gold, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Information included in this news release regarding the La Preciosa project is based on the results of a preliminary economic assessment (“PEA”). The PEA is preliminary in nature and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves and there is no certainty that the results reflected in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for minability, selectivity, mining loss and dilution. There is no certainty that the inferred mineral resources will be converted to the measured and indicated categories or that the measured and indicated mineral resources will be converted to the proven and probable mineral reserve categories. There are no mineral reserves at La Preciosa. The NI 43-101-compliant Technical Report, disclosing results of the PEA, is available on www.sedar.com.

Donald J. Birak, Coeur's Senior Vice President of Exploration and a qualified person under Canadian National Instrument 43-101, reviewed and approved the scientific and technical disclosures concerning Coeur's mineral projects contained herein. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, please see the Technical Reports for each of Coeur's properties as filed on SEDAR at www.sedar.com.

Cautionary Note to U.S. Investors-The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We may use certain terms in public disclosures, such as "measured," "indicated," "inferred” and “resources," that are recognized by Canadian regulations, but that SEC guidelines generally prohibit U.S. registered companies from including in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in our Form 10-K which may be secured from us, or from the SEC's website at http://www.sec.gov.