NEW YORK--(BUSINESS WIRE)--UBS Investment Bank announced that today is the first day of trading on the NYSE Arca® for the ETRACS Diversified High Income ETN (NYSE:DVHI). DVHI is linked to the performance of the NYSE® Diversified High Income Index (the “Index”).

|

DVHI Profile |

|||

| Underlying Index | NYSE® Diversified High Income Index | ||

| Index Yield* | 7.71% | ||

| Income Potential | Variable monthly coupon linked to the cash distributions, if any, of the 138 Index constituents, less investor fees and any withholding taxes | ||

*The Index Yield is calculated as of September 13, 2013 by the sponsor of the Index, NYSE Group, Inc. Because the Index Yield does not reflect investor fees or applicable withholding taxes, and the variable monthly coupon that may be paid by the ETN, if any, is subject to fees and withholding taxes, the yield on the ETNs will always be less than the Index Yield (and the total return on the ETNs will always be less than the total return on a hypothetical direct investment in the Index or Index constituents). Investors are not guaranteed any coupon or distribution amount under the ETN.

DVHI Offers Investors:

- Significant income potential in the form of a variable monthly coupon linked to the cash distributions, if any, on the Index constituents, less investor fees and any withholding taxes.

- Exposure to an index comprised of a diversified portfolio of 138 publicly-traded, income-producing securities.

- Diversification across geographic regions (e.g., emerging market bonds and international equities) and across asset classes and sectors (e.g., equities, fixed income, MLPs, BDCs, REITs, preferred stock, high yield bonds, etc.).

“Investors seeking high yields typically turn to investments in narrowly-focused asset classes or sectors,” said Paul Somma, Senior ETRACS Structurer. “DVHI's exposure to a multi-asset index provides investors with access to a diversified portfolio of income-producing assets in a single, transparent, exchange-traded security.”

About the NYSE® Diversified High Income Index

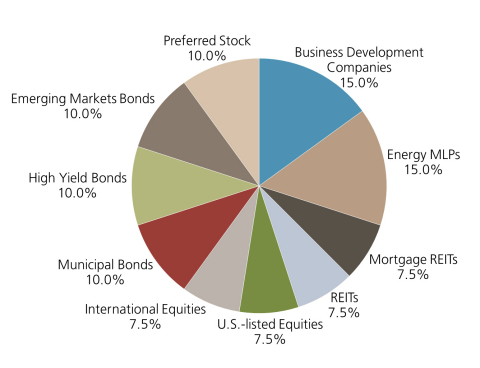

The NYSE® Diversified High Income Index (the “Index”) measures the performance of a diversified basket of 138 publicly-traded securities that historically pay significant dividends or distributions (referred to herein as “dividends”). According to the Index sponsor, NYSE Group, Inc., the Index’s features and construction seek to highlight income, while the diversification of the Index constituent sectors seeks to reduce price volatility. The Index methodology incorporates minimum free float market capitalization, as well as dividend yield, liquidity and asset class and sector weighting requirements. The Index is rebalanced quarterly to maintain the sector target weightings set forth in Table 1 below. The Index is a price return index (i.e., the reinvestment of dividends is not reflected in the Index; rather, any cash distributions on the Index constituents, less investor fees and any withholding taxes, are reflected in the variable monthly coupon that may be paid to investors of the ETN). The Index was created on August 20, 2013 and, therefore, has no performance history prior to that date.

|

Table 1 – Asset Classes, Sectors and Sector Target Weightings |

||||||||||

| Asset Class |

Asset Class |

Sector | Sector Securities |

Number of |

Sector Target |

|||||

| Equities | 60.00% |

Business |

Business |

15 | 15.00% | |||||

| Energy MLPs | Energy MLPs | 25 | 15.00% | |||||||

| Mortgage REITs | Mortgage REITs | 15 | 7.50% | |||||||

| REITs | REITs | 20 | 7.50% | |||||||

| U.S.-listed Equities | U.S.-listed Equities | 50 | 7.50% | |||||||

|

International |

International |

4 | 7.50% | |||||||

|

Fixed Income, |

40.00% | Municipal Bonds |

Municipal Bond |

3 | 10.00% | |||||

| High Yield Bonds |

High Yield Bond |

1 | 10.00% | |||||||

|

Emerging Markets |

Emerging Markets |

1 | 10.00% | |||||||

| Preferred Stock |

Preferred Stock |

4 | 10.00% | |||||||

|

Source: NYSE Group, Inc. |

||||||||||

|

Top 10 Index Constituents |

||||||

| Name | Ticker | Sector | % Weight | |||

| PowerShares Emerging Markets Sovereign Debt ETF | PCY | Emerging Markets Bonds | 9.97% | |||

