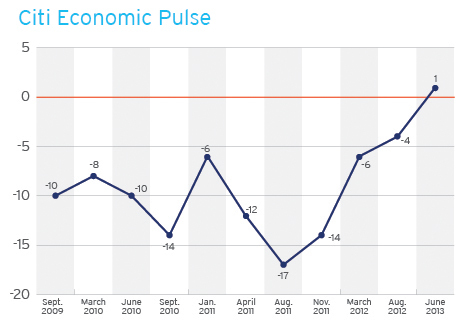

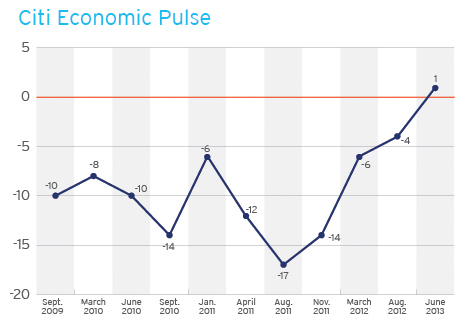

NEW YORK--(BUSINESS WIRE)--Americans’ views of current and future economic conditions rose to their highest levels in at least four years, according to the latest Citi Economic Pulse, which reached positive territory for the first time since its inception in 2009. Citi today issued the results of the nationwide survey, which was conducted by Hart Research Associates. The +1 score marks a five-point gain from August 2012 and an 18-point gain from its lowest point in August 2011. Among the key shifts that have pushed the Pulse to positive territory are:

- Local Economic Conditions: More than a third of consumers (34 percent) rate the condition of their local economy as good or excellent, up six points from summer 2012.

- Job Opportunities: Nearly a quarter of consumers say job opportunities are good or excellent, up five points from summer 2012.

- Personal Finances: For the first time since the Pulse began, more consumers see their personal financial circumstances improving (23 percent) than see them declining (22 percent).

- Future Business Conditions: Those who believe conditions will improve over the next year rose five points to 56 percent, and negative expectations fell to an all-time low (21 percent).

- Middle-Income Households: While economic outlook remained flat and negative for lower-income households, substantial gains were seen among middle-income households.

Despite the broad improvement in outlook, especially on future conditions, negative views of the economy remain. The Economic Pulse score for families making less than $30,000 remained flat at -16 and stands in stark contrast to other economic bands, all of which improved and are in positive territory. Those who rate their local economy and current job opportunities as fair or poor dropped to the lowest levels yet, but at 65 percent and 72 percent respectively, both still represent the majority.

“For the first time since we initiated the Citi Economic Pulse in 2009, Americans report a positive outlook on the economy and their personal finances,” said Jonathan Clements, Director of Financial Education for Citi Personal Wealth Management. “Since we hit the low point for the Pulse in August 2011, we’ve seen a meaningful rise and have now finally broken through to positive territory. Consumers have not totally abandoned their concerns – and lower income households continue to report facing major challenges – but it has been at least five years, and quite likely a bit more, since overall attitudes about current and future economic conditions were this high.”

Middle-Income Americans Account for Largest Gains in Economic Outlook

As measured by the Citi Economic Pulse, households with an annual income between $50,000 and $75,000 showed an eight-point jump and those with an annual income between $75,000 and $150,000 experienced a 10-point jump. Households making less than $50,000 experienced a slight gain of two points, while the score of those making more than $150,000 remained flat.

Outlook Among Lower Income Households Remains Negative

Disparities in views about the economy continue to exist across income bands as the outlook among lower-income households remains negative. The Economic Pulse score for families making less than $30,000 stands at –16 which is unchanged from the summer of 2012, but it is up 13 percentage points from the overall Pulse’s lowest point in August 2011. Families making $30,000 to $50,000 rose to +3, a five-point increase from the summer 2012, and a 27 percentage point increase from August 2011. A greater percentage of those who define themselves as “poor” consider themselves upwardly mobile – 13 percent in June 2013 versus 9 percent in April 2011 – and a lesser percentage say they are downwardly mobile – 12 percent down from 17 percent over the same period.

A Growing Optimism about Future Business Conditions

As consumers continue to turn around their negative views of the economy, there is a similar shift in attitudes toward the business environment, with 56 percent of consumers expecting business conditions to improve in the next 12 months, a five-point increase. Meanwhile, negative expectations fell to an all-time low.

Consumers Take Control by Making the Necessary Changes to be Financially Secure

Coinciding with a more positive mindset on the economy, Americans say they are taking the reins on improving their financial situation. Half of the respondents say they are now making enough to save, up 10 points from November 2011. And more than three quarters (77 percent) say they are optimistic they will feel financially secure in the coming years, including 30 percent who feel very optimistic. Again, middle-income Americans were the most optimistic, with 81 percent of households between $50,000 and $75,000 and 79 percent of households between $75,000 and $150,000 sharing the sentiment.

Given a list of financially responsible actions, 74 percent of consumers say they have successfully taken control of their finances by learning from their financial mistakes, 69 percent by setting and managing a budget and 60 percent by having enough for emergencies to meet unexpected expenses. Additionally, having a long-term financial plan came in at 60 percent, paying off your credit card balance each month at 59 percent and putting enough money in savings at 56 percent.

Only 23 percent of consumers judge the economy in their local area as poor — a seven-point drop from 10 months ago. Similarly, 34 percent of consumers say employment opportunities in their area are poor, down six-points from last summer.

Citi Economic Pulse

The Citi Economic Pulse is calculated by subtracting negative responses to each item from the positive responses for 8 Pulse items, divided by 8. The 8 Pulse items include: current condition of the economy in area; business conditions in area over the next twelve months; current employment opportunities in area; buying climate for big ticket items; personal financial situation compared to a year ago; outlook on personal financial situation for the next twelve months; comfort with current level of savings; and comfort with current level of debt. The Pulse scale can range from +100 (if every respondent gave positive response to each of the 8 questions) to -100 (if all respondents expressed consistently negative views).

Hart Research Associates conducted the telephone survey of 1,805 adults from June 14 to June 19, 2013. The overall statistical margin of sampling error is ±2.31 percentage points for the main sample and is higher among subgroups.

About Citi

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi | Blog: http://new.citi.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi