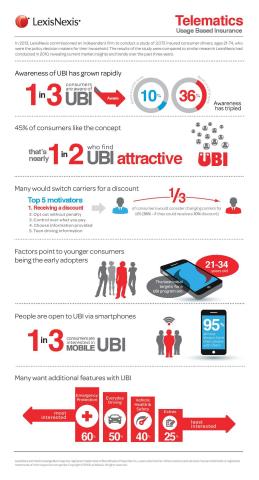

ATLANTA--(BUSINESS WIRE)--One in every three consumers is aware of usage-based insurance (UBI), or telematics, tripling its awareness in the last three years, according to a new LexisNexis Risk Solutions study. While still a novel concept for many consumers, usage-based insurance programs offered by car insurers to track driving habits are becoming more mainstream, less unique than they were three years ago. The study found discounts are the number one driver for UBI enrollment – 50 percent of consumers are likely to sign up for a 10 percent discount while 36 percent would actually change carriers for a 10 percent discount.

A telematics program shares information about when, how much, and how your car is driven. This information is automatically collected and stored and is available for an insurance company to review in order to determine if a driver is eligible for discounts on premiums.

The study also found that:

- 61 percent are more likely to accept telematics if insurers offer a trial period for 3 months, while 72 percent of drivers are more likely to accept if an insurer offers an automatic discount of 10 percent for the first 6 months.

- One in every three consumers finds the idea appealing and is likely to use a personal smartphone to collect and transmit telematics data.

“While UBI continues to become more mainstream, many consumers also find the use of their smartphone in UBI appealing,” said Ash Hassib, Senior Vice President and General Manager, Auto Insurance, LexisNexis. “For insurers, this creates an opportunity to offer programs that fit consumers’ lifestyles such as smartphone use, value-added services based on their interests and capture important information to gauge future driver risk.”

The 2013 LexisNexis Insurance Telematics Survey, conducted by independent research firm Lynx Research Consulting, measured policyholder receptivity to allowing insurance companies to use data collected from telematics devices in their vehicles to help determine rates. The web-based survey polled 2,072 U.S. residents representing a sample of insured drivers, ages 21 to 74. For more information, download the study.

About LexisNexis Risk Solutions

LexisNexis Risk Solutions (www.lexisnexis.com/risk/) is a leader in providing essential information that helps customers across industries and government predict, assess and manage risk. Combining cutting-edge technology, unique data and advanced analytics, LexisNexis Risk Solutions provides products and services that address evolving client needs in the risk sector while upholding the highest standards of security and privacy. LexisNexis Risk Solutions is part of Reed Elsevier, a leading global provider of professional information solutions across a number of sectors. Our insurance solutions assist insurers with automating and improving the performance of critical workflow processes to reduce expenses, improve service and position customers for growth.