| iShares iBoxx $ High Yield Corporate Bond ETF | HYG | High Yield Bonds | 9.93% | |||

| iShares US Preferred Stock ETF | PFF | Preferred Stock | 7.04% | |||

| Market Vectors High Yield Municipal Index ETF | HYD | Municipal Bonds | 4.94% | |||

| Ares Capital Corp | ARCC |

Business Development |

4.15% | |||

| Energy Transfer Partners LP | ETP | Energy MLPs | 4.00% | |||

| iShares International Select Dividend ETF | IDV | International Equities | 3.80% | |||

| PowerShares Insured National Municipal Bond ETF | PZA | Municipal Bonds | 3.74% | |||

| Prospect Capital Corp | PSEC |

Business Development |

2.66% | |||

| American Capital Agency Corp | AGNC | Mortgage REITs | 2.66% | |||

|

Source: NYSE Group, Inc., as of September 13, 2013 |

||||||

About ETRACS

For further information about ETRACS ETNs, go to www.etracs.com.

ETRACS ETNs are exchange-traded notes, an innovative class of investment products offering access to markets and strategies that may not be readily available to investors, and offer unique diversification opportunities in a number of different sectors. ETRACS ETNs may offer:

- Access to asset classes with historically low correlations to more traditional asset classes

- Convenience of an exchange-traded security

- Transparent exposure to a published index

ETRACS ETNs are senior unsecured notes issued by UBS AG, are traded on NYSE Arca®, and can be bought and sold through a broker or financial advisor. An investment in ETRACS ETNs involves risks including the risk of loss of some or all of the investor's principal, and is subject to the creditworthiness of UBS AG. You are not guaranteed any coupon or distribution amount under the ETNs. We urge you to read the more detailed explanation of risks described under "Risk Factors" in the prospectus supplement for the ETRACS ETNs in which you are interested.

This material is issued by UBS AG or an affiliate thereof ("UBS"). Products and services mentioned in this publication may not be available for residents of certain jurisdictions. Past performance is not necessarily indicative of future results. Please consult the restrictions relating to the product or service in question for further information. Activities with respect to US securities are conducted through UBS Securities LLC, a US broker/dealer. Member of SIPC (http://www.sipc.org/).

ETRACS ETNs are sold only in conjunction with the relevant offering materials. UBS has filed a registration statement (including a prospectus, as supplemented by a prospectus supplement for the offering of the ETRACS ETNs) with the Securities and Exchange Commission (the "SEC") for the offering to which this communication relates. Before you invest, you should read these documents and any other documents that UBS has filed with the SEC for more complete information about UBS and the offering to which this communication relates. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you can request the prospectus and the applicable prospectus supplement by calling toll-free (+1-877-387 2275). In the US, securities underwriting, trading and brokerage activities and M&A advisor activities are provided by UBS Securities LLC, a registered broker/dealer that is a wholly owned subsidiary of UBS AG, a member of the New York Stock Exchange and other principal exchanges, and a member of SIPC.

The NYSE® Diversified High Income Index is a service mark of NYSE Euronext or its affiliates (“NYSE Euronext”) and has been licensed for use by UBS AG in connection with the ETNs. The ETNs are not sponsored, endorsed, sold or promoted by NYSE Euronext. NYSE Euronext makes no representations or warranties regarding the ETNs or the ability of the Index to track the general stock market performance.

NYSE EURONEXT MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL NYSE EURONEXT HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

UBS specifically prohibits the redistribution or reproduction of this material in whole or in part without the prior written permission of UBS and UBS accepts no liability whatsoever for the actions of third parties in this respect. © UBS 2013. The key symbol, UBS and ETRACS are among the registered and unregistered trademarks of UBS.Other marks may be trademarks of their respective owners. All rights reserved.

Notes to Editors

Headquartered in Zurich and Basel, Switzerland, UBS is a client-focused financial services firm that offers a combination of wealth management, asset management and investment banking services on a global and regional basis. By delivering a full range of advice, products and services to its private, corporate and institutional clients, UBS aims to generate sustainable earnings, create value for its shareholders, and become the choice of clients worldwide.

UBS is present in all major financial centers worldwide. It has offices in more than 50 countries, with about 36% of its employees working in the Americas, 35% in Switzerland, 17% in the rest of Europe, the Middle East and Africa and 12% in Asia Pacific. UBS employs about 62,000 people around the world. Its shares are listed on the SIX Swiss Exchange and the New York Stock Exchange (NYSE).